Getting to financial success is quite a trip.

Ready to coast through this week’s epic long Carnival of Personal Finance #106? What I have prepared here is a little something unusual, since I’m bringing into this presentation a touch of the stuff that interests me. I’m a lover of fantasy and mythology and with a little stretch of the imagination, I decided to look upon the journey to financial independence as its own odyssey, replete with tasks, tests and challenges you meet to reach that proverbial pot of gold at the end.

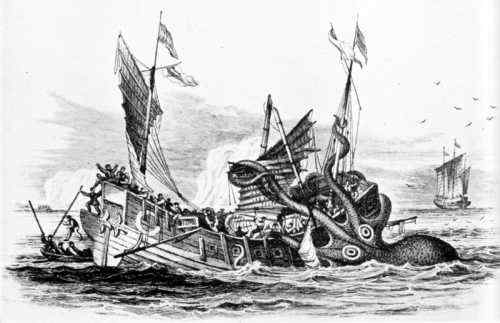

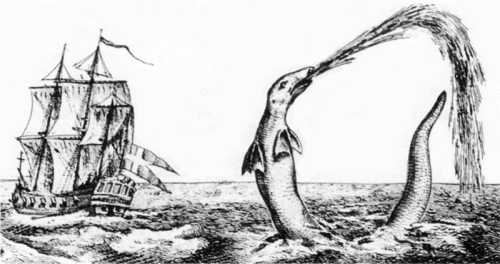

Here’s where I bring you the financial articles for this week, interspersed with some fascinating legendary creatures from Cryptozoology that I’ve made to stand for some interesting financial allegories and symbolisms. Who knows what you’d encounter on a real sea-faring voyage on a visit to faraway lands? Do click around and see what intriguing things you may uncover while you’re here.

About the posts: An amazing 91 posts have been included! If a blogger has provided a comment with their submission, I tried to incorporate some of their own words when presenting their articles. And before I forget, I’d like to encourage you to receive automatic updates from this site through the following measures:

#1 You can subscribe to my feed here.

#2 Or you can subscribe via email here.

Finally, all the images you see here are from the Wikipedia.

Let’s begin!

Focus on your money goals.

Editor’s Choice

Kent from The Financial Philosopher brings up provocative points with Financial Blogs: The Making of Efficient Markets, where he discusses the efficient market hypothesis (EMH) and how it relates to the recent proliferation of financial blogs. He then wonders: could the resulting abundance of investment knowledge be narrowing the competitive edge that professional traders have over the prudent investor? Are financial blogs making the markets more “efficient?”

Having parents that were not financial wizards will have an effect on the next generation. KRG from FilAm Personal Finance tells us how we can help our kids get on the right financial track with Breaking The “Financial Illiteracy” Cycle In Your Family.

I won’t lie — my head started to spin slightly when I began reading Madame X’s article about the math we find in our finances. But it was a pleasant return to my roots, with many years spent buried in math textbooks. Madame X from My Open Wallet presents Rule #17: Numeracy.

Beautiful. I appreciate all photos of your travels on your blog. David from MoneyNing turned the tables on the Japanese by going camera crazy on their wares with photos of mortgage rate ads, fast food menus, vending machines to see how Japanese consumption and prices compares to what we have in the U.S. The result is Japan Standard of Living – MoneyNing Style.

Patrick from Cash Money Life goes biblical with this piece: The Ten Commandments of Money, saying that he wrote it in response to the Vatican releasing The 10 Commandments for Driving. I’ve seen a few posts on the ten commandments on money (including my own), but here’s a new take on it!

I’ve decided not to do what David from Money Under 30 suggests in this piece: Using Multiple Bank Accounts to Control Your Spending. This is because I like to keep accounts to a minimum to make things simple. But he shares his technique to make budget keeping easier. Awesome diagram included.

Truly an excellent post on one man’s experience with his credit card debt. The post is a bit old, but the lessons are timeless: 1mansmoney from 1mansmoney presents Paying off credit card debt from years past.

The witty Cap from The Mint Blog decides to rebut the IRS’s own humorous, sarcastic list in his article, From the IRS: 10 Reasons to Put Off Saving for Retirement. If you do the opposite of what’s on the list, you’ll be in good shape.

