It’s not uncommon for people to use their retirement plans and only their retirement plans through work as savings vehicles over the course of their careers. For a lot of people, that’s all they can manage and, frankly, it is really the most convenient. But as someone who works in the financial field, what I often see that occurs is that the bulk of people’s retirement money and ultimately their estate is in tax-deferred accounts (Traditional IRA, SEP IRA, 401(k), etc.) While the tax-deferred status of these accounts may allow these assets to grow more rapidly than other funds you might own and you get a deduction upfront, it can actually become problematic.

What Happens When Your IRA Accounts Are The Bulk Of Your Estate?

One of the biggest problems is that all that money you have tirelessly socked away in online brokerages and mutual funds for so many years will be treated as taxable income when you spend it. This means that what you draw from your accounts, after-taxes, will become less. Can you believe that contrary to what conventional wisdom tells us, many retirees are in a higher tax bracket compared to when they were working? Because of this possibility — in addition to the fact that you may not be be too sure about what tax bracket you’ll fall into in the future — your lifestyle could be in jeopardy. You may think your nest egg will last your entire life, but what if you investments do not perform up to par and your tax liabilities are higher than you think? Where will that leave you?

This can also cause a big problem for non-spouse beneficiaries who may have to use a large portion of the accounts to pay taxes. Everything that you own is included in your taxable estate. Hence if you die and your estate exceeds a certain amount, a federal estate tax must be paid on the excess. Then to make matters worse, your heirs will have to pay income tax on the inherited accounts based on their tax bracket. So what you thought you were leaving to your children and/or grandchildren oftentimes becomes a lot less. That’s why it makes sense to try to balance your nest egg between pre-tax savings (later taxable) and after-tax accounts (regular savings/investment accounts, Roth IRAs, etc).

Need to open an IRA? Here are a few investment sites that offer IRA options:

- Open a TradeKing IRA account & get a tax deferral.

- Open A Lending Club IRA (investors get cash bonuses based on funding amounts).

- Get an E*TRADE IRA. No-fee, no minimums and 100 Commission-free Trades. Here’s our ETrade brokerage review.

- Check out these free stock trades from brokers when you open IRA accounts.

Roth IRA Rules & Tips: 2010 and Beyond

When you start living off your savings, having spending flexibility can be key to maintaining your lifestyle and making your money last over what could easily be 20 or even 30 years. Drawing from your taxable accounts and Roth IRAs first can keep your taxes down and allows you to withdraw less than had you taken pre-tax dollars out.

- All Roth IRA withdrawals are tax free if you meet certain conditions, given that you contribute to the account with your after-tax dollars.

- There are no mandatory minimum distributions at age 70 and a half, as in the case of a traditional IRA plan. This feature allows passing on more savings to your beneficiaries.

- You can withdraw money from your Roth IRA at any time up to the amount of your contributions, without paying taxes.

- There is no age limit on contributions.

When beneficiaries other than your spouse inherit your non-Roth IRA, they will have to withdraw the funds based on your life expectancy (faster pace than if it were their life expectancy). And the distributions will be considered taxable income to the recipients. However, with a Roth IRA, the original account holder’s age is not a factor when determining the payout schedule since the Required Minimum Distribution Rule (RMD) does not apply. Rather it is based on your heir’s life expectancy. Therefore, your beneficiaries have the opportunity to leave more money in the Roth and for a longer period of time than they could with a non-Roth IRA.

For example, suppose you left your Roth IRA to your 30-year old granddaughter. She would have the option to take withdrawals over the next 53 years instead of over your shorter life expectancy. As long as the assets have been in a Roth IRA for at least five years, money coming out of the account is income tax free, no matter who takes it out. Nor does it matter how much they withdraw. But the more money that can stay in the account, the more it can accumulate tax free. This tax-free compounding can possibly mean greater growth when compared to taking the non-Roth inherited funds over a shorter period of time then investing in a taxable account.

In my opinion, almost everyone (young and old) should consider a Roth. But, what if you already have a Traditional IRA or 401k account? Depending on your situation, converting now might make a lot of sense.

No one particularly likes to pay income taxes. And, when you convert your IRA to a Roth, you will have to pay on the total transferred. But look at it this way: You’re paying today to help you and your heirs build a tax-free nest egg for the future. What you pay in taxes today is most likely smaller than what you would pay later upon withdrawals after years of growth. The same goes for your heirs. But, there have been income limits on who can contribute and convert to a Roth IRA, so this may not always be possible for you.

Save Tax Dollars With A Roth IRA. What’s Unique to 2010

Roth IRA Conversions. Beginning on January 1, 2010, anyone can convert their pre-tax retirement account to a Roth IRA, regardless of income. The previous $100,000 Modified Adjusted Gross Income (MAGI) limit will no longer apply to anyone wishing to convert. The good news is that this new rule will now apply on and after the year 2010. Note, however, that if you convert your IRA in 2010, taxes may be reported and paid in the following two years (2011 and 2012). This may help dilute the tax impact somewhat, as it your tax obligation is spread across a couple of years. Be aware though, that applying your tax over two years may not be the wise approach, depending on certain scenarios. Find out more about this matter here. This accommodation only exists for 2010 conversions though, as any conversions made later will apply in the year they are made.

