Here’s where to find the extra money to fund your financial goals.

In an effort to bring our spending down and to cushion our income shortfall over the last year or two, we’ve been working on stretching our budgets a little further. Unfortunately though, I have the nagging feeling that our budget is still not quite as optimized as we’d like it to be.

For instance, while our utility bills are somewhat lower in general, it’s not the case with our water bill, no thanks to the hotter-than-usual summer and drier weather we’ve been having. Because I’m a big freak about our garden and haven’t yet decided to replace our lawn with artificial turf 😉 , we’ve no choice but to pour a slice of our budget into the upkeep of our yard. Can we really cut our expenses further? I think so. We know there’s always room to bring down our bills further if we try hard enough.

Which brings us to the subject of money drains and what it means to really begin operating on a lean budget. Many of us have frittered away some of our money on occasion. But what if we’re able to put a stop to the mindless spending that eats up our money without us even realizing it?

In a perfect world, I’ve wondered how much additional savings we’d be able to build by being more careful with the money that passes through our hands.

Small Costs Add Up! How Much Money Are You Kissing Goodbye?

The “latte factor” is a phrase (by the financial author David Bach) which describes the way small costs can catch us by surprise. Are you curious about how much you could be trading off for convenience and a bit of enjoyment? The answer may astound you. What I’ve done is a simple exercise that shows what would happen if we seriously account for the common money drains that besiege our budget. When taken into totality, our vices, habits, impulse purchases and daily fixes can amount to some huge numbers!

But keep in mind that many times, what we consider as a “waste” or money drain can be classified as a guilty pleasure. We may want to ask ourselves if we’re willing to give some of these up for the resulting savings.

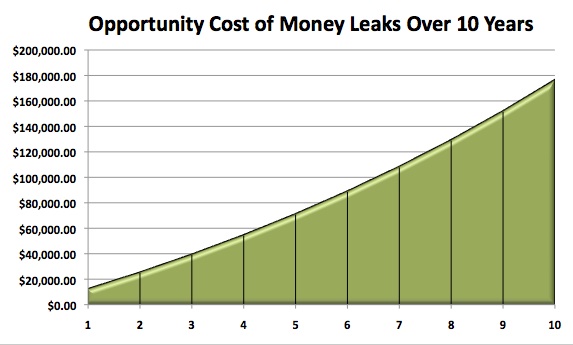

I’ve worked out an approximate picture of how much money can fall by the wayside by putting together this table and graph based on Bankrate’s and AOL’s discussions on well-known money drains.

The table shows the total annual cost of all the money drains combined, plus what your savings would amount to if you invested those savings at an annual rate of 8%, compounded monthly over 10 years.

| Money Drain | Average Price | Estimated Annual Cost | Future Value In 10 Years* |

|---|---|---|---|

| Coffee | Average price of brewed coffee: $1.38 | One coffee each week day costs around $360 annually. | $5,488 |

|

Gum |

Average price for one pack: $1 | Chew a pack a day for a year: $365 |

$5,488 |

| Cigarettes | Average price for a cigarette pack: $4.54 |

Pack-a-day smoker’s annual cost: $1,660 Weekend smoker’s annual cost: $236 |

Pack-a-day smoker’s cost: $25,247 Weekend smoker’s cost: $3,659 |

| Alcohol | Average: $5 per beer (includes tip) | One beer a day, annual cost: $1,825 | $27,807 |

| Bottled Water | One 20 ounce bottle costs $1 | One bottle a day for a year: $365 | $5,488 |

| Manicures | Average cost: $20.53 | Weekly manicure, for a year costs $1,068 a year | $16,282 |

| Car washes | Average cost: $58 | Cost of detailing every 2 months, for one year: $348 | $5,305 |

| Weekday lunches out | Daily lunch: $9 | Weekday lunches for one year: $2,350 | $35,857 |

| Junk food, vending machine snacks, soda | Average snack: $1 | Afternoon snacks for one year costs $260 | $4,025 |

| Credit card interest charges | Median amount of credit card debt is $6,600. Standard rates average 13.44%. | Minimum payments will take 21 years to pay off the debt, costing $4,868 in interest. | N/A |

| Unused memberships | Monthly service fees: $35 to $40 | Per year, unused memberships cost $480 | $7,318 |