Nigel from Retire To India presents some sample charts when suggesting a withdrawal strategy for your retirement: Living on interest payments in retirement? This gives us a hard look at retirement withdrawal rates and how to figure out how much we should be taking out of our retirement kitty each year.

Devour as much financial information as you can.

Economics, Money Management and Financial Planning

John from Queercents ruminates over net worth, it’s value and place in our mindset: Almost Debt Free: Confronting and Understanding the Purpose of Net Worth.

Trent Hamm from The Simple Dollar walks us through advice on how to work out a plan for your finances and your future if you are a social worker: Financial Planning For A Life Of Volunteerism And Social Work. This calling may have additional money challenges in place given how much focus is placed on assisting others who may have great needs.

Hitting close to home, Golbguru from Money, Matter, and More Musings tackles a reader’s question with Is It Wise To Quit Your Day Job And Depend On Your Website For Income? How feasible is this? Well it depends on how HOT your web site happens to be. I’ve seen some serious money generated from simple web sites before, but it’s a rare occurrence. In general, if you analyze the situation like Golbguru has, you’ll get your answer in a flash!

ispf from Grad Money Matters wonders about What Would You Do With “Found” Money? We do a lot of mental accounting with money and the question is, whether by doing so do we help or hinder ourselves financially.

Shannon from Save to Quit claims that it’s more important for her to reduce the amount of money that she requires to live rather than to increase the money that she already has. She also believes that “the world will end as we know it in 5 years and money will cease to exist.” Read more in How Safe Is Your Safety Net.

Penny Nickel from Money and Values confronts the question: How much do I owe my parents for my college education? This is a wonderful example of how finances can become a family affair and where everyone involved pitches in to work things out. If only more families dealt with finances this way.

Boomie from The Wastrel Show gives us a peek into her financial life when she discusses her money concerns in Sometimes Things Are Just Fine.

Here’s an introduction to two basic types of safes: fire resistant and burglar resistant. Inswatch from Homeowners Insurance Guide informs us about the types of safes.

Uh oh! Could this be trouble ahead for me? Mr Credit Card from Ask Mr Credit Card is now warning us about why we shouldn’t have joint accounts! This is bad news for me because all our accounts are joint! His post, Unified Credit Estate Tax Exemption – The Real Reason Not To Have Joint Accoints, will now find itself in my tax guy’s mail box for scrutiny!

bluntmoney from Blunt Money points the fingers on parents when our kids mess up their finances. Agree with her when you read It’s Not the Fault of the Schools, although I believe schools should have a curriculum on personal finance. There’ll always be people who will never receive appropriate financial education or exposure in their homes (it’s a case of “you don’t know what you don’t know”), and at the very least, students could get that exposure from the schools. But yes, I agree it’s foremost the parents’ responsibility to inculcate money principles in the family.

Benefits come, and benefits go, and how do we know how to budget through all the changes? InsureBlog’s Henry Stern LUTCF, CBC has news of two major trends in employee benefits, and how they could affect your bottom line: Lose Some, Win Some.

FMF from Free Money Finance wonders What Do You Do When a Business Makes a Mistake in Your Favor? He makes some very strong cases about the circumstances under which he’d try to correct financial mistakes that have erred in his favor. I’m sure most will agree that it all depends on the situation.

Smith from Smith’s Trading Post discusses Obopay: The new way to send money. How different is this from Western Union and Moneygram money transfers? Well how about using your cell phone to do it?

Grace from GRACEful Retirement was able to work out a payment issue with her daughter’s private school in The Best Laid Budget Meets the Occasional Roadblock. Well and good! Otherwise she would have had a $6000 headache.

The gloomy Cap from Stop Buying Crap asks simply, Ever Got Depression from Your Finances? He brings up a couple of questions for his readers: Have you ever gotten depressed due to your personal finances? If so, what did you do about it?

Edith Yeung from Edith Yeung.com Dream Think Act lists some sound money management principles in 7 Habits of Highly Effective Money Managers.

Ride those market waves.

Retirement Planning

NCN from No Credit Needed covers the details behind 403b Contribution Limits / Roth IRA Contribution Limits For 2008, saying he’s striving to meet his goal of maxing out his contributions for his retirement accounts.

