I am celebrating my 4th anniversary as a blogger with a simple giveaway event. In fact, I’m celebrating a variety of things this week, including my wedding anniversary (so we’re off on a little family break too). So to mark the event, I am happy to offer a few items for this giveaway. The main sponsors for this event are the companies behind two of my favorite personal finance products: PerkStreet Financial and YNAB (You Need A Budget).

PerkStreet Financial contacted me recently about a promotion that they wanted to share with our audience here at The Digerati Life. I also asked YNAB if they would like to give away a free copy of their software, and was kindly granted this request. So here is what you can get by joining our giveaway this week.

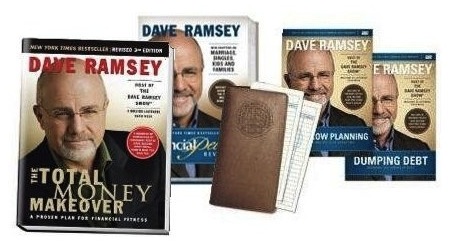

Free Dave Ramsey Starter Kit, YNAB Software From The Digerati Life

We’re offering this list of prizes:

- 1 Dave Ramsey Starter Kit (retail value around $120)

- 2 Total Money Makeover Books by Dave Ramsey

- 2 Generation Earn books by Kimberly Palmer, which we’ve reviewed here.

- 1 YNAB software download. It’s a great budgeting tool.

All in all, we have 6 prizes to give away.

How You Can Join our 4th Blog Anniversary Giveaway

Anyone who is a U.S. resident can join. In order to win any of the offers that I’ll be sharing today, you only need to do a few things:

1. Leave a comment below. Maybe you can answer this question: do you have debt? If so, how do you manage it?

2. Follow me on Twitter or become a subscriber who gets free updates via this link or this. If you’re already a subscriber, then you can just do #1. Your comment will count as an entry.

That’s about it! I hope to pick out 6 winners from the comments by next week. It’s a random pick, but I’ve found that the odds of winning are typically high for these giveaways. I’ll notify winners via email.

Who Are Our Sponsors?

Our sponsors for the giveaway are PerkStreet Financial (for the Dave Ramsey kit and books) and You Need A Budget (for the desktop budget software download). We’ve written about PerkStreet Financial before, expounding on their checking account and debit card, both of which can help you earn rewards while you save and spend.

PerkStreet is a great product for those folks who want to avoid debt and keep to their budget. They are more than your traditional checking account because they offer many rewards and perks when you bank with them. Also, the PerkStreet Financial debit card may be a much better alternative to credit cards, especially for those who want to prevent any more credit card debt from piling up! So with the holidays approaching, you may want to get more cash back when you spend on your gift list, while making sure you don’t create any more debt.

PerkStreet offers great incentives for those who are interested in a new checking account: they’ve got a new promotion up which is ongoing until November 15, 2010. You can get 5% cash back with the PerkStreet debit card when you shop at certain popular stores. After the promotional period, you’ll continue to earn 2% cash back by using your card. You can sign up for a free online checking account and debit card (and earn up to $600 in rewards per year).

As for YNAB — it’s a popular budgeting desktop software application that has picked up a lot of rave reviews. I’ve written a lot about it and like it for being well supported, with some interesting features that really emphasize the power of debt management and saving.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 57 comments… read them below or add one }

I have about $3,900 in consumer debt that I am actively trying to get down to $0. I will say that it was about 2.5x more when I first decided to learn more about personal finance. I’m making big payments and making extra income and using all that to apply to my debt. I can’t wait until the day when I have $0 consumer debt…

I love PF books (& blogs) so I would love some Dave Ramsey.

We currently only have a mortgage on our house and a loan on a car. In about 2 years both of them will be paid off. Then we will concentrait on savings. I love the PF topics on this web site and love the reminders to stay out of debt.

You have a great website…we’re currently working off our debt and Dave Ramsey has been a real help!

I’d love the Dave Ramsey books. I finally finished paying off all non-mortgage debt a few months ago…but recent home sales put my (modest) house under water just as I am trying to refinance to a lower rate. It’s hard not to feel discouraged at being behind again, and I could use a Dave-style kick in the pants!

