The following is a guest post by Neal Frankle. He’s a Certified Financial Planner and blogs at Wealth Pilgrim. Neal writes about taking action steps to improve your financial situation and finding balance at the same time.

People worry about money for all sorts of reasons. They worry about spending too much. They worry about earning too little. And they worry about how to invest for their retirement.

Well…..after you read this, you’ll never fret about your investments…ever again. That’s a promise. You see, there is a very simple idea that explains how investments work. If you understand it (and hold on to that understanding) you won’t second-guess yourself or worry. As an added bonus, you’ll make much smarter investing decisions.

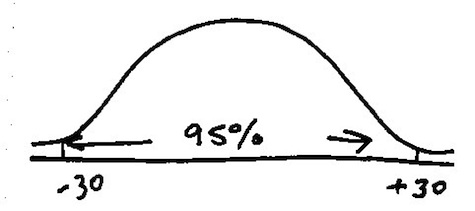

I can’t really explain this killer concept without showing off my artistic skills…so here goes:

No…this isn’t a hill or a snake that just devoured a mouse. It’s the only thing that I remember from statistics class and it’s all you need to vanquish your fear and anxiety. It’s a bell curve. But don’t worry. This isn’t a statistics lesson.

Even if you think you don’t know statistics, you use the concept of the bell curve every day….you just do it wrong when it comes to investments.

Let me explain.

Assume you’re considering making an investment and you look at the historical returns. Let’s say the bell curve above represents those historical returns. It demonstrates that, over a given period of time, the fund either made or lost 30% — 95% of the time. So, when you look at the fund results, you (might) tell yourself that you can live with a return of plus or minus 30% in any particular year.

That’s your first mistake because that’s emphatically NOT what the bell curve is saying.

Sometimes (2½ % of the time) the return will be much greater than 30%. Usually, that’s not a problem for investors. But another 2 ½ % of the time, the return will be much worse than -30%. This 2 ½% chance of having a terrible loss is something many people forget about. Or we ignore it. OR we lie to ourselves. And this head in the sand mentality isn’t restricted to money.

We know people die getting hit by lightning. But we tell ourselves it can’t happen to us. It might happen to other people or in the abstract but never to us. Of course I hope you never get hit by lightning and chances are…you won’t. But you probably own life insurance anyway…don’t you?

If you are an investor, you will get hit by this 2 ½ % problem sooner or later. And because you dismiss the possibility of it happening, you get terribly discouraged and frightened when it does happen. That’s when you make the next mistake.

You react emotionally.

Either you “double down” (get more aggressive in order to make up for your losses) or you pull all your money out of the market forever and promise to never invest again. Both reactions are understandable. You could say those reactions are almost inevitable. Anyone would react that way after such a severe disappointment. But while understandable, if you react this way, you’re shooting yourself in the foot.

So what is a smart investor to do?

How To Be A Smart Investor Who Makes Wise Investments

Be a girl scout.

Always be prepared. (I’ll admit that I was never a Girl Scout but I figure if it’s good enough for the boys, it’s good enough for the girls too….right?)

Expect really terrible returns. There will be years – possibly quite a few of them strung together – that will be tough. You have to expect them rather than pretend they’ll happen to someone else. And no matter what your investment strategy is, don’t think you’ll be able to navigate around all the rough water. You won’t. Be realistic about your investment time horizon.

The longer your horizon, the greater your ability to average out the good and bad. If you’re investing for 1 year, don’t invest in equity growth. And don’t think that the performance of your investments in any one year means anything. They don’t.

Allocate your assets with the worst case in mind.

Pick your portfolio allocation carefully. If you can’t live with a 2 ½% chance of losing more than 30%, then don’t invest in this fund. Invest for a worst-case scenario and you won’t be shocked and awed. If you can’t tolerate huge losses, balance your portfolio with fixed income.

I will admit that it’s impossible to know what the “worst case” is for any particular investment. One way to approximate the “worst case” is to review the history of the market over the last 95 years. Look at the kind of fund you own and compare it to the appropriate index. That will give you a sense of the risk you’re taking.

Do you disagree? Do you think it’s possible to have a fail-proof investment plan? Are you willing to accept that your plan may not work out?

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 9 comments… read them below or add one }

Thanks for allowing me to contribute!

Maybe I’m in the minority here, but why would you invest expecting terrible returns? I mean, I didn’t get married expecting divorce. Why should I in my investments?

Invest for a worst-case scenario? To me, this is just setting yourself up for failure. The smart investors invest to win. They don’t invest expecting terrible returns or the worst-case scenario. The plan for them but that isn’t stamped in their minds.

