Last time, I wrote about how we can predict inflation using a market index as an inflation indicator. For the chartists and other crystal ball readers out there, here’s something else for you: is there a way to predict when the economic downturn has ended?

Is The Economic Downturn Really Over?

Based on some simplistic observations, here’s how I can tell when things are getting better: the stock market has recovered somewhat from its lows (despite claims by some technical analysts that it’s supposed to “retest” previous lows before any meaningful recovery can resume) and the job market has either stabilized or begun to improve, with more companies looking to hire again. I’m actually getting more inquiries from headhunters about my availability for technical jobs around here in Silicon Valley (imagine that: they still have my resume!), and I’m getting more inquiries from online advertisers as well. Signs of life?

According to a certain economist, the recession is indeed now over. Do you believe it? It may be hard to catch on to the idea that we’re now supposedly out of the economic slump that was so dramatically sparked by the twin American nightmares that were the subprime mortgage mess and credit crisis. Then again, the thing about recessions, they’re in with a bang and out with a whimper (or if you prefer another analogy, they’re in like a lion, but out like a lamb).

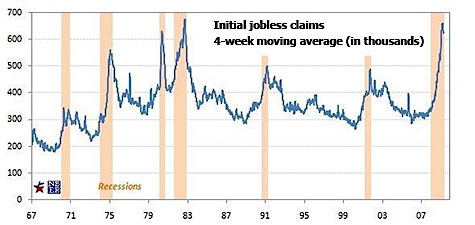

Robert Gordon is the economist who’s responsible for this call. He is using a single indicator upon which to base his conclusions: unemployment benefit claims. According to MSN Money’s article on this, history has shown that when the number of employees who file for unemployment benefits has peaked, the recession bottoms out shortly after that. It appears that this has in fact been true over the last 6 recession cycles we’ve had. Just check out this intriguing chart, care of MSN Money:

The chart plots the recession cycles (pink shaded areas) against Initial Jobless Claims. As you can see, the peak in claims coincides with the end of each recession since the late ’60s. But if you aren’t entirely convinced that you can read the recession this way, then there are also a few other variables that have been used to make determinations about the health of the economy: total payroll jobs, industrial production and the unemployment rate.

Well, I’m all for better times ahead. So what happened to all that talk about the “Next Great Depression”? Do you feel that we’re finally out of the woods? I want to exhale just a little, but my spouse is still waiting for the next shoe to drop. I wonder if he’ll be waiting for a while.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 31 comments… read them below or add one }

You’re right — the chart shows initial jobless claims peak at the end of recessions. But that chart also shows that several recessions had one or more false IJC peaks before the real one rolled along.

It’s always impossible to tell if the recession is over of course. Silicon Valley will also recover faster than other areas because of the large cash stashes most tech companies keep. What I’m betting we’ll see is a small Q2 decline in GDP, less than 2% annualized. Q3 GDP will show recovery.

This will be a slow recovery, with a possible dip into a new recession if commercial defaults pick up as expected. Employment will be the biggest problem for the next 18 months, and after that period housing will start a noticeable recovery. Do I swear my life on this? No, but it’s probably pretty close.

Many factors that influences the economic growth so that it is difficult enough to determine when this recession will end. The employment and unemployment are the most hot issue in every country…. I just hope that world leaders, economic experts and all institutions with influence can make things get better…

I think that the official “recession,” as defined by economists may be over, but that doesn’t mean the pain is over. Employment tends to be a lagging indicator because employers will push current employees to become more productivity. I think hiring will begin when productivity reaches the tipping point. again.

You better listen to your husband

Who cares about indicators. What matters is CAUSES.

The cause of this recession has not been addressed. The underlying economic issues are still deteriorating, though less slowly. A dying patient eventually shows slowing blood loss also. But that is because they are running out of blood to lose.

There was a moratorium of foreclosures. There are nearly 1 million “shadoe” foreclosures, or properties that banks own but are not yet on the market for fear of driving prices even further. Ther are nearly 2 Trilliion, yes with a T of mortgage option ARM resets coming due in the next 24 months.

An entire closet full of shoes is about to drop.

I am not seeing that it’s over. Sales have not picked up at my work or my husband’s.

The economy like most things in life is cyclical. 5 years from now we will be able to see that this was most likely the turning point to move out of the recession.

What I look at is the amount of emotion present among stock investors.

We have been to insanely dangerous prices four time in U.S. history. On the three earlier occasions, we eventually went to stock prices 50 percent down from where we are today. My guess is that we have one more huge stock crash ahead of us sometime in the next five year. When people lose even more of their retirement savings, they will cut back more on spending and that will causes more businesses to fail and more people to lose their jobs.

It takes many years to recover from the sort of bull market that we experienced in the late 1990s. It appears to me that we are about halfway there today.

The good news is that, once we get over the emotion caused by the out-of-c0ntrol bull, we will have many years of great returns ahead of us — Presuming that the economy doesn’t go entirely over a cliff during the recovery stage!

Rob

The jobs numbers from this morning seem to suggest that we have a waaaays to go…

Yeah, doesn’t it sound like I spoke too soon? Based on the latest reported job numbers, unemployment claims could still have a ways to go as well…. making this recession stretch out even further.

I think that certainly many factors have improved, but only in the sense that “the bleeding has stopped” (to use an unfortunate metaphor). I think nothing major is getting worse at this point, but that true growth might take a while all across the board. I don’t have numbers on this like the Weakonomist does, I just recall what I hear other analysts I respect saying. We need to see earnings in August. And from an article I just read on foreclosures, looks like they’re still going strong in Florida…

I think perhaps you should leave the economic predictions for the experts to get wrong and stick to personal finance.

