I pride myself for not being duped too easily, if at all. I often make the claim that I can smell a scam a mile away. But there was one story that will live in ignominy, at least for me and my money — and that was a time several years ago when I found myself succumbing to a set up in a Yahoo! Finance forum.

I Got Fleeced By A Penny Stock Scammer

What was I doing in such a forum, you may ask? Thinking back, it was foolish. Dumb. Stupid. But it may have been a time I was studying penny stocks and thought I’d like to learn more about them. Purely for research’s sake. But ultimately, I got schooled, and here’s how it went. I heard a pitch that sounded like this:

I have some information that you need to know. It’s not public knowledge so please don’t tell everybody that you know what I’m about to tell you. There is a small company that is about to announce that they have had a breakthrough. They have been doing research for quite some time now and are going to announce that they have a very promising treatment for a certain disease.

It’s a stock that currently trades at $1.01 per share. Once this announcement is made, the stock is going to go up significantly. If you have seen small biotech firms like this who have made announcements like this, they sometimes go up 20% or 30%. You have to get in on this stock now or you’re going to miss the big move.

Image from asic.gov.au

The forum had people calling out the announcer, but it looks to me now that those people were also in on the game (they played the role of intelligent investors who started out as skeptical, made arguments, then decided to buy in at the end). It was all a set up.

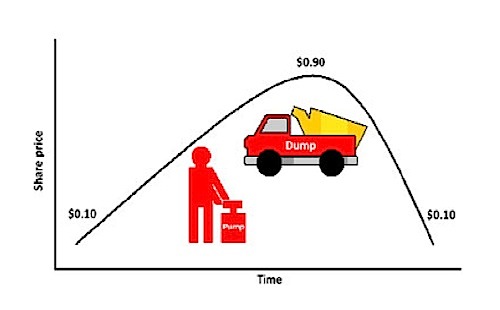

There’s a name for this sort of thing — a pump and dump scheme. Make no mistake, this is a scam, and I fell for it. Let’s look at what happens behind the scenes.

The author of the message above will deliver this message to the unsuspecting public via a public financial forum, thread or even e-mail. What they did was find a penny stock that traded little to no shares per day. They know that a stock that has very little trading volume only needs a small amount of buy volume to send the stock up significantly.

Before the fraudster sends the message out, he purchases a large amount of shares of this company. Then, he announces the news about the stock he’s just bought to a large number of people. He then watches the ticker very carefully and sees the value of his stock purchase go up significantly. By the end of the day or maybe the end of the second day, he will sell his shares for quite a nice profit. On the other hand, those people who took the bait and followed his call then hold on to the penny stock for some length of time, awaiting for good news to further propel the stock upward. But over time, it deflates instead, and those who hang on ultimately lose money.

The Pump & Dump Investment Scheme

Now that you know the anatomy of the pump and dump scheme, let me tell you why you can be sure that this is a scam. I didn’t realize this at first, but here are some points of concern:

1. You’re breaking the law! First, if you buy stock based on this type of announcement (via email, for example), you could be breaking the law. If you buy shares of stock based on non-public information, it is considered insider trading. As you have surely seen on the news, insider trading results in prosecution.

2. Why would you trust a random stranger? Next, ask yourself why somebody who doesn’t know you would want to give you such lucrative information? Nobody cares about your money more than you and the only reason they would provide information like this is if they are profiting themselves.

3. Don’t purchase a stock without due diligence. Finally, one of the cardinal rules of investing is never to buy a stock based on a recommendation alone. It is your job to do your own research and buy because you know the company is a winner. Regardless of how trusted the source, never buy based on a recommendation. Here are more investing tips for the beginning stock picker.

Now that you know what a pump and dump scheme is, make sure to stay away from financial forums (and if you don’t, be aware of the risk of encountering these scams in these places). Also, delete any e-mails that have the tone I described above, as soon as they enter your inbox.

Contrary to what I thought about my track record, I’ve been stupid about money more than once. More of my idiocy can be found here ;):

- My Foolish Money Mistakes: Moves That Cost Me More Than $1,000 Each

- Top 10 Scams Of 2006: Some Personal Encounters

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 3 comments… read them below or add one }

I had this argument with my BF the other day. What 50 cent did with his stock, had he sold it before his lawyers got to him, would have been the same thing! You can’t entice people to buy stock saying that they’re guaranteed to make money and you especially can’t do it if you have a financial interest in the company. I’m waiting for the SEC to Martha Stewart him.

Always good to keep in mind that when it comes to investments, the “something for nothing” urge must be kept in check. Many of us have that, which is probably quite normal, but we have to be vigilant to use our better judgement if something seems to be good to be true.

Don’t feel bad, by the way…we’ve all made mistakes, and I’m sure you’ve learned from it. Thanks for sharing.

Whenever I make a stupid mistake with money like this, I figure — well, lesson learned! In fact, that’s a pretty good way of looking at money lost to a scam or bad decision. One way to get some consolation out of the experience is to think of it as tuition to a life lesson. You are right Squirrelers, in saying that we shouldn’t feel too bad (although feeling bad can be a good thing, so that the sting of one’s error stays with you long enough so you don’t repeat it).