As you watch the investment markets, you’ll find that often, you’re back where you started. I’m of course referring to the volatile nature of the markets, and its tendency to go every which way. You may think that a record high in the market is a cause for celebration, until it pulls back (for the umpteenth time) over the span of a few months.

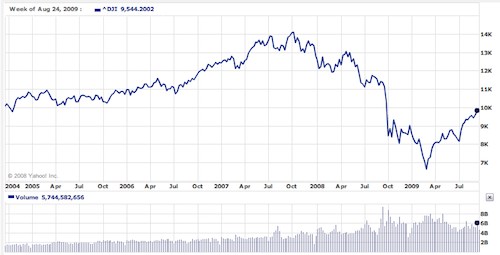

During an upward move in the midst of a low interest environment, being in cash savings (e.g. high yield savings accounts and certificates of deposit) is much less appealing, while stocks look like a great play. Check out the historical chart showing the performance of the Dow Jones Industrials over a five year period (From Yahoo! Finance: click to enlarge).

A chart like this shows how you could end up being in the same spot even after 5 years, giving the impression that the market has not budged. But here’s the good news. The market has not made much progress, but if you had continued to invest regularly during the last year and had dollar cost averaged throughout this time, you’d be a happy (or relatively happier) camper.

One Year Investment Performance With An Automatic Savings Program

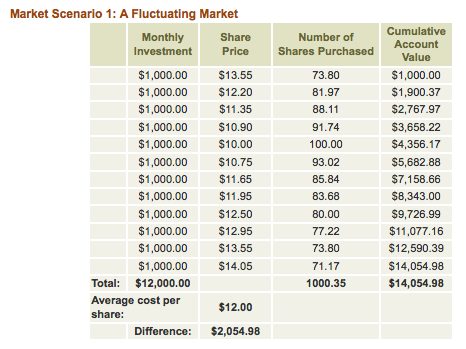

If you’re enrolled in an automatic savings program, you’ll find that this is one effective way to ensure that you gradually build your net worth. How effective is it? Let’s take a look at this case: I found this interesting example of how your investments would fare if you dollar cost average into a fluctuating market (the example is taken from Tomorrow’s Scholar College Savings Plan). They have a dollar cost averaging calculator where I plugged in a monthly investment amount of $1,000 as an example and got these results:

The monthly investment of $1,000 invested over a hypothetical one year period yielded some nice results even though the share prices shown during that year seemingly went nowhere. In this particular case, the return is 17%! Now apply this example to a situation where the market dips then rises and returns to its former levels. Taking this approach should help you achieve positive returns (which could actually be more fruitful if you’ve doubled down when the market was at its lowest). If you don’t dollar cost average but instead rebalance your portfolio when the DJIA carves out a bottom, then you’re also likely to see some gains as the market recovers.

So did you make any money this past year? Do you employ this strategy with your investments?

For more on this topic, check out my articles. These can explain why a market dip may not be too bad.

- Lump Sum Investing, Value Cost Averaging & DCA: Investment Timing Strategies

- Contrarian Investing During A Bad Market

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 17 comments… read them below or add one }

@SVB – Great reminder on the importance and value of dollar cost averaging. We’ve been in a ‘stagnant’ market since the peak in 1999/2000 and most of these kinds of markets cycle up and down, but wind up where they started anywhere from 10 to 25 years later. The value of dollar cost averaging during these markets cannot be overstated because DCA works best when markets produce no real return, but have a great many ups and downs.

Since the tech bubble burst, we’ve been on one helluva ride, but we have yet to make sustained progress. With fiscal spending at an all time high, we can expect it to be a good while before we make sustained gains in the market (usually fiscal spending like this brings the economy out of recession, sparks inflation, then interest rate hikes and taxes, and then another recession before it’s all worked out). In the meantime, DCA is the best friend any investor could ask for…well…aside from a crystal ball.

Thanks Michael! I still actually remember just how emotionally difficult it was to do anything when the market was plummeting so drastically earlier in the year. I felt paralyzed to do anything, wondering if the market was going down even further (headlines were visualizing Dow at much lower levels). Now if we could just ignore all that and keep our investment programs going, we’d actually be making money at the moment. Of course, things could shift on a dime, but a fluctuating market isn’t all that bad when you think about the opportunities it could bring.

Its always good to see the markets picking up, when there is movement there are always winners and losers, it’s simply a matter of investing in the right commodity – easier said than done.

SVB-

Nice article. That’s nearly verbatim what happened to me over the past 2 years or so, with nearly identical amounts of money.

I’m a new professional and a new investor, and I had in July-ish of 2008 opened up a 529 Plan for myself to get a foothold on graduate school expenses I was planning to have in the next 5-6 years.

Well, after a $3000.00 down payment to Vanguard, the market took a dive and my $3000.00 was slashed to $1800.00 by November. I was ready to stuff my savings into a jar under my matress, but I had read about dollar cost-averaging before, and was determined to see if it worked firsthand (Even if it didn’t work, I would be out maybe $5 grand tops in investment losses over the next year, which really isn’t much for a fresh graduate, who would then be armed with that information: “dollar cost averaging doesn’t always work.” Fair trade, in my opinion.).

