What should you do when your credit card company raises your interest rate? Here are some thoughts on credit card reform from our contributing writer, Jacques Sprenger.

I thought I had the best credit card around. But then getting a sudden rate hike on your credit card for no reason whatsoever is like an icy shower when you expected warm water. My issuer just hit me with such a raise which didn’t improve my mood in spite of their friendly accompanying letter: “Your history as a preferred customer has nothing to do with the interest hike which was caused by the economy’s present circumstances. You may reject the raise by paying off your credit card balance.” Right, like we have $4,000 lying around just for that purpose. The average American family owes more than $10,000 on credit cards which used to be given in cereal boxes (a little hyperbole!). Now you have to show that you make as much as Bill Gates to be approved (yes, another hyperbole).

The Government Intervenes With New Credit Card Rules

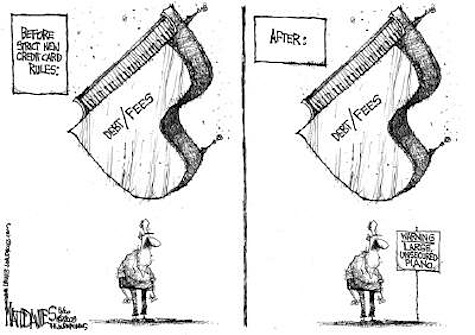

Check out the following image by Make Them Accountable. Left panel says — “before strict new credit card rules”. Right panel says — “After: Warning. Largest unsecured piano”.

President Obama would get a lot of kudos if he can convince the credit card companies to play fair: it’s actually good to see some inroads made on this matter, where the credit card industry has been made to face the “new rules of the road”. The President is apparently very much committed to leveling the playing field: “The days of any time, any reason rate hikes and late fee traps have to end,” Obama said. Chris Dodd, a long time senator who has been embroiled in lobbying controversies, is trying to burnish his image by going after the credit card companies full blast; you may have seen him make the news a lot recently. Sen. Dodd wants the new credit card rules enforced immediately and has demanded a freeze on interest rates on all existing credit cards debts. In fact, he’s introduced a bill on this recently.

What About a Credit Card Bail Out For Families?

What we also need is a plan to help those families who face a financial crisis because of illness or lay-offs. Why should we bail out all these banks, many of which own the credit card companies, if all they can think of is to lower your credit limits and raise your payments? For the life of me I can’t figure out how punishing people is going to allow them to pay their debts. And yet, banks routinely smack us with humongous interest rates because we are late ONE day. While the Fed has lowered rates to almost zero, predator credit card companies charge up to 39% for making a late payment. They should talk to some insurance companies which offer first accident forgiveness. Being late on one payment happens to all of us due to oversight or simply a slow post office. Forget the deadbeats and irresponsible people who max out their credit cards knowing they will never pay them. We are talking about upstanding people who have been paying religiously for 10 years and who’ve made these companies (and CEOs) rich.

Should You Opt Out of Interest Rate Increases?

Some people have felt the pinch: here’s someone who tells us his own story about paying 8.9% on his credit card bill, and he’s never missed a payment. He mentions how his interest rate “.. would change to a variable rate of 14.65% annually.” His card issuer is BofA — “the fine folks at Bank of America, who’ve spent the last few years buying up failed institutions like Countrywide and Merrill Lynch and taking some $163 billion in taxpayer bailout pledges..” So while BofA has screwed up and received billions of bail out money, they’re not exactly giving their customers much leeway. Here’s what this customer tells us:

The credit card interest rate hike is an offer I’m allowed to refuse. I can reject the increase and pay off the balance at the current terms, but that means I would no longer be able to use the card. If I reject the increase, it also means my credit line on that account would effectively shrink to the current balance, which could hurt my credit score.

Whether or not you decide to opt out of your interest rate hikes, you may be up the creek either way. But then again, we shouldn’t forget that using credit cards is simply a privilege. I’m crossing my fingers that existing 0% APR credit cards and balance transfer cards avoid going the way of the Dodo bird.

What Are Your Options?

Is there something we can do? My opinion here is that unless you have no choice (the new card terms and conditions are unacceptable), then keep the card, pay the least amount possible above the minimum and DO NOT use your card again. It will preserve your credit and will allow you to sign up for a new low interest rate credit card … as soon as you can find one. If you have to pay off the card, make sure you don’t close your account; simply stop using your card, again to keep your credit rating intact.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 11 comments… read them below or add one }

We need only one more bail out – for the tax payers. The blunt reality is that there are too many people taking from the pot of current and future taxpayer contributions. While there are many people who should be provided with assistance (at least in any society in which I would like to live), the number of people being given assistance is beyond our ability to support.

Credit cards are the Financial Drug of the masses today.

Stop worrying so much about your credit score and get your cards paid off! I recommend a personal loan from Lending Club; you can then pay off your $4K in installments over 36 months and stick it to the banks.

-Erica

@Erica,

I like Lending Club too, but they require a high credit score! 🙂 But I agree that getting your debt situation under control is top priority. I’m quite debt averse, so it’s always my #1 goal to wipe out debt and not to think about borrowing unless it’s for the right reasons (e.g. taking on good debt vs bad). I think that credit and debt management (and personal finance in general, in fact) requires a fine balance among various goals and requirements we have (e.g. how much we borrow, pay off, spend, save, invest).

I’ve seen this topic in numerous blogs recently and can’t help but look at this issue from a big picture perspective. I realize that credit card companies are only increasing their interest rates in an attempt to offset their bad debt but wonder if doing this will end up causing more consumers to default.

Even biz credit cards rates are increasing. My ‘fixed’ rates are now variable for personal and business. Like Erica I expect more people to start using services like Lending Club, so now might be a great time to start investing some money with them.

Your opinions are so wrong. The credit card companies need to be punished for their blatant abuses. No way would a person who has never ever missed a payment on not only credit cards, but every other bill, in over 40 years, such as myself, need to endure greedy, insane interest rate hikes and abuse – simply because the banks feel entitled – so we, the honest customers, can pay for their egregious bad business practices, even though we’ve spent billions to bail them out already.

It’s really a shame how credit card companies raise their interest rates so outrageously high that such an act destroys the savings and financial state of many families in the US. There should be a new law passed that restricts these high interest rate hikes.

Many would wish they could just pay off their credit balance in order to void paying huge interest rates. But who can afford this?

Didn’t the government see it coming? They gave them until Feb 2010 to raise interest rates and of course they are raising them as fast as they can. Credit is tightening and people are afraid to spend. Our economy will not recover until credit is loosened and people no longer fear losing their jobs.

No matter how I see it, debt and unnecessary spending seems inescapable once you own a credit card. But there’s only so much fast cash and being liquid can do nowadays and sometimes you just can’t avoid using plastic money.

It’s about time the government steps in here. I’m not promoting more government but when credit card companies raise interest rates without warning, it can have significant financial impact. Do they want us to default or something. Just doesn’t make sense.