Your kids can become millionaires before the age of 40.

Have you noticed that sometimes, the more we spend our time worrying about how we can become millionaires, the farther behind we find ourselves from reaching our financial goals? I find this pretty ironic. For instance, doing too much with our money can lead us to joining multi-level marketing or “MLM” schemes that promise us riches, or to day trading away our savings, or to starting businesses we aren’t truly prepared for. And it can lead us to financial setbacks that take even longer to make up for.

Sometimes, we may be trying too hard to get ahead when in fact, just some time and discipline will be enough to lead us to a financially fit end. There are ways to get rich without that much hassle, and I’m one of those people who eagerly advocates this road to wealth.

The key is to invest in the stock market as early as you can.

While it may be late for some of us to maximize our lifetime investment potential, it may not be the case for our children. If you start an investment program early enough, especially for your kids, you could help them acquire a million dollars by the time they’re 40. Investing even with the simplest of portfolios can help get you to that point.

We can only envy those kids who began investing their lunch money in the markets when they were 16. Though I learned some basic investing concepts at a fairly early age (at 23) right after I started my first job, I do think that any kind of head start still counts for a lot.

How Early Investing Builds Your Wealth

Just to illustrate the value of investing early, see these charts showing how various investors have fared over time.

Invest early with less money, and you could still be ahead of those who save later.

In this example, one investor starts investing early but only contributes $2,000 a year to her investments. A second investor starts much later but even with higher contributions, does not catch up to the net worth of the first investor when they reach the age of 60. The assumption is that both investors earn 8% returns every year.

The only way a late starter can catch up is if he or she invests a potentially significant amount of capital at some point.

Time makes the difference.

Here is another cool chart courtesy of Motley Fool, showing that a simple lump sum investment done earlier can make quite the difference.

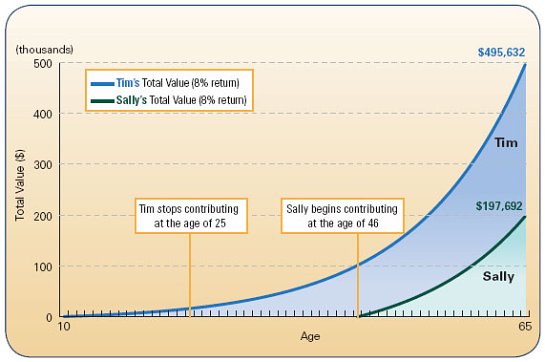

Even if you stop contributing, you could still be ahead.

And finally, I find it fascinating that there are situations when “discontinued” investment programs done early in your life can actually still BEAT the overall returns of someone who started much later but who continues to invest indefinitely.

This example from MainStay Investments may not reflect the above concept completely, but it provides the gist — that you could have a hard time building the same net worth as someone who’s started investing a lot earlier than you have:

In this hypothetical example, 10-year old Tim starts putting aside $500 a year until the age of 25 and then stops making contributions. Over this time, he puts aside a total of $8,000. On the other hand, Sally doesn’t start making contributions until she is 46 and puts aside $4,000 a year until she reaches age 65. Over that time, her contributions total $80,000. In both cases, their account grows 8% a year. Despite the fact that Sally contributes 10 times as much as Tim, at age 65 her account is less than half the size of Tim’s account. This clearly illustrates the benefit of starting early and the power of compounding.

These are all great justifications for saving and investing in behalf of your kids, who could build a hefty portfolio by the time they are in their thirties. Granted, a million dollars in 30 or 40 years is not the same as a million dollars today, but it’s still a fortune. Or you can give them the equivalent of a million by setting up a 529 plan in their name. And if your kids are earning income, they should consider opening retirement accounts. Even just $300 a month in an index fund can get you very far, if you set up a program to contribute this amount over 40 years (test this idea using this calculator).