I have 1 credit card which I pay off every month in full, and some college loans that I’ll have to pay off when I finish school. That’s all for me in terms of debt! I try to stock away excess money for future unforeseen expenses, just in case they come up, and it helps in case of emergency.

I haven’t decided how to deal with my debt. My first step was to lay it all out in a spreadsheet. Haven’t gotten to Step 2

I am very new to personal finance and I just turned 40. I have started because I want to be in control for once. Thanks for yor great website, you are one of my must reads for sure.

I would enjoy any of the products in this giveaway. I managed to pay down all of my credit card debt recently. I am working to pay off my mortgage and student loans now.

I do have debt since I just got done with school. Just now trying to get it under control.

I will resume trying to clear our debt once i get a better job than the one i have. We are keeping from adding to our debt but not making any headway currently.

I am pretty new to having debt, my husband got ill and is out of work so we were totally unprepared for one income living. I manage it… the best I can! But I could definitely use some Dave Ramsey help. Love your site, so much great info, thanks for putting it out there for us.

Hmmm, what debt do I have…. mortgage, student loans, car note… and that is it. Granted that accounts for 6x my annual salary (3x when the wife is accounted for).

Only have a mortgage. Plan on getting that taken care of in the next few years. We can’t seem to find the gazelle like intensity that Dave talks about to do it sooner then that. We are working on car replacement right now and also retirement. Also want to do some work on the house, refinish basement, re-do kitchen and master bath. Lots of things to spend money on that will take away funds to retire the mortgage.

Do I have debt? Yes. 6 years of higher learning and a mortgage. I manage it by using tax refunds, or any extra cash. I renewed my mortgage (a full 2.5% less) and used the difference from the lower payments to increase my student loan payments. Snowball!

Recently paid of CC. Now working on mortgage. signed up for bi-weekly program.

Lots of good comments here! In light of the debt free promo theme we’ve got going here, I was wondering if anyone has decided to chuck their credit cards in favor of debit cards or cash only? One great way to put a halt on credit card debt would be to make adjustments to the way you spend. Anyone try out the cash-only lifestyle?

In the past, I used to think of debit cards as a way to “work up to” using a credit card but you can also do the reverse — wean yourself from credit cards by switching to debit cards instead, particularly if you like to keep using plastic.

I have no consumer debt but I do have a mortgage. I try to pay extra on it when we can.

We do have student loan debt and we’re currently on Dave’s Baby Step # 2- paying it off. We’re foregoing buying a house until we have it paid off!

We had significant credit card debt but recently took a loan from our 401K to pay off. Now, it comes right out of our paycheck. I know its not the smartest financial move, but its working for us and we our spending has dropped drastically.

Would love the YNAB tool to help us even further. Great blog by the way!

We have about 11,000 dollars in credit card debt, and 103,000 dollars in mortgage debt. I blog about my debt and my journey to pay it off… which keeps me accountable.

Hey everyone,

My name is Jenna and I work in the Marketing Department at PerkStreet Financial. I love that everyone is super excited about getting out of debt! The giveaway options are great ways to begin or continue your journey to a debt-free life.

Keep in mind that signing up for a PerkStreet checking account is another great way to stay on budget and get debt-free. The average American earns over $600 cash back every year just from spending on their PerkStreet account! That’s a lot of extra money to put towards upcoming holiday purchases, paying off some debt or giving back to others.

Simply click on “PerkStreet Financial” in this post for more information.

Thanks and good luck to everyone,

Jenna Walker

PerkStreet Financial

We have student loan debt. We have been managing it following Dave Ramsey’s baby steps, and would love to have some additional materials to help us along! A regular budgeting plan has been a huge help in getting us to pay off our debt!

