What else is big in Japan? The secret life of Japanese suburban female market speculators.

There’s this woman who is not your typical Asian housewife. Well, neither am I, but that’s beside the point. 😉 This woman though, is part of an “underground activity” considered taboo, that many a suburban Japanese wife participates in. It’s clandestine, dangerous, and extremely exciting for those who do it. It makes for the adrenaline rush that many a bored housewife trapped in a domestic setting would get addicted to.

This secret occupation is nothing else but day trading.

This New York Times article lets us in on the growing popularity of online trading in Japan:

Tens of thousands of married Japanese women ventured into online currency trading in the last year and a half, playing the markets between household chores or after tucking the children into bed.

Ms. Itoh, a homemaker in the central city of Nagoya, did not want her full name used because her husband still does not know. After cleaning the dinner dishes, she would spend her evenings buying and selling British pounds and Australian dollars.

Well, you know what they say when you’ve got a smart, idle, thumb-twiddling housewife cooped up at home while you’re away at work, right? Don’t look now, but she may just lose control and get herself into some speculative investing (also known as day or online trading). And may make millions without you even knowing!

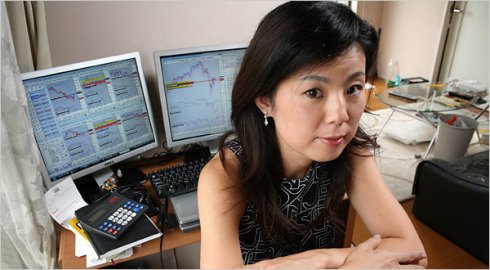

YUKA YAMAMOTO dutifully quit work to assume her expected role as suburban homemaker when she married six years ago. But she quickly grew bored at home, and when she saw a television program about online stock investing, she took $2,000 in savings and gave it a try.

Today, Ms. Yamamoto says she has turned her initial investment into more than $1 million as a day trader, scanning her home computer for price movements in stocks, futures and foreign currencies that could lead to quick profits. And by writing books and holding seminars on trading strategies, she has also become a celebrity among homemakers who are investors. She says she has met thousands of other married women who now play the stock market online, many without their husbands’ full knowledge.

Beware, the lure of online day trading.

There are many other reasons beyond the typical for why these women speculators engage in these activities. Sure, there are the usual attributions to greed, to boredom, and to the competitive nature of aspiring wealth-builders. And in Japan, doing this sort of thing is even more distasteful as it is considered “wrong” to be making money without working for it. But for these particular women, could it be that culture also played a part in waking up this perfect storm — something to do with women wanting to ensure themselves some form of financial independence even as domestic homemakers? Lots of women want to feel in control of their financial destinies and want to avoid feeling vulnerable even as they dial down their careers to keep an eye on their home, children and families. And I guess they’ve become quite resourceful about addressing these matters in certain countries 😉 .

Some reasons for why this type of market play has taken off in some places:

- Japan is a culture that highly values job stability. But in recent times, people are no longer guaranteed their jobs for life.

- Living with uncertainty can change one’s views on how to make money.

- Who knows how financial information and education are assimilated elsewhere? In different countries, market and cultural orientations are different, so what’s common knowledge for us here, such as index investing, asset allocation and so forth may not be as readily understood elsewhere.

And speaking of cultures…and subcultures — how about this possible motivating factor for trying your luck out this way?

The surge in day trading has even created celebrities, including its own “stock idol,” a young woman named Maiko Asaba who poses in miniskirts for photographs in day trading and stock investing magazines next to captions describing her fondness for ice cream and index futures.

“In Japan, every true subculture has celebrities,” said Ms. Asaba, 28, a financial researcher and part-time day trader who keeps a giant teddy bear next to her trading terminal in her cramped Tokyo apartment.

Oh yeah… the sweet taste of fame and glory. I quite find it amusing that this movement has molded “celebrities” out of those secret traders who went public with their success. These folks have gone on to ride their publicity to branch out as authors, as founders of trading groups, and as so-called expert consultants in this “money generating” field.