But don’t forget your own situation either — fund your retirement accounts on a regular schedule as early as you can for there isn’t a moment to lose. Your money is bored and would like to work hard for you, the sooner the better. 🙂

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 29 comments… read them below or add one }

Like you, I didn’t get really smart (or interested) with money until my early twenties. I began working part time jobs when I was 16, and continued throughout high school and college. Imagine if I had been able to put away just a couple hundred a month in a Roth IRA during that point. Today, I’d be looking at over 15 years of compounding growth! I think it is an old Chinese proverb that says, “The best time to plant a tree was twenty years ago. The second best time is today.” It’s never too late to get started, but the younger, the better!

Frugal Dad,

What’s interesting about this concept is that it doesn’t come across as apparent. You don’t really see the benefits of this strategy for quite some time and due to the lack of instant gratification, it’s something people don’t feel inclined to give high priority to.

If you’re not particularly mathematically inclined, it’s something you won’t easily buy into, especially when there are so many other things to “spend” your money on. So I find it important to spread the message about this, esp. through example. Hopefully it’s an idea that people can put enough faith in — it would make all the difference in a couple of decades!

Excellent post!

I thank my lucky stars every time I look at our retirement accounts. My husband and I are 24, but our parents encouraged us to open IRAs at 16 with our first jobs. We put a few hundred dollars in a year, and it’s already growing.

If we don’t contribute anything else, they should grow to $500,000 by age 65. Of course, we plan to fully contribute for a few more years yet. 😉

To extend the “start early” idea, you can contribute to your children’s Roth IRA if they have the earned income to support it.

You had a fantastic post on being self-employed a couple of weeks ago and these two topics go together well. If you own your own business you can hire your kids to help you. You can take some of the money that you will pay them and open a Roth IRA for them. To start an IRA you need to put “earned income” into it, which means they must have a job to earn the money to start the fund.

However if you are creative I am sure you can find some ways to employ your kids at a very young age and set up the Roth for them. Imagine what an extra 20 years or so of tax free growth would do for their retirement plan.

What a great post. I’m only 25 but have started putting a small bit aside but after reading this I don’t see why I don’t invest more.

After all, it’s not going to do much just sitting around in the bank.

We’re expecting our first-born in a few months too – maybe we should start doing something for him right away.

Craig

This is a very good post digerati. Teaching your kids about investing is something that every parent should do. But it seems to me that parents these days rely on the public education system to teach their kids on the “important” stuff like sex, money etc.

Oh how I wish my grandparents had bought me $1000 worth of stock when I was born instead of savings bonds.

@Jim and Dividend Growth Investor,

Excellent ideas about keeping the kids busy over the summer with some jobs! Now I wonder what kind of work would be suitable for a 6 and 3 year old? I guess operating the crane would be out of the question and uh, we don’t have talent scouts in the area. 😉

Okay, I’ll probably wait a good number more years to work something out with them.

Excellent post showing the importance of compounded interest. I don’t know if the average American really understands how putting aside just a little money each month can really add up. Instead we live in a society where most people count on living off their social security check. The big question is what is everyone going to do if the government stops the social security program? Ouch…

It is important to note that a child’s assets weigh heavily when applying for financial aid from colleges and universities. If they have a good amount in an IRA for example, they may not receive any financial aid and subsidized loans may be difficult to come by, potentially eating into those savings.

I would not recomment putting off savings but one should investigate vehicles that do not need to be declared when filling out the financial aid forms.

Of course, with the benefit of hindsight I should have been saving 20 years ago. Frightening how little time I have left.

I started when I was 18 I think, I am still waiting for it to pay off. I think I still have a while to go considering I am only 20!

I started at 23 and I am now 28. I have about 50k put away in 401k & Roth IRA. I know it doesn’t sound like much but I am hoping because I started right out of college it will grow grow grow.

Too bad I didn’t start at 16.

My dad always says…the best time to invest is yesterday and the second best time is today!

Pfft. I think a pyramid scheme is the best way forward. How could you possibly lose?

Great article on dividends. Most people do not realize how much money they will earn over the years. I set up some accounts for my kids and sisters kids. I used some of the old stand byes like exxon and coke.