Amy L. Fontinelle from SavingAdvice.com Blog surprised me with this Money Hack: How To Open Up An IRA For $1 In 15 Minutes. So as she says, even if you don’t have an IRA, here is a simple way to get started even if you don’t have much money at the moment. Now there’s no excuse not to open an IRA!

RothIRA from Roth IRA Explained gives us some valuable heads up on the Traditional to Roth IRA Conversion Loophole in 2010. There’s some time left for Congress to change things up for us even as we await 2010 for that conversion! Who wants to bet they’ll act before the deadline, even if it becomes “retroactive”?

Maybe you should beware of IRA annuities. That’s what retirehappy from My Retirement Blog tell us in Avoid IRA Annuities, where he gives some pros and cons.

Lazy Man from Lazy Man and Money suggests checking out a fine retirement calculator to determine when it’s time for you to “hang in the towel”: When Can You Retire?

Full of facts and figures, Matt from The Boulevard to Retirement writes about 6 Myths: Investing for Retirement. He attended a presentation from a top Certified Financial Planner and is here to share what he learned, covering the basic principles for retirement investing.

How much are you paying in mutual fund fees? The Dough Roller opens our eyes with How Half a Percent Can Ruin Your Retirement. Even if we can’t control how the market behaves, this aspect of our returns is indeed, something we can control!

Joey Rosario from Own Your Life With Joey Rosario reviews his retirement options and is settling on a self-directed IRA: Is Self-Directed IRA For You? I learned something new here, with the realization that you could use your IRA for unconventional investments such as real estate, mortgages or franchises (and more) if you use the self-directed type.

Investing and Trading

Not too long ago, I covered the subject on asset allocations quite a bit. Now Jason Shafrin from Healthcare Economist shares with us the Ultimate Buy and Hold strategy along with a model portfolio based on Vanguard Index Funds. Here’s where you’ll find a discussion about an economist explaining why index funds decrease risk without losing any expected return.

Flexo from Consumerism Commentary shares a good discussion of whether it’s “better” to pay off a mortgage early or use that money to invest in the stock market with Ben Stein: Invest of Pay Off Mortgage. True to form, he provides both a mathematical and an emotional point of view in this discussion.

Kirsten from Simple Pound has a life insurance investment account and is wondering about How to select funds to invest in her account. She goes through some points to consider in the selection process.

Cool, there’s a special type of mutual fund for investors who have a 7 figure net worth. If you’re planning to get to that point, you’ll want to read what Plus6 from Plus6 Personal Finance has to say in Hedge-like Funds Reduce Risk And Offer Diversification. Just make sure the funds aren’t on the way down due to investments in bad subprime loans.

Money Analyst from The Mad Money Analyst presents a very fact-based post: Make Corporate Bonds Work for Your Portfolio. He promises more information on bonds in future posts. I certainly appreciate this information while we shop around for bonds ourselves!

plonkee from plonkee money has done an interview with Christopher Traulsen of Morningstar UK. Read about it in Interview Part 2: Funds. There are several parts to this interview with the second installment highlighted in this carnival. Note though, that the first installment is about differences between the UK and US, the second about funds and the third about information for investors.

How does Average Joe from Dividends Matter pick out stocks? He offers us his techniques in Valuing a Dividend Yielding Stock.

Tyler from Dividend Money talks about What’s The Score? If you have ever wondered what the financial gurus were talking about when they mentioned a stock’s Z Score, wonder no longer! Dividend Money has explained exactly what the Z Score is and how to calculate it for any stock. A great read to improve any investor’s education.

Clint from Accumulating Money tells the story of one of the most extraordinary delusions and speculative markets from history — the tulip mania: Tulip Mania and the Stock Market.

Rick MacGuidwin from Tips From Rick is a behavioral finance trader and discusses his trading techniques in Use Behavioral Finance When Picking Stocks.

Michael K. Dawson from Breaking The Shackles Of The 9 To 5 got quite excited about agriculture stocks. Read about his thoughts on commodities in Eric Bolling’s Agriculture Stock Play: Is it Too Late?

Trader’s Narrative feels quite bullish after reviewing the details and data in the COT: Commitment Of Traders Report Still Bullish. Interesting, since I’ve seen opposing views from my own readings. Let’s see how this market turns out.

Slay your debts.