Que Man,

The economic predictions are done by the experts, and I’m just reporting on what they said. What the economists are telling us has a lot of bearing on our personal finances, hence part of what I do here is speculate on those calls that the “experts” are making. I think these ideas are worthy of some interesting dialogue.

You only cited one economist and you did a fair bit more than report on what he said. You concluded in your second paragraph that things were getting better. How anyone can do that with an employment rate that was still trending down even before the last jobs data was released and before the bulk of the quarterly earnings are released is beyond me.

The unfortunate fact is that many of the jobs that are being lost now are structural jobs, jobs that will not be replaced when the economy actually begins to improve. They won’t be replaced because they won’t exist any longer.

I have been watching many many financial analysts on TV and they appear to be pretty positive now. They aren’t saying there won’t be a few rough months ahead. The Dow is still volatile, consumer spending will be light, and unemployment will rise. But some are saying that we hit a bottom last week.

I asked questions and did not specifically maintain or state outright that it is the end of the recession. I did wonder if it may be the end though. So yes, it is a cautious optimism that I hoped to express through this piece. Those hopes I have for better times can certainly be dashed by a turn for the worse in any of the stats and indicators that are under scrutiny.

I am not in the business of predicting, but I am in the business of speculating. And I guess most people can tell I’m expressing an opinion or sharing some hopes about the near future. I guess it’s just too bad if those hopes aren’t necessarily met anytime soon, although what’s been happening lately seems to lend credence to the aforementioned recession indicator.

We will have to agree to disagree 🙂

Heh, you could very well be my spouse (incognito)! 😀

I know for sure that the economic downturn is over, why? Well…what else can explain my 4,000% stock gain in the last 6 months.

Even though I would wish that we have seen the worst of it I honestly don’t think we have seen anything yet. The financial policy of the US and other governments might seem like it is helping but I believe that it is only making it worse. How can it possibly be a positive thing that you need to print trillions of dollars out of thin air? It’ll come back and hit us all hard!

I’ve researched already, but all I’ve found is about how a recessions are determined, which is by certain indicators. I do know, however, that overproduction causes economic downturn. Please tell me more factors!

I agree with your spouse. The other shoe is still to drop and it may be more painful than the first one. We created a lot of excesses in our country over the past 2 decades. Very similar to someone who has gained a lot of weight slowly over the years. No one expects them to lose the weight quickly. We all believe that it will take time to get the weight off and establish a new base line.

Unfortunately economists that end up on TV are usually bullish by nature. Very few of them predicted the crash last year or even that things were going to get bad. The one guy I have been reading for several years that seems to have a pretty good handle on things is John Mauldin. Here is a link to an article on his blog talking about the future. He has also written a couple of books. If you are interested in learning more about macro economics and how they impact the future, I would highly suggest getting on his newsletter. He also publishes his newsletters on Safehaven.com if you don’t want to give up your email address :). Safehaven is an excellent resource of contrarian viewpoints.

One thing to think about from a stock market standpoint is how the market performed in the 1929 crash and following years. Here is an excellent view of the Dow Jones Industrial performance during that time. The crash wasn’t a one year event. It took several years to get rid of the excess and eventually a drop of 90% from the top. I have no idea if we are facing that, but given the macro state of the global economy and our governments responses to it, I would suggest that we have much more downside ahead.

I’d say the real estate market is about mid-way through the settling process, considering the number of alt-a, option arms, and equity lines made in the years prior to the bust. Pending mortgage resets, and home refinance restrictions due to credit, equity, and income issues point to a lower bottom.

Based on all the info that I’ve been seeing “Heck no!”. Like everyone else is saying, the other shoe just hasn’t dropped yet. We are still in for an Alt-A and Option ARM crisis that is just beginning. Unemployment is getting higher and higher. People’s spending habits have been altered, which is bad news for storefronts and the GDP. I just don’t see any green shoots yet.

…the only economic indicator you need to determine whether we are still in a depression…is Barack Obama still the president?

Not yet. As a home maker, saving money by cutting expenses is a crucial thing that I must do often nowadays. The prices is still rising but our income is constant. Our buying power is low now.

A nicely written article. You gave good accounting of where your thoughts were based and invited responses. My thoughts are that the downturn is not over. Main reason at this time is unemployment, and government plans to extend benefits. We all know the government plays numbers games as well, so the total number of people who have lost their job is not reflected in unemployment figures, but does impact the economy in a negative way.

The other shoe(s) will be passing cap and trade and/or the” health reform”. Either will have a great impact once those left holding the check realize they have to pay for all this somehow, printing more money will only work for so long. Eventually, you have to pay those IOU’s. If no other major spending bills are passed, I expect a slow recovery.

Nice article. You have some objectives that do make sense. However, I do believe that, although we are not in a depression, we are certainly engaged in a recession. Just look at the stock market, that pretty much identifies the state of the economy.

I think the only time we will be able to tell if we are out of this economic slowdown is when we are back to the level that we were at when the economy tanked.

I feel that it has peaked but is not yet close to over. Unemployment is going up and there is not much news of employers hiring. Also, banks need to start lending to businesses and individuals without all the restriction and excess requirements to get money flowing and encourage growth.

I think there is a long way to go in order to get things right. I haven’t seen any improvements on the sales side. In fact, there are more layoffs expected.