But maybe this advice is more prevalent because people are experiencing terrible returns and the worst case scenarios. It’s unfortunate…but I think it shouldn’t be part of the plan.

I think the problem today is that people get too attached to a “product” and an “investment” rather than evaluate their entire plan. I do believe there is a “fail-proof” plan: the Infinite Banking Concept. The focus is on the process rather than the product. However, when a great plan is coupled with a great product, then it becomes very powerful.

My advice? Invest to win. Make sure you are OK with the worst-case scenario, but don’t let that scenario drive your investing decisions. Focus on your plan rather than the products.

Great insights, Neil. Realistic expectations are really part of the game if you want to succeed in it. While none of us plan to fail, some of us do fail to plan properly and end up taking risks with unrealistic expectations for returns. At best this causes continuous headaches, and at worst it can lead to great losses.

I know there are many who rarely expecting the realistic probable outcome (i.e. the one typically near the middle of your nice bell curve) but rather something much better. Seems like madness to me that you always expect to be lucky – sure better than always expecting to be unlucky, but equally unrealistic. When building your investment portfolio, you absolutely need to understand and acknowledge what the probable investment outcomes are for each kind of asset class and or investment method. Similarly you need to have a realistic picture of the behavior of your assets in various market situations and in different parts of the economic cycle.

Luckily, there’s plenty of information out there for us to use for building realistic expectations about the probable returns of our investments. It’s just up to us to build the puzzle and get the picture. This way we will know what to expect, plan accordingly, and let our investments positively contribute to the good things in our lives.

Do you disagree? Do you think it’s possible to have a fail-proof investment plan?

I disagree with Neal (although I am a fan of his blog and I think he makes his point effectively in this Guest Blog Entry). I do not think it is possible to have a fool-proof investment plan. But I think it is possible to do a whole big bunch better than what Neal is suggesting is possible.

He’s right about the bell curve concept. You need to be prepared for the worst-case scenario because it could indeed turn up. If you are not prepared, you will indeed panic and that’s a disaster. Neal and I are in complete agreement re all that.

Where I differ is that I say that there are multiple bell curves, not just one. There is one bell curve that applies at times of low valuations, another that applies at times of moderate valuations, and yet another that applies at times of high valuations. It is not realistic to expect stocks to perform the same regardless of the price being charged to purchase them.

Neal is suggesting that the stock crash was a possible but unlikely bad outcome. If you use only one bell curve, that’s so. But if you use multiple bell curves, you see that the outcome we have seen with stocks over the past 10 years is very much on the positive side of the bell curve that applied in 2000. We would need to see a price drop of another 60 percent to get to the returns that were most likely starting from the valuations that applied in 2000. If we happened to pull up a result at the bad end of the bell curve that applied in 2000, we will see a price drop of a good bit more than that.

People are upset today only because they were not prepared for what was coming. To truly prepare people, we need to let them know that there is not one bell curve that determines stock returns, but many. To know the bell curve that applies at a given time, you need to be willing to look at the price being charged to purchase stocks at that time (this is something that Buy-and-Holders unfortunately take a vow never to do).

Rob

A smart investor is always prepared for loss and has good strategies to come out of the situation.

Interesting post. I like the approach: Allocate your assets with the worst case in mind. You can still hope for the best in the investment, but plan for the worst. Regarding Bern’s analogy above regarding that this is negative thinking and would be like getting married and expecting a divorce. To this I say: 50% of couples are getting divorced, so while you hope and expect the best, planning for the worst might not hurt folks. For instance, a prenuptial agreement is something “just in case” things don’t work out in the marriage, at least you have agreed on certain things and prepared while the 2 of you were still sane. A prenuptial can be a great financial planning tool even though it is based on the worst happening. By the way, life insurance and a will are also good financial tools even though they are also based on the worst case scenario.

-ConsumerMiser

@ ConsumerMiser,

I agree with you. Planning for emergencies and bad scenarios are important in making financial decisions. However, this article says to “expect terrible returns”.

I think people will be self-sabotaging themselves if they do this. Ask really successful people if this is their frame of mind when they are making decisions.

Successful people play to win…and to win big.

@ Bern,

Thanks for the food for thought Bern. I’ll look into your theory that in general really successful people “play to win…and to win big.”

earn, earn, earn…nowadays, it’s the most common word in the world. after earning of some cash, many people begin to invest them. One of the most popular, i think, is via forex. But i’m not here to promote forex. i’m just wondering is it possible to earn on forex on complete autopilot using a programme which, after setting definite trading limits, will buy and sell itself?! well, i’m not sure…