I read a report from Forbes the other day that offered the premise that there are currently four investment categories that are experiencing asset bubbles. Two asset classes in the commodities arena: oil and gold, while two more familiar classes: government bonds and stocks, are deemed overvalued (according to the report). Supposedly, these asset classes have already seen huge run-ups over time, with gains great enough to discount any recent dips seen in some investment markets (in particular, the stock market!).

Here’s a summary of the changes in some investment markets, as of late:

- Oil prices have increased by 63% since 2009, to $75 a barrel.

- Gold has gone up by 20%, surpassing $1,100 an ounce.

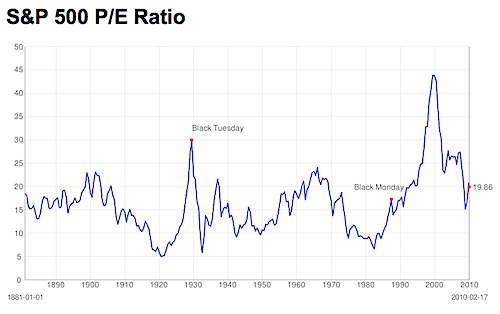

- S & P 500 stocks have a collective P/E ratio of almost 20 at this time.

- 10 year treasuries have lower yields these days (down to 3.6% from 5.5%, which was the average rate from 1993-2007), given their higher prices.

There’s debate about these investment categories being overvalued. For instance, while stock prices have jumped up recently, it’s certainly not as expensive as it was during the dot com peak periods (1999 and later), and I’d argue that P/E ratios are on the average to lower end of the historical scale, when you consider only the most recent 20 year period. Still, stocks are considered expensive according to some economic formulas.

Whether or not you care about P/E ratios and stock valuations in this way, the following chart offers an interesting glimpse into the valuation levels of the general stock market, as seen through history.

Current P/E: 19.93 +0.08 (0.42%)

Mean: 16.35

Median: 12.87

Min: 4.78 (Dec 1920)

Max: 44.20 (Dec 1999)

P/Es are based on average inflation-adjusted earnings from the previous 10 years (P/E10). Data courtesy of Robert Shiller, Yale Department of Economics. Source:Multpl.com

So if you believe investments are overvalued, where are you putting your long term money today? How about real estate? With home loan rates still low and the home buyer tax credit dangling an $8,000 carrot, why not buy a foreclosure or get into short sale real estate?

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 13 comments… read them below or add one }

SVB,

Good posting. Whats less clear to me however, is if gold, stocks and oil are all overpriced, what assets should the average American be looking at?

Thanks,

James

You raise points worth considering regarding stocks and commodities.

Real estate too may not be a great thing in the short term. There are studies that indicate the current efforts to help people with their mortgages are only delaying the inevitable and continuing foreclosures will place additional pressure on pricing for some time.

@James,

I mentioned that real estate is considered a “better” buy these days. Perhaps REITs and inflation protected securities could be considered ways to diversify further — either because their run ups aren’t quite as pronounced as those of other asset categories, or because they’re depressed and as in the case of real estate, may be considered unpopular picks these days. I prefer to make contrarian plays myself!

Gold is an excellent conductor of electricity, so that at least sets a floor on its value, since it has industrial uses.

About a year ago, I was talking (well, not TALKING, but conversing electronically) with Lazy Man about the concept of an agricultural REIT. I spoke to a friend who is more familiar with ag business than myself (I went to college specifically to get away from the farm) and he confirms that this sort of a beast does exist.

The basic gist (at least of my concept) is that the trust would own a chunk of farmland. They would get income from it by renting it (or by farming the land). So the investors would get dividends as well as potential growth. There’s no concept of a “vacant” property, since the REIT (or whatever the term is) could always plan, cultivate, and harvest if they couldn’t find a renter.

In Iowa (where I live) farmland has appreciated very nicely over the past couple of decades (although I think there was a slight dip last year).

So if you believe investments are overvalued, where are you putting your long term money today?

Stocks don’t return to fair value following times of insanely high prices. They fall to half of fair value (that’s a two-thirds drop in price from where we are today). The reason is that overvaluation causes a massive misallocation of resources (people are spending on things more expensive than what they can afford because they believe that they are so much more wealthy than they really are). The misallocation of resources caused by overvaluation of stocks is Adam Smith’s invisible hand in reverse. It’s not a magic way to build a thriving economy. It is a magic way to destroy a thriving economy. The economic destruction caused by massive overvaluation brings stock prices for a time to levels far below fair value.

When we go to prices far below fair value, stocks will provide an amazing long-term value proposition. I think that the best thing to do today is to protect your assets so that they are available when stocks are offering a 10-year annualized return of 15 percent real. When you count the amount that money now in super-safe asset classes will be earning after the next stock crash, the super-safe asset classes are paying a high long-term return today.

Rob

I recently bought some Exxon stock, because I like the long term prospect in oil. The amount of alternate energy we are actually using compared to oil is almost insignificant (in terms of the number, not value).

We will be dependent on oil a long time, so I thought it was a good long term play. Probably should have done it 1 year ago, but did not for other reasons.

I am not so sure on gold, seems steep. But its run has surprised me…

I think we’re going to go on looking out for bubbles until we’re well into the next bull market. We’re all still bubble crazy.

Oil for instance definitely has a bit of investment froth in it – supply is greater than demand at the moment. But comparing the price to the trough of the biggest depression for decades doesn’t seem helpful.

I agree on some measures the US markets look at least fairly valued. But remember the P/E can fall through earnings rising, as well as through price falls. Earnings have beaten analysts expectations again this quarter.

If the economic recovery tails off and earnings stop rising, then we’ll be in trouble. I don’t see it though.

Nice post SVB,

For several reasons, I personally have a hard time digesting that oil is overvalued right now, even thought we seem to be hovering around the apparent psychological figure of $70-80 per barrel level for many months now. If I were too predict one out all the examples you mention, I think gold seems to be overvalued right now and has the potential to have some serious downside. Of course, a lot of that depends on how the U.S. economy plays out.

Even the Federal reserve raised the discount rate .25% it is a little too late. Furthermore, all Obama did was push George Bush out of the car that was going 100 mph towards the cliff and stepped on the gas.

The massive deficits and low interest rates will lead to inflation which will push up Gold, Silver, Oil and other commodities. The reason distraction in Greece with the Euro falling helped the dollar but investors are to keen as to how the dollar is safer. As the Chinese let up on buying our IOUs (which is happening) and the government has to print even more the dollar will surely fall and Gold (valued in dollars) will surely go up.

I don’t think we have a bubble at all. We have a bubble in our money supply right now. A great guy everyone here should follow is Peter Schiff. Schiff is a stock broker who predicted the .com bust and the recent housing bust. Check out his video here.

Cheers!

You can read Schiff’s commentary here.

This post explains what is happening in the market right now. Awesome!

“Platinum is hot these days”. I read an article in my local newspaper about people melting their old jewelry because of the very high gold prices.

At some point in the future, gold could see $5,000 an ounce. That would be similar to where the price was 40 years ago in today’s dollars! Worth thinking about gold prices.