Where do you stand on risk vs reward?

And yes, I agree, this day trading thing is a money generating field….sometimes. When the market goes up and we’re in the midst of a massive economic boom, everyone’s minting money, and day traders, speculators, market timers are all big winners, along with the rest of us who’ve got investments at stake in the market and riding that same market wave. But when the market hos instead of heaves, and the market wave recedes? Well, then the hopelessly hopeful get a quick lesson on risk vs reward.

Regardless of where you’re from, it doesn’t change the fact that day trading is highly risky. No matter where you do it, how smart you think you are or how rich (or poor) you already are, playing this game is very risky. That risk is the reason for both the huge returns:

During the four-and-a-half hours each weekday that the Tokyo Stock Exchange is open, Mr. Mimura sits in his bedroom monitoring stock prices on three computer screens. He said he became hooked two years ago, after he put all his savings, $25,400, into shares trading at about 25 cents, and then watched the price jump to 45 cents in just two days. He said his parents, who are farmers, were opposed to his day trading, but he appeased them by earning $127,000 in a month and using the money to renovate their home.

Over all, he said, he has made $2.54 million by trading stocks at home, enough to be invited to a New Year’s party attended by a few dozen of Japan’s biggest day traders.

and the massive losses that traders experience:

When the turmoil struck the currency markets last month, Ms. Itoh spent a sleepless week as market losses wiped out her holdings. She lost nearly all her family’s $100,000 in savings.

And you can definitely magnify those risks even further by doing a few more things:

- Use margin trading. It’s speculative to the nth degree.

- Leverage your entire life’s savings.

- Put all your eggs in one basket.

- Don’t tell anyone what you’re doing, especially not your spouse.

- Don’t stop.

Even a broken clock is right some of the time.

For those who continue down the trading path, it doesn’t sound like they’ve read this book: Extraordinary Popular Delusions and the Madness of Crowds. If they did, then they’d realize that our history is littered with stories of snake oil, money schemes and fads that took off, became big sensations, and made a whole subset of people rich then very poor in a span of a few years. They’d realize that their financial strategies haven’t really been thoroughly tested until they’ve sat through full market cycles with trend lines going in more than just one direction. But as we would have it, there will always be a place in the investing community for market speculators, timers and traders because the dream to get rich quick will be one that people will nurture through eternity.

But don’t get me wrong, I don’t dispute that market timing can work for some people. A minute few, perhaps. But are they really experts or are they just lucky? Market timing experts do exist, but I doubt that you’ll find these people among the ranks of Japanese suburban housewives.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 26 comments… read them below or add one }

Day trading is like gambling… you have to know when to quit while you’re ahead.

That is, assuming you are fortunate enough to get ahead in the first place.

Yes, I was planning on another post to emphasize that very point! Day trading is pretty much gambling!

Interesting story-Sounds like here in the U.S. in the late ’90’s/early 2000’s. You don’t hear too much about day traders in the US these days, although I am sure they are still out there. I wonder if they are setting themselves up for trouble!

My mom did this before when she was about to lose her job. She made about 15k in 3 months on 10k principal, but she really studied the whole thing before she went in. Her friend is an analyst at Barclay’s and he gave her a bunch of books and gave her tips as to how the individual investor can expect which way the market is going to go because market makers trade their positions in stages. She didn’t really do day trading. It was more like short term momentum trading and she bought mostly companies she knew about and wouldn’t mind holding. Then she quit because she said it was too much stress to do it while working,and taxes ate up a lot of her gains. Anyway, it’s too scary sounding for me too.

Hey I don’t know much about day trading other than the fact that I lost a lot of money trying one day (it was a great lesson in itself in my young investment life).

I also heard from my friend who helps people file tax returns that most people who are day traders lose money.

Based on those two points, I would suggest to everyone “DON’T TRY IT”!!

