Many people are drowning in debt and don’t know where to start. It’s time to take the bull by the horns. If you’re one of those folks who started the year by resolving to get your finances and debt under control, and feel that there’s more you’d like to do for this cause, then do read on. You might want to check out Savvy Money, an online debt management tool that aims to give you transparency over your debt. SavvyMoney allows you to chip away at your debt by bringing you more visibility of your situation and by helping you make the most of your current resources. Following is our review of this online service.

Reviewing SavvyMoney Pro For Online Debt Management

SavvyMoney is a website that offers to help you understand and manage your debt. If you’re feeling stuck wanting to reduce your credit card balance but are finding yourself only able to afford minimum monthly card payments, you’d probably welcome a way to get yourself debt-free faster. SavvyMoney offers a subscription service called SavvyMoney Pro for this purpose (along with other free tools and content). It’s a good fit for those debtors who are still able to pay their loans on their own and who aren’t yet too deep in debt to require intervention or assistance from debt professionals or debt settlement companies. If SavvyMoney determines that your situation may best be handled by a debt resolution expert, then they will inform you of this option. If you still decide to take things into your own hands and you’d like to be proactive about debt management, then this is one tool you can use. Here’s a list of basic steps you’ll take when you use this web application:

How SavvyMoney Pro Works

1. Get a big picture of your debt.

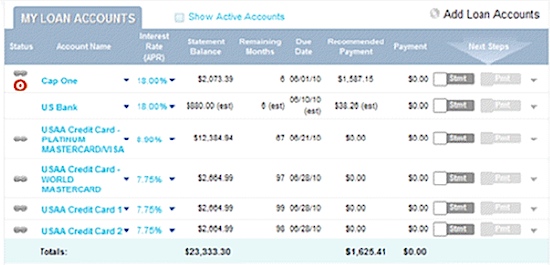

Find out where you stand so you truly understand your debt. The easy DebtPlan Wizard leads you through the process of entering your account information manually. The process only takes about 10 or 15 minutes and will show your savings instantly.

To manually input the amount of your individual debts, list the debts and loans you have, such as credit cards, car loans, personal loans, student loans, mortgages, and other types of credit. You’ll need to know the account balance, annual percentage rate (APR), the minimum payment due, and the due date for each debt.

2. Aggregate your data by linking to online accounts.

If you don’t want to list the debts manually, it’s possible for you to link to your online accounts, allowing SavvyMoney to obtain your data automatically. Linking your online accounts to your SavvyMoney Pro account will consolidate your loan information in one place. This is helpful if you have creditors like Chase, Bank of America, Citibank and other widely-known lenders. You’ll be asked to list the account you use for payments, too. However, you can skip that part if you want.

3. Create a debt reduction plan.

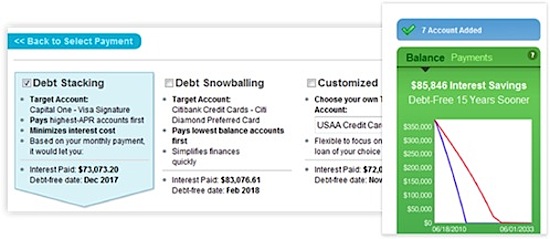

Then here’s where it gets interesting. At this point, the DebtPlan Wizard can help you create a plan. The debt management plan shows your interest information, how much you’ll need to pay for your Monthly Commitment and how long it will take to be debt free (you’ll receive a target date for retiring your debt). You can customize a debt plan based on how much you can pay towards your debt: can you pay more than the minimum owed, only the minimum owed or less than the minimum for each debt?

Review your resources and select a payment strategy that fits into your monthly budget. There are three different strategies: Debt Stacking, Snowball and Custom Order. The strategy you select determines the account you pay off first, which is called the Target Account. Some people prefer to feel a sense of accomplishment by paying smaller bills off first. Others want to tackle the big ones right away. Your payment strategy is based on your preferences.

4. Track your progress.

Once you choose a payment plan, SavvyMoney Pro tells you how much to pay to stay on track. To carry out your payment plan, confirm your statement for the month and record your payment. You can override any entries if you need to adjust your payments. Your DebtPlan automatically reflects progress and changes as debts are paid down. Ultimately, you make the final decision and know exactly where your money is going.

Track your progress as you continue to execute your plan, under the My DebtPlan tab. There’s a lot of visibility here: you can see what your balances are, and you’ll know if you’re sticking to the plan or not, how much principal you’ve paid on your debts and the interest you’ve saved by staying on course with the plan. You can also edit or modify your plan by adding a loan, changing your Monthly Commitment, adding a payment account, and more. If you have extra cash, you can make a Bonus Payment. People who follow the plan usually pay off their credit cards in just 3 or 4 years. What’s also great is that help is available through the user forum or a contact link to customer service.

Watching your progress gives you hope about becoming debt free (working with certain debt agents or counselors may not provide you this depth of information).

5. Pay off debt quickly.

To pay down your outstanding debt faster, explore Accelerator Actions. After your plan is set up, it shows you ways to find extra cash to apply to your loans and to help lower your interest rates. If taken, these Actions can help you reduce the amount of time you’re in debt. Sample Actions include reducing insurance expenses, turning clutter into cash, and applying savings to debt.

