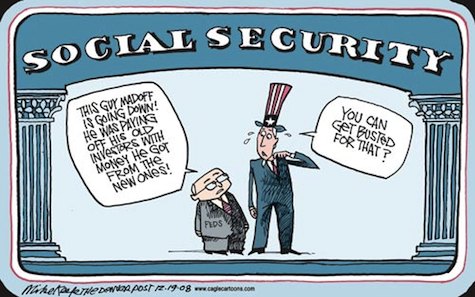

I don’t know about you, but I’m beginning to wonder about belonging to the sandwich generation. Not only am I taking care of my kids, but also my aging parents. And we’re all seeing less and less of our paychecks thanks to an ever increasing deficit in the funds pool for Social Security, among other things. With so many baby boomers signing up for Social Security over the next few years, is there any wonder why so many people in my generation are starting to think that there won’t be any money left by the time we retire?

Are You Ready For A Social Security System Overhaul?

Even the Congressional Budget Office is worried. For the first time since its inception, Social Security will actually be taking in less than it’s going to pay out. Experts agree that the deficit would last through 2013 before rebounding slightly and then slipping into the depths of oblivion forever.

I guess we should be thankful that it’s the Obama Administration’s goal to revamp everything that’s ever been wrong with this country over the four years he’s in office 😉 . So, it looks like it’s Social Security’s turn to get a face lift. In my mind, this might be a good thing if it hadn’t been for the government spending the cash on other things that caused the deficit in the first place. Of course, they never intended for this to happen, but it seems as though bailing out Wall Street, two of the Big Three, and paying for the executive bonus packages and employee retention bonus program for AIG, not to mention supporting a big expensive war that doesn’t appear to be on the verge of victory any time soon, has left them more than a little strapped for cash.

So, here are some of the ideas that Obama and company are throwing around to revamp Social Security.

1. Edging up the retirement age. Currently, you can begin drawing Social Security benefits as early as 66 years of age. In the current design, this age would be increased to 67 by 2027, but some don’t think that this idea is aggressive enough to make a dent. Experts want to move this time table up by adding 1 month every two years. This sounds like a reasonable plan, but this will still only address about 20% of the expected shortfall.

2. Reducing the amount of benefits you’ll be entitled to. This one bugs me because of the selective nature of this recommendation. The plan is designed to hit middle and higher income earners only, while sparing low income workers, such that the first group will end up receiving less benefits than everyone else. It feels very Robin Hoodish-you know: steal from the rich and give to the poor, except that many people who are labeled rich aren’t truly rich — they are mostly regular people like you and me.

3. Raising taxes. You should expect our government to rely upon the obvious fallback — taxation. Yes, the Feds want to take a larger portion of your wages in order to make up for a deficit they created. And here’s the sad part: this is probably the only way the existing deficit will get addressed, at least in the short term.

The fact is, neither Obama nor any other sitting president will allow Social Security to go by the wayside…at least not on their watch. I’m not sure what the solution is to this problem, but we’re not going towards privatization here, at least not yet. The privatization of Social Security, as once proposed by the Junior Bush, is currently on the backburner. While I like the idea of deferring my contributions into a 401(k) style account that I can manage and grow, I can’t see this one being an option under the current administration. Employing a program this radical can have far-reaching ramifications and it’s not one that the government is interested in worrying about at this time. So maybe a cost of taxation raise isn’t out of the question.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

It’s kind of the big purple elephant sitting in the corner. No one really wants to acknowledge it.

I agree with you that having some kind of selective filter just seems wrong. Option 1 and 3 seem like the most likely which sure makes ROTH IRAs seem more and more attractive. Thanks for the detailed information!

Actually fixing Social Security is not that difficult. Increase tax rate a bit, extend full retirement age slightly, and increase limit. Play the game over here.

Here’s my novel suggestion: invest the surplus in the stock and bond market this time. Don’t let Congress spend it. If we had invested the surplus from 1983 on we wouldn’t have the problem we have today. I hold Greenspan partially responsible for this. He knew what was going on – after all he headed the commission – but was so busy defending his derivative issuing friends as Fed Chairman he only payed lip service to this important issue.

Forget privatizing. Retirees are in a bind today because of the privatizing impact of 401(k)s.

Of course, if you throw Medicare and Medicaid into the mix you’ve got a real mess on your hands.

I think in the wake of what we are seeing in Europe, we are not far behind in the area of government sponsored retirement plans like social security. This article is spot on – retirement ages for social security will have to change, taxes will have to go up, or both.

However, I must admit I do share somewhat of a different mindset. When you look at the average American household and where they are today, will they be ready for retirement at age 65? I am 40 and have been diligent in saving and also putting a minimum of 10% in my 401K every year for 16 years now. I get the company match and all that jazz. I have a ROTH and the story goes on. Well, I figure I have enough saved for about 5 years of retirement at best. I have not been crazy in investing or risky, but the compounding growth in my retirement plan that was supposed to happen has not occured. I figure I should have well over 300K in my 401K alone… however it is no where close. My point is people will have work longer or have part time jobs as they age, so there will not be the drain on social security the experts expect.