I bet they will really like me in 20 years.

I believe starting to invest when you are young is one of the best ways to become rich. The markets are the best place to make money and the earlier you start the more you can make.

Have just got to the point where Ad Sense gets me about an extra $100 a week – so am going to start dividing this up: 50% in the pot to work with, 50% to invest as above!

Wow, so how did you manage that extra $100 a week, Colin? That sounds sweet.

Yes, you’ll need some discretionary income before you can invest. I wouldn’t recommend borrowing in order to invest. Way too risky, since you’re guaranteed to pay interest on your loans but not guaranteed to make any money in your investments, no matter how optimistic you feel about the markets.

But I applaud Colin’s idea of putting some money towards his business while the rest is invested. It’s a nice way of diversifying the use of his added income stream.

I started when I was 20

And I still waiting for it to pay off.

Great article…even better involve your kids in the investing process from an early age. This way when they grow up, they will be more financially savy and secure.

My goodness! 16 year old and starts to invest money in the stock markets? Perhaps I would make a new poll on my page whether those kids know about what a stock market is! Great article!

I have read things like this since I was 15 years old. But never knew where to start. I am currently 22 years old and would love to put away $100 a month, but I can’t really afford much more. But if I go to an investor they wouldn’t give me the time of day. That little money isn’t worth their time. Where do I go?

@Where To Start,

These are the steps I would take to get on the path to investing (if I were a new investor). In fact, I am helping some young family members invest in this very fashion:

0. If you’ve got money to spare, invest in your company’s 401K program. Your money usually grows fastest in a retirement account with matching funds from your employer.

1. In general though, before you invest for the long term, make sure you have an emergency fund set up (these are for your short term savings). Have at least 6 months’ worth of expenses here.

2. Put those short term savings in a savings account, whether it be at your local bank, say in a money market account or a regular savings account, or a higher yielding savings account like the ones I describe here. Most banks will allow you to start an account with very little.

3. Any money you now save (after funding the emergency fund) can be used for longer term investments. Shop around for good no load funds for your long term money. Check the requirements by Vanguard, Fidelity or T.Rowe Price to see how much is needed to open a new account with them. Some funds require a minimum deposit of at least $1,000 to $3,000 before you can open an account with them.

4. Invest in equity index funds and international index funds, which are great choices for those who can afford a moderate amount of risk. Also, you’ll need to determine how much to put in U.S. funds vs other types of funds. To start, just put your long term investment money into the S & P index fund (or total market index fund). These are very well diversified vehicles.

5. You can also invest without a minimum deposit. You’ll need to check the policies of specific fund companies and brokerages for details. For example, you can also start investing in well-diversified investments via ETFs that represent the indexes. These ETFs behave like shares of stock and can be purchased at online brokerages. Here’s a list of some good and cheap online stock brokers.

6. Once you open an investment account (either with a mutual fund company, a brokerage firm or a bank), begin investing regularly by setting up a systematic or automatic investment program with your financial institution.

I too was about 17 when I started reading about how to get ahead financially, etc., but I never had much discretionary income through university/college – only been able to put away $50 here and there (perhaps I could have tried harder, but I was living away from home and in an expensive place). What I found very helpful, though, was setting up DRIP plans – these would be perfect for WhereToStart – you can invest as little as $25 if that’s all you have and start reinvesting dividends.

Very awesome article. I wonder if the current economy would make this harder though? I will be sure to explain all of this to my kids.

I was just wondering which software you use to prepare the graphs… they look very well made.

My bad… they are from other websites. Heh… I am still curious. Excel and OpenOffice aren’t too great for making really nice graphs! 🙂

Sadly those HYPOTHETICAL lines are not so smooth in Reality…Truth is there are high commissions in the index funds and if you put money in 2001 you would be upside down today. Indexed Universal Life policies have no downside and the Ratchet Effect will keep you from starting at the bottom every time the market has a downturn like in 2001 and 2008. Zero becomes your Hero and you save a bundle on commissions.