I am feeling a bit overwhelmed as of late. I went back to school and finished my Masters degree, and plan on transitioning to a new job in the next few months. I now find myself in debt of $60K in education loans, and just started looking hard at budgeting. Personal finance is one of my biggest weakness. I enjoy this blog as it gives me insight to different aspects. Hopefully I can figure out a plan to work at getting all my education debts paid and a mortgage, and still find a way to balance out life. One small step at a time I keep saying to myself…

First, let me say thank you for writing this blog, I read it daily. I’m $13,000 in the hole, which I’m working hard toward paying off so I can finally propose to my girlfriend, who’s been so supportive, and start a debt-free life together. I manage my debt by researching anything and everything I can get my hands on relating to finances and debt reduction. I find researching daily keeps me focused and provides me with positive reinforcement that I can, and will, get out of debt. Congratulations on both anniversaries!

We are on Babystep 2-hoping to become debt-free (except the mortgage) in 2011!

@ Jeff Frantz & @Dawn – Great to see that Dave has really helped you with your finances. Dave Ramsey actually recommends opening a PerkStreet account because we give 2% cash back on all of our non-PIN purchases, as well as 5% cash back on popular holiday retailers until the end of the year. This amounts to over $600 in cash back every year for the average American. That’s a lot of money to put towards getting debt free!

Jenna Walker

PerkStreet Financial

The only debt I have is a mortgage. I’m conservative about handling loans so I try not to have any. Been a big credit card user without any debt for a long time now but I can use a refresher from Dave R.

Our debt is mostly in the mortgage, which we are 1/2 a month ahead in our payments, so that if we are in a pinch we have 2-4 extra weeks to get money together to pay it. Other than that we have a small student loan debit that we are paying about 200% extra on each month. That way we can save for our various other upcoming expenses like vacation and a new car while still making good head-way on our debit. We’d love to learn more about the Dave Ramsey system.

I am fortunate that my only debt is my mortgage and I am looking to do a refi to a shorter term/lower rate in the next month. I am a long time fan of your site!

I have two teenage sons getting ready for college. I would like to get them off to a debt free start and not have to claw their way out of a hole at the beginning of their adult lives. These blogs are a great way for them to learn the benefits of good planning to start with, but that you can also recover from mistakes you may have made throughout your life. Thanks!

I pay off my credit cards every month to avoid the high interest fees, and I save in every way I can in order to manage debt effectively.

We definitely have debt, we are currently trying to manage it with the ‘snowball’ method. We will see if it works….

I have debt and am currently managing $12,000 in debt. I want to go back to school in the next 3 years, so priority 1 is paying that down. My mortgage was so small it is almost paid off, and the rest is from credit cards. Once I have no debt I will be able to pay for school as I go, without any loans!

I have four credit cards and a total of about $6,000 in debt. I’ve decided to use the debt snowball method, but winning a Free copy of YNAB would help also.

I just finished paying off my credit card debt today – it felt great! Now I’m moving on to student loans, a car loan, and eventually my mortgage. I’m using the snowball method and it works well for me. I’d love to get some more Ramsey advice to keep pushing me toward the ultimate goal – being debt-free!

My wife and I have no debt, we are young and have not purchased a house yet. We recently decided to only use debit cards, but then later changed our minds and use credit cards only because we need to build our credit history. Otherwise, I see no reason to use a credit card.

I have significant debt, and I feel that a little economic education could have served me well. I had about 250k in debt by the time I was 22 (between mortgage, cars, student loans, etc.). We are using the snowball method and plan to be out of debt in less than ten years (except the mortgage).

I have a small amount of consumer debt. I’ve paid it all off before via strategies learned from various financial blogs, but fell into it a little again recently, especially when a close friend had emergency surgery and needed medication. I choose not to put myself in large amounts of debt for new cars and the like, but sometimes small expenses start upping my credit card debt until I get frustrated with it again. I’d like to learn the discipline to STAY debt free after I pay down that credit card. 😉

Yes, I have debt. School loans, credit cards, and medical bills. Have not done too much about it because I am now unemployed. Don’t know where to start, but looking for employment first then tackle debt second.

I have several student loans at the moment. I am about to wrap up my education and begin working. I could use some guidance from Dave.