On another note, I just came back from my honeymoon in Japan which I have quite a few videos at my blog about so I want to respond to the question in your title by saying that Japan’s got EVERYTHING!

Interestingly enough, this sort of speculation has always been more prevalent in many asian cultures than in the west. Perhaps it is because historically, many asian cultures are very risk-adverse when it comes to family and reputation. But blips on a screen don’t seem so real, so it gives an outlet for speculative expression many people just can’t get elsewhere.

I think it is wise to discourage people from day trading. However, I found the final sentences in your post to be exceptionally sexist, which I wasn’t expecting as a long-time reader of your blog. Because of Japanese culture, many highly educated and intelligent women become housewives (also something that happens often in the USA, Australia and the UK!) and some of them no doubt have the mathematical skills and ingenuity to succeed at anything they turn their hands to.

@Amanda,

I greatly apologize if I offended you about anything I may have said; the issue I may have made here is to boldly state that I believe that market timing experts are *very rare*. What constitutes an expert? Someone who makes millions consistently by performing their craft.

I also agree that I am biased here. But my true bias is with day trading itself, not necessarily with who performs it. The case here is that I am unable to be convinced that “anyone” can do a good job at it because to me, the whole system is flawed — the house is stacked against the player. Hence, my seemingly sweeping generalization. My mistake here is not to have generalized enough: I should’ve said that I don’t think you’ll find market timing experts anywhere from here to Timbuktu.

The only real experts I’ve seen are big names in the business of hedge funds and market timing, who are in fact, the market movers who pretty much own the market. I may stand corrected here, but I think that most of us who are playing the day trading game are just fooling ourselves into thinking we know what we are doing.

Perhaps with the appropriate technical resources, time, education and a good deal of experience, anyone can be such an expert, but I do doubt that suburban housewives (such as myself, for example) have the time and inclination to do all that and be a TRUE EXPERT in that craft. Most of the traders I read about dabbling in this sort of thing are very young people and that in itself says something.

That was all that I meant about it. I guess we disagree on the designation of “expert” that I use in this article.

P.S. Japan is my absolute favorite country ever. 🙂

I have a friend who is a Ukrainian stay-at-home mom who makes a nice profit day trading. However, she has a MS in Quantitative Finance and worked as a trader. I would not recommend this for most people.

If indeed day trading is a form of gambling, an expert day trader would be about on a par with a professional gambler: a person who understands the odds very well but who, over the long run, probably fares about the same as anyone.

But it that’s true — that day trading is truly like gambling — would it make sense to have a kitty that you gamble with and use only that amount and the proceeds from that amount for your avocation? Say you start with $1,000. A few trades later you have $1,500, so you use that amount for further trading. A week later you’re down to $750; you limit yourself to investing only that amount. When you run completely out of money, you stop.

In that scenario, you might set a rule that each time you doubled your money, you put the profit in savings or some safer financial instrument and went back to trading with the original kitty. That is, one day you find yourself with $2,000. You take $1,000 and put it in a Vanguard index fund and use the remaining $1,000 to continue day trading.

Those parameters would stop you from betting the farm and MIGHT allow you to build wealth, at least in a bull market. They kinda take the gambling out of gambling, though…which puts a crimp on the adrenaline rush!

I think day trading concepts being taught by many of these firms haven’t been working in this current market environment.

Day trading takes significant time and effort to master and in my opinion is much more complex than most of us have time to committ to. It is a full time job in itself for the simple reason that you must research, research and research and then adopt a creative stragey to building a portfolio

day trading is one of the many solutions of economic crisis like now. someone maybe think it’s like gambling. it depends on yourself..

Asiafxonline,

I agree, some day traders can make money but I also believe as others do, that it takes a significant amount of learning and experience to make money well via day trading. Most people will just lose their shirts because they don’t know what they’re doing when they try out this activity.

” YUKA YAMAMOTO….And by writing books and holding seminars on trading strategies…”

It is easier to make money TEACHING how to day trade, then it is day trading.