Roth IRA Contribution Rules. I find it interesting that if you wish to make a normal contribution to a Roth IRA after January 1, 2010, you still must meet certain MAGI requirements. In 2010, if you are married, your MAGI must be below $167,000 to make a full contribution to a Roth. If you’re single, it must be below $105,000 to qualify for a full contribution.

Using the Roth IRA Conversion as a Contribution Loophole

But, what is to stop someone who doesn’t qualify for a contribution from making a contribution to a Traditional IRA and then immediately converting to a Roth IRA? It would seem that nothing would. I have not heard of them closing this loophole as of yet.

The same would apply to a number of other tax-deferred retirement plans with much higher contribution limits, such as the SEP IRA, SIMPLE IRA or 401(k).

A Roth IRA makes more sense now for virtually anyone -– whether you’re younger and starting out or older and want to convert. Either way, you and your heirs will be much happier with tax-free withdrawals. So why wait?

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

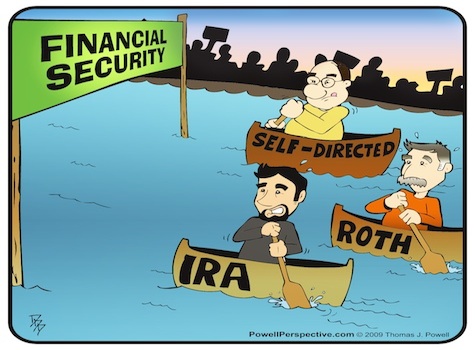

I prefer a self directed IRA over the Roth IRA.

I actually agree with Todd, “In my opinion, almost everyone (young and old) should consider a Roth”, I think the Roth is a much better option, but then again, you guys probably know more about it than me.

Great points. People are really surprised to learn that they don’t have as much as they thought. In the U.S. people think in pre-tax terms. Go to a job and ask what the pay is and they’ll say $50,000. What you get to keep is a lot less. In Uruguay ask what a job pays and they give you an after tax number.

Also, we think in terms of the past. Many on the brink of retirement think they are rich because they have $1.0 million in an IRA.

Roths make a lot of sense for people just beginning their careers – since they are often in the lowest tax brackets (and thus are likely to be in a higher bracket later on).

Later on, the decision can get a lot more complicated – especially if your peak income for a year greatly exceeds your expected retirement income.

I couldn’t agree more – tax free income will be very important in retirement. Of course, if your company offers a matching 401(k) or 403(b) plan, I would contribute up to the match to get the free $$. But, I wouldn’t give a dime more than the amount required to get the maximum match. After that, I’d work hard to maximize a Roth IRA.

Not only may your tax bracket be higher in retirement, but who here doesn’t think that income taxes will be higher in the future? I think tax free income will be very important!

@ DIY Investor,

good to know, 🙂 in Germany is it like in Uruguay?

People don’t realize the importance of a Roth IRA. So many folks focus on traditional IRAs because of the deductibility that they miss a great investment tool. This is especially true with the new conversion rules.

If the conversion to a Roth IRA is for all years 2010 and beyond, then I’ll wait to convert, or do just part of our SEP IRA into Roth Rollover for the next few years. I was under the impression that we only had 2010 to convert without regard to our MAGI. Good to know we have more years, thus more control!

These are great ideas, especially the ones directed towards younger individuals. The earlier you start saving the better. It is so easy to save and you don’t need a lot of money to get started. I wish more young people knew this so that they have a big sum waiting for them once they retire.

SVB, I wish the Roth IRA did not have any income limits or at least they considered raisiing it to include more middle class folks. I know that some in retirement may end up with more taxable income than before retirement, but I wonder just how big a group this really is??? Thouhts? Seems like a nice problem to have and I plan on having it, but I do want to minimize my tax burden and careful planning and a strategy will help. Additionally, I really care about leaving a legacy for my kids and future generations, so this is another incentive for me to do some planning, including retirement and estate planning.

Thanks for the wonderful information. Keep it coming!

Roths should play a part in everyone’s financial plan. People focus way too much on the tax deduction of traditional IRAs. With tax rates going up, having tax free income in retirement is a great way to go.

It’s a great time to get a Roth. Make sure that you do the analysis to determine the right choice.

I think Roth IRAs are great for investors. While there is a risk tax laws could be changed in a way detrimental to Roth IRA holders this risk is much smaller than the risk that tax rates will increase, in my opinion. If Tax rates increase, and everything else remains the same, (and your investment increases) Roth’s will provide better investment returns.

Still I would suggest hedging the Roth IRA risk by not having my entire retirement savings plan based on Roth IRA and 401(k) investments. But in general, I believe, Roth type investments are under-represented in people’s portfolios not over-represented.

Thanks for your thoughts, Curious Cat. I can always count on you for a great opinion. I actually argue with my tax guy a lot about the Roth, and in the end, he says he’ll convert our stuff if we insist, but he sure is discouraging.

I do like your idea of “hedging” though. Just like with everything else, it makes sense to diversify your funds into various retirement plans, I suppose. Roth IRA limits may prevent me from putting all my eggs in one basket anyway.

IMHO Curious Cat’s remark (above) is right on. You need some money invested in low-overhead instruments such as Vanguard or similar funds that yes, are taxable, but no, don’t depend on whatever quirks some future Congress cooks up. I’m also beginning to suspect that ordinary CDs (in the form of CD ladders) should play some part in a long-term investment strategy, even if you’re a younger investor.