My comment after I Twitted you and added followers as a new twitter is that I don’t have Any debts. Ok so this doesn’t qualify me maybe as a person who needs Dave Ramseys Kit, well, I followed him for a year and had his tapes and books and I loaned them out and guess what they never came back to me. The best part of Dave’s recommendations is to “tithe” or “dontat” “give to higher Source” –and Money is just a tool…either way I was in debt and the kit worked for me and now I would love my own copy back. I love to help others and know that Dave’s kit Works. I hope to be one of the winners…thanks and may you be a blessing to those who read this.

– Jackie Paulson

I have debt–I still owe a tad on the car loan and then a student loan. I am paying those things off aggressively though. I want to be able to be sitting pretty with no debt in the next year in order to pursue some new professional goals.

Well, I have debt, and I am working on it slowly with an Excel spreadsheet. I am actually living a cash lifestyle right now. I have to admit that it takes some getting use to.

This is a great turnout! I’ll gauge interest to see how much longer I will run this giveaway but depending on activity, I will determine when to announce the winners. You still have time to join so get in your entries while you can!

Boy do we have debt, but we have a decent shovel and I’m considering getting a third job. We have been blessed with many tools that provide valuable information such as blogs, Dave Ramsey, and YNAB. We are really going to kick some “arse” this next year to get closer to debt free!

@Holly Hobby – It’s great that you are so committed to getting out of debt. Becoming a PerkStreet customer could help you put over $600 every year towards that goal. We are focused on providing the best debit card rewards to customers so that they can get debt free and stay on budget!

Check us out by clicking on “PerkStreet Financial” in the article. If you have any questions, you can also email help@perkstreet.com.

Good luck!

Jenna Walker

PerkStreet Financial

Awesome giveaway SVB and congrats on the milestones!

Luckily I don’t have any debt and never carried any before. It was a lesson I was fortunate enough to learn early in life. 🙂

I am going through a very sad divorce right now and I am very anxious and scared about my upcoming financial situation. I have been researching all night for money management software programs and finally came across YNAB. I’ve read a lot of the reviews on Amazon and am sold. Now, to see that you are giving away a copy makes me very happy! I’d love to win. My soon-to-be-ex has been out of work (his company closed down in June), which makes my situation even more dire! If I don’t win, I’ll probably be ordering it anyway. I want to make sure that I am getting started on the right foot as I walk forward alone. Thanks for such a great giveaway! Just found your site tonight and am signing up! 🙂 Becky

I’ve got a car note and mortgage. Paying extra on the car note to pay it off two years early.

I have been struggling with debt for all of my adult life since graduating college. Mostly Credit card debt but nothing too crazy where I could not make the payments, but still concerned with finally getting the monkey off my back. I have paid off about 12K CC debt since I stopped using Credit cards in 2007. I am almost about done with my last card from about 6 cards. I recently got into a master’s program and have added a bit of student loan debt but at least its deferred for a while and I keep reading that Student loans are not as bad. Aside from that no other debt, I think I will be the happiest person when I finally get rid of that last card in December 2010.

I’m 25 years old, just got married, and my husband and I are looking to purchase a home. We want to do things the smart way so that we DON’T end up in debt like so many other people do. I’d like to educate myself to avoid making a wrong move.

Thank you so much for your interest in this personal finance giveaway. Given the great response we’ve had here, I am planning to hold more in the future! So at this time, I’m no longer accepting entries and will be announcing the winners of the giveaway very soon.

Thanks again to everyone for dropping by and sharing their debt stories! It’s wonderful to hear how you are all taking steps to conquer debt.

We definitely have debt, we are currently trying to manage it with the ’snowball’ method. We will see if it works.

I am trying to get rid of debt. These books would help!

I’M DEBT FREE!! fortunately we never had much debt to begin with. We are Ramsey fans and want to stay debt free. We need to do better at budgeting. The You Need a Budget Now software drew me to your site. It would be awesome to win that and get it for free.

I am a 36 year old single mother who is currently living in a safehouse due domestic violence. I am currently unemployed. I pay my debits a little at a time with what money I do have which is not much. I am currently looking for employment, housing, etc. I have never learned how to budget. I am starting on my own and wanting to learn how to budget and save my money.

I’ve heard so much about this guy, I think this year I’ll finally read the book and try it out. I would love to pay my house off in 7 years…