This is probably how she made MOST of her money.

Hide, you certainly have a point. Alot of “market/investment/trading experts” do not have a clue about trading but are certainly good at marketing, they suck but you can’t blame them for trying to make a good buck.

Regardless, it sounds like a lot of you guys out there are either overwhelmed or lacking in confidence.

People who like to mention trading is another form of gambling USUALLY (>99%) don’t know very much about trading. A key point is that they both involve probability. However, trading requires more: skill, intellect, risk-seeking behaviour, a positive mindset, perseverance, and last but not leaast, discipline.

But if you feel like you’ve got that list (especially the last two), you’ve got a high probability of succeeding. If you don’t, I’d still recommend you try because it’s a fantastic lifestyle you can have if you succeed.

ABN,

I actually agree with you. The average investor has no business day trading. But I know a lot of people who do it well. But most people shouldn’t try it because it is LIKE GAMBLING for most of them. If you approach it as a serious activity and develop true skills in this area, then yes, more power to you. There’s a small percentage of people who can make it work.

Thanks for sharing your views — would love to hear more about the fantastic lifestyle of a day trader.

Interesting article! Well, reading the comments, overall I could say that most people here haven’t got a clue what day trading really is, let alone they ever heard about using simulation accounts and learning money management and discipline in the first place. Not passing that phase first, you indeed will blow your real account in no time (like these guys somewhere here in the comments mentioned):). Big mistake !!! LOL.!!!

Anyone who writes about trading as gambling should probably not be a trader. Trading is about calculated risk. It is about being disciplined and having a trading plan and working strategy. People who say trading is gambling should be working 9-5, leave trading to the rest of us who work 24 hours a day making sure we continue adapting to the ever changing market environments.

So day traders, tell us how much you’ve made in one year? I’m curious to read about your track record. Not saying that day trading is a bad thing — it IS a bad thing if you don’t know what you’re doing and you enter into this thinking you’ll get rich quickly. Like any higher risk endeavor, it requires some study and experience to execute well. Heck if you can make money this way, then more power to you!

Interesting write up on day trading. You mention a few times that day trading is akin to gambling, but that begs the question, what type of equities investing isn’t? 😉

If you think about it – day trading is just another time frame of investing. Instead of buying a particular stock and holding onto it for years, the time frame has been reduced to hours, minutes, or even seconds. Swing trading is usually in between both extremes where one would take a position that’s expected to last a few days to a few weeks only.

The reason day trading gets a bad rap in my opinion is the improper use of leverage and risk management. If a person were to “invest” for the long term with the same bad traits, they would stand to lose just as much as the day trader. We’ve witnessed this type of long term blow up with all the Wall Street banks when they got caught on the wrong side of the housing market meltdown which took years to culminate.

Of course day trading is harder than longer term trading because it requires much faster decision making. Another key difference is long term trading can be based on fundamentals, technical analysis, or a combination of both. Day trading is all technical as fundamentals mean little to nothing in the short term.

It all comes down to whether one can successfully “time the market” to capture the differences between the lows and highs. I say the answer to that is yes, if you are attune to the markets and keep updated on the day to day, month to month activity. Looking at the market in 2008, it was clearly showing weakness and a red flag long before the market went into free fall.

The key is technical and fundamental analysis aren’t exact sciences so one will always have to interpret the data, which is where the risk comes in regardless whether one in a long term investor or day trader. Proper leverage and risk management will determine the winners and losers in all time frames.

Soullfire you have hit the nail on its head. I started day trading six months back. I started slowly investing only a small amount and watching and learning market.And now i am beginning to make profits. It takes discipline and control over greed and few more traits to be good at it. And for those who love passing un-thoughtful comments, it always will be “gambling”.

This are just my views and not meant to hurt any person’s sentiments.