Well, it did.

$1000.00 dollars per month later, I’m looking at roughly a $13,000 dollar investment on my part which is now teetering at a value of $15,0000 — and the value of the fund hasn’t even returned to it’s original high: I bought in at $15.67 per share, we’re only at like $14.00 per share or so now, so the sheer volume of shares I could buy with $1000.00 per month just dwarfed the risk in my eyes (My lows were roughly $10.50. Buying at that price was terrifying to me, but thrilling now that I look back, knowing that I would make money, hehe.).

Dollar Cost Averaging Works. I highly recommend it.

(Jeez, I make it sound like a bottled product, don’t I?)

I’m not a fan of Dollar-Cost Averaging. It is a strategy that gives protection only from short-term price swings and not from the far more important long-term price swings.

What determines your long-term return is the valuation level that applies on the day you make your stock purchase. Stock were selling at insanely high prices all the way from 1996 through 2008. All those who bought stocks during that time-period hurt themselves by doing so (better long-term returns were available in far safer asset classes). Dollar-Cost Averaging did not help.

It’s true that those who practiced Dollar-Cost Averaging after the crash are likely to see a good long-term return if they hold those stocks for at least 10 years. But how likely are they to do so? We are likely to go to valuation levels at least 50 percent below those that apply today within the next five years. How many of those who do not pay attention to prices are going to be able to hold through another stock crash? My guess is that the media will be so negative on stocks after another stock crash that most of those not practicing valuation-informed strategies will sell at low prices.

Those who purchased at post-crash prices with the understanding that they will probably need to hold through another stock crash will probably do well after the passage of 10 years or so.

Rob

Dollar cost averaging works for some investors. Just as with any investing strategies, there are exceptions.

Buffett wrote on dollar cost averaging that it was foolish to buy when the market was obviously high. Lump sum investing, for Buffett and for those who are willing to do the homework, can often give better returns than dollar cost averaging.

Interesting comments! I had actually written about lump sum vs dollar cost averaging before, as well as value cost averaging, so I updated the post above with some additional articles I had written on the subject.

@Adam – thanks for the endorsement 🙂 . I think that for passive investors, it’s been one way to keep them invested despite the turmoil in the markets.

@BB, thanks for bringing up lump sum investing — while I’ve read that this approach has trumped dollar cost averaging over time, a lot of people, myself included, like the psychological crutch that dollar cost averaging offers. If it’s one way to keep you invested and not nervous about your investments, then why not use this method? If you invest at the “wrong time” via lump sum, your money could be doomed. How do we know when “the right time” to invest a good chunk of our money is? At Dow 6000? In hindsight, it was a sweet time to invest, but back then, the media was screaming Dow 4000 or worse, so who would have had the guts to do it back then? DCA takes away the guesswork.

@Rob, interesting point of view, and yes, you are right about how things have transpired in the markets: for those who began investing only recently, the market has been cr*p. You’re not big on passive investing if I recall. Would like to know what it is you advocate, especially for the average investor. For many people (esp. those who don’t really have much time to pour into studying the markets), passive investing has been the best and most reasonable way to invest.

You’re not big on passive investing if I recall. Would like to know what it is you advocate, especially for the average investor. For many people (esp. those who don’t really have much time to pour into studying the markets), passive investing has been the best and most reasonable way to invest.

Passive Investing worked well only for the length of the insane bull market. It always works well during times of irrationality. It never works well in the long run. I believe that the average middle-class investor needs to be focused on the long run. That means doing the opposite of what the Passive Investing advocates urge. That means not ignoring price, but always taking price into consideration when setting your stock allocation.

I believe that the average person should be investing in indexes. That keeps investing simple as simple can be. But I believe that the average person should never, ever, ever give two seconds thought to investing passively (to invest passively is to stay at the same stock allocation regardless of the price at which stocks are selling). Losing as much money as Passives always lose in the long run complicates investing by making it ten times more emotional an endeavor than it needs to be.

Passive Investing has been tried four times in U.S. history. It has brought on huge losses for all who followed it on each occasion and also an economic crisis for the entire country. Yes, even people who invest not a penny in stocks end up suffering when The Stock-Selling Industry promotes this long discredited idea.

Both common sense and the historical stock-return data tell us that the price we pay for stocks matters. Would you pay $60,000 for a car with a fair-market value of $20,000? Most middle-class people would think someone who did that was insane. But that is just what millions of us did when we bought into the marketing slogans that told us that stocks are always best for the long run and that there is no need to time the market and all the rest. Stocks were selling for three times their fair value at the top of the bubble. The expected long-term return for stocks at the top of the bubble was a negative number.

To time the market is to pay attention to price. If you fail to time, you fail to respond to price changes. If millions fail to respond to price changes, all price discipline is lost and we get to the price levels that we saw from 1996 through 2008. The inevitable follow-up is a price crash and an economic crisis. When things get as out of hand as they did this time, a depression becomes a serious possibility. It is hard to exaggerate how much human misery has been caused by Passive Investing on the four occasions when it has been tried.