Managing Your Debt, Loans and Credit

Jimmy Atkinson from Ask The Advisor helps us determine how to hit upon the best loan for our needs. Find out in How to: Get the Best Rate on a Loan, Every Time.

I love movies, so TFB from The Finance Buff has given me another movie idea with his review of Maxed Out: Documentary About Debt in America. I’m slotting this into my netflix queue!

Stephanie from Poorer Than You explains what makes up a credit score and offers information on how to build good credit in You Can Build Good Credit – Here, I’ll Help.

Rock those real estate investments.

Real Estate Matters

There’s a difference between real estate investing and speculating. Christopher Smith from EquityScout :: Real Estate Investing in the Real World discusses what speculation is all about in his article, In defense of real estate speculators, saying that either investing or speculating may be right for you, but the danger comes when you think you’re doing one but you’re actually doing the other. He asks: the benefits of investing are clear and obvious, but is there room in your portfolio for a speculative position as well?

Blair from Asset Almanac promotes some lesser known avenues and assistance programs that are actually available to low- and moderate-income potential home buyers in Massachusetts and beyond: 9 Tips for First Time Home Buyers. This is a great resource list if buying a home seems out of reach but you’re bent on owning one someday!

Colonel Cash from Money and Credit gives us the lowdown on mortage loan points in What’s the point? with some fine examples.

Larry Walker from Larry’s Take on the Cocoa Beach Real Estate Market shares a couple of case studies about clinging to False Realities. He tells us that clinging to a false reality often carries a high price. When that reality is about your biggest asset, the consequences can be devastating.

livingalmostlarge from Living Almost Large is having some *serious* condo problems and had to rant about it in Condos burn in hell. I don’t blame her when she explains: “Why I hate condo living. Last time, someone said it was harder to live in a single family home. Really? Please tell me more about single family home living and see if it compares to my hell-hole.” Does this potentially extend to any form of housing relationship, whether it be a tenancy, community or any other neighborly variant? Unfortunately, it’s hard to get along with anyone, especially if you have to live so close to them!

Frugality and Saving Money

tehnyit from Cheap as Chips asks Are you hanging out with other frugalist? and advocates getting to know your fellow frugalists in order to hone one’s financial acumen further.

Gal Josefsberg from 60 in 3 covers all the great things about The Farmers’ Market, your place for healthy bargains. I’ve just recently gotten into the habit of visiting our markets and let me tell you how there’s no comparison to the fresh vegetables and fruits you find there for the taste and price!

FrugalBabe from FrugalBabe gives us a collective high five with Congratulations To All Of Us. She says it best with her message about her article: Money is not a taboo subject, and how we stretch our dollars and save for the future is something that we’re proud of. This article is intended to encourage others to be proud of their money-wise habits, whether they’re just starting out on the personal finance awareness path, or have been on it for years.

Here’s another vivid reminder that Time is Money. Christine Kane from Christine Kane’s Blog asks us Are You Saving Money or Wasting Time? It’s not always about getting the most out of that dollar, when you need to consider the time you spend doing so.

On the same subject of Time is Money, Jon from Smart Money Daily brings us The relax tax: the Wisdom of Wasting Money, a totally different way of looking at money that you end up wasting, mostly by accident.

Rad from Daddy Financials gets into a saving mood with How To Save Money. Lots of tips and advice here on just how to do it. And um, baby, we love you too. 😉

Brett McKay from The Frugal Law Student describes how he’d go shopping in the piece: When To Go With The Brand Name and When To Go Generic. His troubles with generic soda are enough to warn me away from those!

David from David On Finance presents a nice compilation of eight Money Myths for Young Graduates, where his goal was to list some misconceptions he’s dealt with since entering the “real world”. He’s learned a lot of these very myths the hard way.

Could j2r from Journey2Retirement be missing out on some enjoyable, enriching things in life? He reflects on how one should strike a balance between saving money and relishing special life moments in Caught by The Police last night.

Matthew Paulson from AmericanConsumerNews.com has some great frugal lunch ideas that he and his co-workers have traded. He writes about these in Five Meals You Can Bring To Work for Under $2.00. Wait a sec, under $2.00?? I haven’t succeeded on doing this yet, so let me see what I can pick up from these recommendations.