If, at any time, you’d like to reduce your debt sooner or if your financial situation changes, you can use the Commitment Calculator to find out how you can change your plan or to see how increasing your payments will impact your plan. As you pay off your debts, the plan will adjust so you can make faster progress on the remaining loans.

Get A Free Trial

You can test out SavvyMoney Pro for free for 7 days. However, you’ll need to provide a credit card number and your address when you sign up. You can cancel the membership while the trial’s still on if you want to avoid being charged.

As mentioned, you can cancel anytime. Even after canceling, you can still access many free tools at SavvyMoney.com to learn more about paying off debt.

A Little Background On SavvyMoney

Savvy Money was formerly known as DebtGoal. Originally founded in 2008, the company rebranded in November 2011 to better reflect their mission and philosophy. They’ve also revamped their application to make it more user-friendly. SavvyMoney was established to help people get out of debt on their own.

Here is their goal, in a nutshell: To get rid of debt, not only will you need a plan, but you’ll also have to change your spending habits. SavvyMoney exists to provide people with a debt payoff solution and also aims to teach people how to be savvy with their money.

The site is visual so as to easily show people how they are managing their money and to give them ways to gauge their progress. The service has helped tens of thousands of people do away with over $1.5 billion in debt. Debts are typically eradicated in about 4 years rather than the 25+ years it takes to pay them off with minimum payments.

Keep in mind that SavvyMoney Pro won’t make your debts vanish instantly. You’re doing the work by paying your creditors month in and month out, and this program isn’t the same as bankruptcy, debt consolidation, or debt settlement. It isn’t credit counseling, either. But this debt planning tool is a way to organize your debt and your finances to get you on track towards debt freedom at a relatively low cost. Before you get in too deep and wind up considering bankruptcy, check out the resources at SavvyMoney to see what plan might work for you.

Created August 29, 2010. Updated January 17, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 11 comments… read them below or add one }

Thanks for being in the alpha group for DebtGoal, I have to say it is a pretty cool tool that a lot of people working to get out of debt will find useful!

Note: DebtGoal has been rebranded as SavvyMoney Pro.

Looks like an interesting tool. For the cost, it’s a better way to go than doing debt counseling or credit counseling, or seeking someone to help with debt consolidation. Plus I think it’s best if you escape out of your hole yourself rather than have someone hand hold you through the process. You’ll learn a lot from the experience as I have. But for the cost, you may do better with going with a free tool like Mint.com or some other software to help you monitor your financial situation.

Interesting, resolving debt problems isn’t that easy. In those conditions individuals may need such kind of web site help or what you would call a tool. Whatever, if DebtGoal works for someone please let us know.

How do I cancel my membership if necessary? Thank you.

@Sara,

Please visit the SavvyMoney site and cancel from there. They should have a contact page to receive your questions.

Thanks for coming by! Yes, I like SavvyMoney (formerly DebtGoal) — hope it proves to be truly helpful to those who want to wipe their debt slate clean.

What’s good about it is that it will lay out your situation in a visual manner and will recommend avenues that make the most sense for you, even if it comes across as being brutally honest. In some situations, it may actually refer you to a debt resolution agency (if your debt is that far along). I like that it offers immediate resources and honest answers based on your unique profile, and a lot of what they have on their site is free. If you prefer not to subscribe to SavvyMoney Pro, you can still benefit from a lot of what’s offered on the SavvyMoney site.

I recently stumbled across SavvyMoney the other day and found their site very interesting. Great info.

This is a very interesting application — thanks for the review. Its a shame that it is not free like other financial software out there (I’m thinking about Mint). In my opinion, getting out of debt should not cost anything. Hopefully it will be free in the future, especially for students such as myself!

@Economically Humble,

Agreed — the question is whether this application will actually save you money so that it’s worth using. Can it save you enough on your loans so that it justifies its cost? For those on the fence with this question, it may be worth it to sign up for the free trial. That would be one way to see how it compares against Mint. Mint is focused on daily budgeting whereas SavvyMoney is meant to address your debt situation.

I don’t get it, they offer a 7 day trial, but how can you expect to see results in 7 days? Why pay them to tell you how much to pay each month? No one should pay money for a simple debt snowball calculator.

I probably won’t call it “simple”, but this service is probably helpful for a certain group of people. Some of the financial products I come across are not for everybody — but there will be those folks that find a lot of value in them. SavvyMoney Pro’s model is subscription based, and is meant to help someone with quite enough debt and who seeks a better way to organize their accounts. As mentioned, it aggregates your loan accounts, organizes them, provides you transparency and develops a plan for you to follow, but the onus is still upon you to follow that plan in order for you to succeed with debt reduction.

I wouldn’t call that a “simple debt calculator”, but I would concur that you can do your own debt plan on your own. However, there are those who want the ease and convenience of tracking through a system such as this.

Given the mess that a lot of people get into with their debt, some may find it justifiable to work out their own debt management plan. Debt and credit counselors are probably more expensive overall, and for those with enough card or personal loan debt, you’d want to apply this type of plan management before it reaches a point when you get overwhelmed and may seek debt relief through more expensive means (e.g. debt settlement, etc). So as far as pricing or valuing this service, this may seem like a form of insurance for those with enough loans to track.