The practical problem is that Passive Investing has huge marketing appeal. It is all rooted in the idea of telling people fantasies, telling them that price does not matter, that there is some magic pixie dust that is going to make it all work out this time. Except that it never really turns out all different. The same pattern has been repeating over and over since the day the market opened for business. We look to people in The Stock-Selling Industry as “experts” but they have a huge financial disincentive to report the realities straight to us.

Rational Investing is not complicated. It means paying attention to price, going with a high stock allocation when stocks are selling at prices that permit them to provide a good long-term return and going with a low stock allocation when stocks are selling at a price that insures a poor long-term return. The hard part is getting over our reliance on The Stock-Selling Industry for advice on how to invest. I would like to see hundreds of personal finance blogs begin taking an independent look at what works in investing, to become a bit more skeptical of the claims of The Stock Selling Industry and to become open to the idea of looking at the historical stock-return data to see what has always worked in the past and what has never worked in the past.

Rob

I was just looking over my investments this morning. I bought some shares in a few companies and havent invested in anything since, this was around the time of the initial crash. My biggest investment is down about 100%, my second biggest is up 250% and third is up 80%. The others just teeter back and forth.

I wish now that I had continued to plug money into some of these and continued to grow as the market climbed back up but I am happy with the gains.

Even though I have a long time to go, it’s nice to see my retirement back on track.

Dollar Cost Averaging the whole time!

This has been the best year for me ever, at least on books, because I haven’t sold any stock yet. DCA had nothing to do with it because I bought big chunks of stock which I never owned before and that contributed to the positives now.

Then again, one year is not much to go by, and my risk profile is probably much more different from most everyone else.

I agree with your visual chart that dollar cost averaging works, but I still am a big proponent of diversification outside of stocks and I will tell you why.

I started contributing to a 401K in 1994 when I started my job. I have put 10% in the whole way, so I got the employer match and all that. I went thru the Clinton years, the dot com boom and bust, the recovery and now the recession.

I do not have exact figures, and I hate writing about topics when I don’t, but I really do not think I have much more in my 401K than my contributions and match. I have been in your usual mutual funds – large cap, mid cap, small cap, international and all that. I may be off base a little, perhaps a 5% return or something like that – but I am not getting rich that is for sure.

While I certainly do agree that dollar cost averaging can work, it can take a long time to work as well. If someone started 5 years ago, I guarantee they are now in the loss column. If you started 25 years ago, you are probably ahead.

Just food for thought

Dollar cost averaging all the way!

It’s too bad this type of strategy can’t be implemented somehow with an investment line of credit:(

Mike

Nice piece. I think dollar cost investing works well provided the investor understands the possible different outcomes that can result from market direction & frequency compared to lump sum investing.

Mickey

We invest primarily in the UK stockmarket, and we have averaged a 120% return on our investments since March this year. If we can do it, what are the banks doing with our money? and paying 3% pa if you are lucky.

Do I want to take advice from a guy who retired much too soon, with far too little money, and with only a half-way plan that is currently failing, even as Rob procrastinates and pretends that he hasn’t made a huge life-altering error for him and his family, as illustrated in this recent article through Rob’s own unwitting words?

Thanks, but no thanks!

Liz Pulliam Weston, on MSN Money:

“Rob’s investment Web site, Passionsaving.com, hasn’t taken off the way he’d hoped. That’s a problem, because the Bennetts had been counting on the extra income to help pay for the college educations of their two home-schooled sons, now 7 and 9.

“It’s not like we don’t have the money to get by day to day,” Rob said. “But that’s a dark cloud on the horizon.

Rob is considering his options, including a possible return to the corporate world and steady pay.

“I have to do something else at some point,” Bennett said. “But I have no intention of doing that today.””

Mr. Bennett says;

“Passive Investing worked well only for the length of the insane bull market. It always works well during times of irrationality. It never works well in the long run.”

One of the most simple passive investing strategies would be to invest in Vanguard’s Wellington or Wellesley Income Funds. The Wellington Fund has annual average returns of 8.09% since its inception on 7/1/1929. Vanguard’s Wellesley Income Fund as annual average returns of 10.14% since its inception date of 1/1/1970. Both those funds seem to have worked rather well in the long run. And both are exceedingly easy for the average investor to use.

The Coffeehouse Portfolio has an annual average return of 8.61% for the 17-year period of its existence (1991 through 2008). Assuming the stock market doesn’t give up the gains made thus far made in 2009, that average annual return will get a bump upwards at the end of the year. Though a bit more difficult for the average investor to implement, it does show the merits of diversifying across several different asset classes.

Mr. Bennett has a most peculiar hobby; traipsing about the internet attempting to sell his S&P 500 market timing strategy. Unfortunately for him, the returns for far simpler approaches like those mentioned above and dollar cost averaging continue to bedevil him. Nonethless, it appears Mr. Bennett is intent on continuing his one man jihad against passive investment strategies all the while ignoring any evidence which contradict his beliefs. Sa la vie. It’s often said that a man’s got to have a hobby!