Super Saver from My Wealth Builder has some quick, simple and dare I say, catchy sounding ways to save in Retirement Saving Challenge – Create Environments and Behaviours. Be sure to check out his Retirement Savings Challenge starting on July 1.

Scott from College and Finance brings it on with 7 Surefire Ways to Save Serious Cash in College. Would the average college student listen to this awesome advice? I still have faith!

One Frugal Girl from One Frugal Girl asks what the big deal is with time management at our jobs today in Clocking In… I second her thoughts on this. I bet if we were more flexible with how we are allowed to work, we’d live in a more productive society.

BPT from MoneyChangesThings focuses on Freegans: Neo-Hunters and Gatherers, discussing how Freegans meet their needs and saying that their ability to do this is a critique of Western materialism. She adds: Where does all the stuff come from – why are we so wasteful?

Laugh along with Madeleine Begun Kane from Mad Kane’s Humor Blog with her limerick Married To Money. Thanks for brightening up my day.

Watch out for slick willies.

Handling Fraud

Jarred by a call, Kelly Bejelly from A Girl Worth Saving wasn’t too thrilled about this unfortunate mishap: Hi, I need to speak to Kelly Bejelly…This is the fraud department.

J at IHB and HFF from Home Finance Freedom asks this question: Freezing Credit To Stop Identity Theft: Good or Bad for Savers? He’d like to hear what everyone has to say about this.

Parting Words

Well that was a rather LONG carnival, but a lot of fun! I also found some gems in there that I’m applying to my own financial life. Thanks for taking the time to visit! I hope you enjoyed this mythical adventure through the financial blogosphere.

A note about this edition: I confess that in the process of putting together this post, I had to toss out many articles from blogs that were simply scraping the content from various e-zines. The financial blogging community does not tolerate plagiarism. And multiple submissions! I had to watch out for those as well.

Image Credits (in order of appearance):

Bunyip, Gevaudan Monster, Giant Octopus (Kraken), Harpy, Dragon, Roc, Vegetable Lamb of Tartary, Water or Sea Serpent

Other journeys from classic mythology: The Golden Fleece, The Holy Grail, The Odyssey

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 23 comments… read them below or add one }

Hey, love the theme. Thanks for hosting, great articles this week! Dan at eveydayfinance.

Hey SVB

Thanks for hosting and including my post. Great job on the pictures.

Mr CC

Great job. I love the theme and pics. Thanks for hosting! 🙂

Nice job! Thanks for hosting and including my article!

Thanks for hosting, and including me as an editor’s pick! And I love the theme!!

Thanks very much for hosting the Carnival. I loved the mythological illustrations!

Thanks for hosting and including me. Great illustrations with snazzy tag lines

Outstanding job! That is a LOT of posts to go thru, and it’s obvious that you did. Thank you for a wonderful job!

Very awesome edition! Thanks for choosing our post as one of the editor’s choice.

Thank you for the epic journey but now I have jet lag and small denominations of unusable foreign currency.

J at IHB and HFF, LOL! Sorry to hear you need to sleep off your exhaustion. You should have left your change with the locals!

Great theme, and even better links!

Great job, thanks for hosting!

Thank you!

Great theme for such an odyssey! Thanks for including my post as one of the editor’s choice.

SVB, awesome job. Will link back in a day or two.

Great job on the hosting the carnival. Very imaginative and creative. Thanks for picking my post as one of your Editor’s choice.

Thanks for hosting! Cool images!!!

Thank you for this site. It’s a lightning blast. so illuminating. My question: I can get “Insider Reports” on stocks from my bank that show that CEO’s and other company hot shots often (in clusters) sell huge amounts of stock at high prices, and then the value of the stock dives. This seems rather unfair to me. Is this something to be paranoid about? Shouldn’t they let the little shareholders in on their plans? Carmela

It is an innovative way to write a post like this. Thanks for sharing.

Wow, what a comprehensive resource for finances. Pretty pertinent right now that there is so much fear in the economy. I’ll bookmark it and share with my kids.

Thanks!

Cool! Lot’s of valuable tips and advice here.

You completely left out my site from your list! But I forgive you. This time. 🙂

Nice work gathering such an extensive and comprehensive list or resources together. I’ve got some reading to do.