@Arvind and Soullfire,

The more I’ve been in the business of covering investment and trading, the more I am realizing now that there is a thriving market in forex, binary options and other stuff in the trading industry. My conclusion is that there is a market for a reason — supply and demand. People want to trade and many are certainly successful with this activity. So you are right. Those who “don’t know” may criticize this and call it gambling and such. I think that most people will find that it’s not the right thing for them. But after some research and study, I’ve realized that it’s still an activity people engage in, enjoy and may make money in (sometimes loads of it). It’s a form of risk taking that may not be about sheer luck — perhaps calculated risk taking? Or calculated gambling? Either way, I am getting to know it a little more and maybe rebooting my way of thinking about it. But let’s not forget it is high risk for those who don’t know what they are doing, where they can lose their shirt. So if you’re going to engage in trading and more complex investments, then you should be highly prepared!

Different strokes for different folks!

I just happen to be a stay-at-home mom and manage my family’s portfolio. I don’t consider myself a day-trader and there are many ways of conservatively investing to make a decent return on your portfolio. I agree with you that people who don’t understand it or who have tried it and try to discourage others. I have a Finance degree and worked in the industry and most importantly, have an interest in investing. I also do the work and spend time reading up on companies and watch movements in prices. Unfortunately, I don’t know many other moms I know who do this, so I end up connecting with online investment communities about different companies. At home, moms need intellectual stimulation too and to feel like they are contributing to the family’s income, at the same time, I have the flexibility to be there for my children. I think the main barrier for people is having/taking the time to learn, so in my case I am fortunate to have studied it. I recommend that others take time to learn more, there are many resources out there, it’s a good investment for yourself!!

I see you’re still differentiating between regular investing vs more active trading as the latter being geared towards the higher risk takers. Would you believe that short term traders are actually at lower risk in the market than long term investors? =)

It helps when you think about it from the macro perspective- the markets in general (equities, commodities, real estate, etc..) are directly associated with risk. Simply being in the market means you are exposed to risk. After all, the only way any investor or trader can guarantee not to lose money is the same for both- to not be in the market at all. Simply put- market exposure is equivalent to risk for any investment that’s not FDIC insured like CD’s.

Knowing that market exposure equals risk, the direct conclusion is the longer one is in the market, the more risk one is taking on. In this regard, short term traders are effectively limiting their risk by reducing their time in the market and thus their market exposure is much less than that of the long term investor.

Let’s say you are in a bad investment that is moving against you. Who is in danger of suffering the greater loss- the short term trader who takes their loss in one day and is out of that investment after that, of the long term investor who lets it “ride” for months/years?

The increased timeline of the long term investor “may” be helpful if the investment reverses course and starts making up for the losses- but what if it doesn’t? This is the real danger and risk to long term investors – an investment that is on a decline from which there is no snap back or reversal. This can destroy an account just as badly as any reckless day trader. Those who “invested” in tech stocks when the NASDAQ was at 5000 are still deep in the red over a decade later if they held onto most of the high flyers of the day.

The reason a day trader blows up their account is usually due to them refusing to take a loss and deciding to hold onto their trade hoping it will turn around, effectively becoming a long term investor and increasing their risk for continued losses.

Regardless of whether one is a short or long term investor, the key to loss or gains for both is knowing how to limit losses and exiting when the extended trend becomes unfavorable. Failure to properly manage one’s investments is akin to gambling or high risk taking in any time frame.

I would also argue that successful short term traders make for better long term investors simply because they aren’t afraid to cut their losses in a timely manner in all time frames.

Being successful in day trading, or even sticking around long enough to get good is very dependent on risk management. When you are loosing you use a stop loss, when you are winning, you take profits and not let it turn into a loss.

It doesn’t matter what your strategy is. Even if you have a winning system, it won’t work all of the time. But if you keep your losses small. You won’t go broke.

I think the problem is people get into it thinking it will solve their financial problems, which puts them in the category of scared money. Scared money always looses. The psychological aspect of day trading is probably one of the most important parts, but overlooked. Done right, the markets are not exciting and are just opportunities that need to be handled correctly.