I recently caught wind of some great things coming down the pike with Mint. They’ve completely overhauled their blog and have turned it into an “online magazine” called MintLife. Just check out the new design!

I love it! It looks great and the content is quite unique, interesting and refreshing, as Mint uses a lot of multimedia forms on their new online magazine. Personal finance has just become more compelling (and attractive) with a lot of visuals — so kudos to the Mint team for coming up with the redesign!

Here is a taste of what you’ll see there. Just check out all the stuff created by WallStats.com and Ross Crooks featured on MintLife:

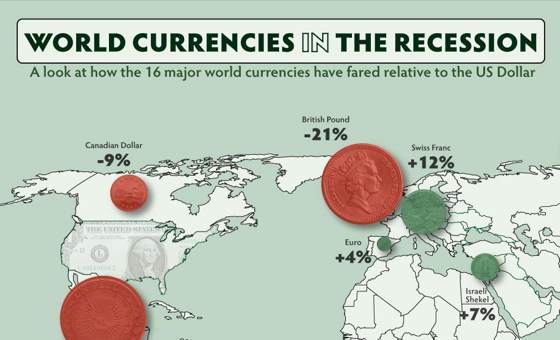

World Currencies In The Recession

The following picture (Mint Map) shows us how 16 major foreign currencies have fared during this recession, in relation to the U.S. dollar. The percent changes in the value of various currencies (relative to the USD) were calculated from June 30, 2007 to June 30, 2009 and presented in this awesome visual comparison.

Click the image to fetch the big picture:

One Trillion Dollars Visualized

“A trillion dollars is only one tenth of the current economic bailout.” To get some perspective on what this kind of money amounts to, we have the following video, which shows us the economic impact of a trillion dollars. It takes a hard look at how much our government is spending.

Even though they paint a withered economic picture through these videos and images, these presentations from Mint are definitely more than just visually appealing, they’re also quite informative! So take a peek at the new blog — I mean ezine — and if you haven’t yet, you may want to try out Mint.com, one of the free budgeting tools that’s available on the web.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 7 comments… read them below or add one }

Its quite a nice and fresh look. I read a couple of articles there and liked them too. There was one on Family Guy Personal Finance and I thought that was fun to read.

Living overseas I often watch what is happening with foreign currencies. I loved the map where it compared the US dollar with other currencies. The drop in the foreign currencies provided a great buying opportunity for people who wanted to diversity away from the US dollar.

Very interesting. Wonder way US and Britain were in the -.22-.23 % and China on took about a -.10% drop?

I would like to reply to “Date Entry Services” comment…I think the reason China had less of a drop in percentage is because of the Olympics. They made a lot of money in tourism and the construction and film/dance/entertainment industries in China produced more jobs during this time, allowing people to buy more and therefore strengthening the economy. Thats just my two cents.

Very interesting, I definitely need to learn more about currency to learn how to predict these discrepancies.

Once Obama’s honeymoon period is over and his insane communist policies start taking effect I think there’s going to be a lot of opportunity investing in other currencies as they rise against the dollar.

Funnily enough, UK property prices went up for the first time in 18 months, so who knows where we are in the whole scheme of things…

UK and USA are heavily reliant on Financial Services which took a right kicking.

It is interesting to me the differences the global “recession” has created even within Europe. One would think that there’d be a general decline or a general gain, not this mix-and-match gain here and lose there result we’ve seen.