I completely ignore any potential Social Security payouts when I perform financial projections. I just assume that our retirement accounts and my pension (defined benefit – yeah, it rocks) and income from accumulated assets are going to be the entirety of our retirement income.

If Social Security is still around, great – we may be able to buy a few extra things every now and then. If not, not big deal.

To me, the strange thing is that the rate for medicare hasn’t increased in the face of rising medical costs.

There will be no money for us when we retire, no matter how much taxes are raised in the next 30 years. It is a good idea to just plan ahead and save some money. Nobody is going to take care of me but me!

basicmoneytips.com: I think the age needs to be changed IMMEDIATELY — it will tick people off, but that is the first change that is needed…and don’t “inch” the age up month-by-month. Make one change and then assess the needs of the SS system accordingly.

The system is going to SERIOUSLY be tested in the near future. Healthcare is being “fixed” now because it is currently the pressing need and that is how Congress operates…fix what will get you votes. Unfortunately, we don’t have time for SS to become a pressing need. Congress is NEVER proactive with legislation, they are always reactive — proactivity doesn’t gain votes.

How are we going to afford it?!? We’re going to have less workers paying for more recipients. I agree we need to increase taxes, but think about this: we need to raise taxes (and cut spending) to pay for healthcare; we need to raise taxes (and cut spending) to reduce the deficit; we need to raise taxes (and cut spending) to fix SS?

This year 47-49% of U.S. tax filers did not owe federal income tax. I think it is time that everyone pays income taxes — that may mean “child tax credits” go away…so be it. Too many are receiving too much in handouts, and the ship needs righted.

Retirement is a concept that is recent and only prevalent in the 20th century. Prior to that, there is no such thing as retirement. As Europe has shown, pay as you go “retirement plans” are doomed to fail due to demographics.

But why not learn from Asian countries like Australia, Hong Kong for example, and dish away with pay as you go. In those countries whatever you contribute to your “retirement account” is yours (just like 401k) and government cannot touch it!

I think that any rich country should be able to provide a modest retirement for its elderly, however I think its best to plan for it not being around in the future.

I don’t foresee any changes to Social Security before the November election. It’s way too politically risky and politicians are already skating on thin ice. They are going to igonore this problem as long as possible, until they can spring it on us as a crisis.

The retirement age has to go up. It has only increased from 65 to 67 since the program started in 1935. In the mean time, life expectancy has gone way up, along with the number of people over 65. France just raised their retirement age from 60 to 62 on Wednesday and I expect we will have to as well.

Great comments. I take Kosmo’s approach and try not to factor Social Security. That said, I am also looking at it as gravy that I would love to add to my financial plate. I have paid into this fund and I do want that gravy out of it!

I like options 1 and 3. Option 2, reducing our benefits stinks. I think the only way you can do this is if you do it for those who are not already invested in the system, but it should not be applied retroactively. Still, I don’t want to see benefits lessened for future generations either, so let’s up the age and implement some type of tax scheme. How about increasing the sin tax on cigarettes and alcohol?

DIY Investor also provided a call Social Security tool that allows you to play with different scenarios that seems cool.

I’ll say this about privatizing: If you were among the many people aged 62 to 65 who were forced into retirement by a layoff at a time of life when you are unlikely ever to get a decently paid full-time job again, at the same time your 401(k) or 403(b) savings were devastated by the crash of the economy, you would not be anxious to see Social Security privatized.

Were it not for the guaranteed income from Social Security, I don’t know what I would do. My savings were intelligently invested and so I lost much less than many people did, but still so much of my 403(b) and IRA savings went down the toilet that I really needed to work at least another eight to ten years.

In the best of times, it’s hard for someone over 45 to get a job. When you’re over 60 and the country is in the middle of a depression, you don’t have a snowball’s chance. I’m now working 15 to 18 hours a day, seven days a week, at freelance and part-time jobs and earning a tiny fraction of what my full-time job paid. Had SS been privatized, I would have lost as much or more of my savings there as I did in the market; that would mean I would have lost my paid-off home and by now I’d be living under a freeway overpass somewhere. The only thing that’s keeping me clinging to the middle class is Social Security.

Everyone shouldn’t take a doom and gloom attitude towards Social Security, all civilized nations have some form of retirement program. There will be something.

That being said, the secret to a financially healthy retirement is to have multiple streams of income and not just depend on one. Social Security, a 401k, stocks, real estate, a side business with residual income cover each other if there are blips or adjustments.

“Had SS been privatized, I would have lost as much or more of my savings there as I did in the market; that would mean I would have lost my paid-off home and by now I’d be living under a freeway overpass somewhere. The only thing that’s keeping me clinging to the middle class is Social Security”

That depends a lot on the choices you made. Personally, my rate of return on social security (per numbers from the SSA) -> is 2.32%. I can beat that fairly easily with a minimal risk approach. Just people people would have options under a privatized system doesn’t necessarily mean they would take the riskiest path.

***Correction***

Love the article, but for the record only two of the “Big Three” were bailed out, Ford never took taxpayers’ money.

@BoJangels,

Thanks for the correction. Have updated the article accordingly! 🙂