This guest post was brought to you by NerdWallet.com, a premier credit card review site.

Times used to be such that anyone could file for bankruptcy when they wanted to screw over their creditors. If you found yourself over your skis, you could just file for Chapter 7 and start all over. What that meant was that your assets would be dissolved and handed over to your creditors, and any remaining debts in your name would be made null and void. Your credit card, mortgage, and student loan debt would essentially disappear and you’d be given a “fresh start”. Unfortunately for some, that game ended back in 2005 with the passage of the Bankruptcy Abuse Prevention and Consumer Protection Act.

In essence, the law tries to make filing as inconvenient as possible, mitigating abuse and preventing people from repeatedly running up big debt bills and then simply not paying them. It sets new requirements for bankruptcy filings, such as mandatory credit counseling classes, substantially higher filing fees, “means tests” to ensure that you aren’t secretly rich, audits, and an eight-year ban on future bankruptcies. If any of these requirements aren’t met, Chapter 13 is your only option, which won’t allow you to get away scot-free. Instead, you have to set up a payment plan to appease your creditors over the next five years.

Bankruptcy & Going Broke In The U.S.A.

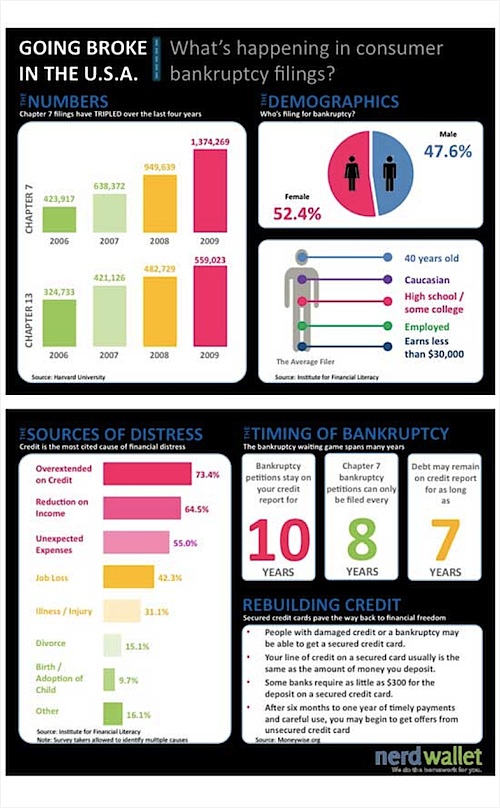

So how have things changed since 2005? Well from 2001 until 2004, an average of 1.5 million Americans filed for bankruptcy each year, wiping out their debts and starting from scratch. And while this number took a slight dip with the passage of the new law, the recent financial ruckus has brought us right back to where we were pre-BAPCPA. Here’s an infographic to give you a quick rundown of what bankruptcy is like in 2010:

What’s Next After Bankruptcy?

After a bankruptcy filing, you have no choice but to start the long slog of rebuilding bad credit. There aren’t many options out there, but secured credit cards are generally your best bet after a Chapter 7 or 13. With one of these cards, you post collateral upfront (generally something like $300 to $1,000), and you get an equivalent credit line to work with. The issuer will then hold onto your money as insurance until you close the account, and you’re liable to pay your bill off each month. Otherwise you’ll be charged interest just like a normal credit card.

If you’re going the secured card route, we recommend that you talk to your local bank or credit union first, since they’ll usually offer lower fees and rates than what you’ll find on the internet (see our wall of shame to get an idea of what to avoid). And reputable banks like Citibank and Wells Fargo also offer the ability to “trade up” to an unsecured card after 12 to 18 months of good behavior. Despite their recent surge in popularity, we don’t recommend prepaid debit cards, since they don’t help your credit. But as a last-ditch effort, they may be what you need to get by until you can really start to build back from the bad credit abyss.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 3 comments… read them below or add one }

Many of the debt relief ads we hear and see promising to wipe out your debt – are really trying to get consumers to file for bankruptcy. I’m sure these solicitations have contributed to the uptick we’ve seen in the # of bankruptcy filings.

Unfortunately, debt relief companies often do what’s best for their bottom line, rather than what’s best for their customers. It’s ironic that making bankruptcy more complicated may actually entice debt relief companies to recommend bankruptcy more often, since they can charge extra for the additional complications and paperwork.

Is it true that different states have different exemptions in chapter 7 bankruptcy? If so how long do you have to have lived in the state before you file?

Also are any of the other chapters more favourable in any number of states?

Thanks