| Expensive salon visits: fake nails | Fake nails cost $500 to $600 | Getting them done once a quarter for a year costs $2,000 to $2,400 | $30,552 |

| Premium gas | At 20 cents more for premium, pumping 20 gallons of it instead of regular would cost $4 more. | Annually, that’s a difference of $171 for a vehicle that averages 14 miles per gallon — as some big sport-utility vehicles do — and is driven 12,000 miles a year. | $2,561 |

| Lottery | Typical cost: $10 a week | For one year: $520 | $7,867 |

| Direct TV | A basic program can run $100 a month | $1,200 a year | $18,295 |

| Total | $11,548 a year | $175,994 |

*Future Value is calculated using an 8% annual rate of return over a period of 10 years, compounded monthly.

Let’s Check Our Calculations

Let’s suppose you are spending $11,548 of what you perceive as “pocket change” on various incidental items. The simple savings calculator I used allowed me to enter a monthly deposit of $962 per month, which was equivalent to the $11,548 of that “found money” annually. Imagine putting that money to better use! When subjecting this monthly contribution to an 8% interest rate that was compounded monthly, the result after 10 years is $175,994. Here are the specifics!

In one short decade, these small, regular expenditures add up to around $175,000. Throw in a few more costly habits and petty charges and your “lost” savings can amount to over $200,000! If the investment climate over the next 10 years turns out to be kinder than it has been recently, a higher rate of return can yield an even larger sum.

The Latte Factor: Money Drains That Can Add To A Lot

If the small stuff can lead to such significant missed savings, what about the larger money leaks that we fall prey to? Some examples:

#1 Unnecessary upgrades

If you’re an early adopter of technology, you could be spending more than you should on electronic and gadget upgrades. Or what about room upgrades when you’re on vacation? Unless it’s a free upgrade, you may want to think twice about paying extra.

#2 Package deals or unneeded extras

I’ve got a relative who bought a new car and who got suckered into paying for a $2,000 cleaning kit for the car. After two years, he’s hardly touched the kit.

#3 Extended warranties

Have you ever successfully used any of your extended warranties? How many times have they expired without being applied? Don’t pay for these.

#4 Buying stuff on sale you don’t use or need

I know people who rationalize that buying stuff on sale means they’re saving money. I don’t agree — you’re only saving money if you buy stuff on sale you really need and use. If you’re hoarding things you’ll never use, you’re just wasting your hard-earned money and adding to clutter in your home.

#5 Bulk purchases

Buying in bulk only makes sense if you can successfully consume everything (or most of what) you buy. Otherwise, it’s just waste on all counts.

#6 Free money that isn’t free

How often do you come across free offers that later on snag you for monthly dues? Too often. I signed up for free stuff on a few occasions but have since learned my lesson: the book club selections and free magazines may sound great at first until you can’t stop them from arriving at your doorstep! The catch was that I ended up owing money on items received after the “free period” was up.

With these illustrations, you can see just how much you may be giving up on savings that may very well be right under your nose! If you think about it, there may be more than enough here for a home down payment, an IRA account, or even to fully fund a 401k account. It may just mean that we need to change our habits to make room for these priorities.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 32 comments… read them below or add one }

Great post — very nice visuals. All the little things do add up, plus the lost opportunity cost. You mean I shouldn’t rush out and buy the new generation iphone just because my older version is 6 months old? J/K — I don’t have an iphone 😉

Excellent post. However, I’m a little uncomfortable with opportunity costs when it comes to living. I’ve started thinking along the same patterns when it comes to vacations and “luxury” items. Opportunity costs will deter you from doing anything really as everything adds up nicely over 10 years. Sometimes we’ve got to put the finances aside. I also believe real significant savings come from big ticket items such as cars (go scooter), houses (shot term mortgages), good asset allocation (take risks) etc. Great post nevertheless.

This is definitely a good way to represent how people usually spend their money and what it amounts to in the long run. For many people, they just don’t understand the size of the situation unless you put a graph in front of their face.

One small point though. On the item of Premium Gas, if your vehicle requires it you must put it in. Though many pundits will argue that you can run on lower octane fuels, it is definitely not recommended in the long run. It can end up costing much more later on in repairs and bad gas mileage. Many full-size SUVs do not require premium fuel unless they are Mercedes, Acura or Cadillac. Now if someone is putting premium just to do it and not because the engine requires it, then that is definitely wasteful. Purchasing a vehicle that requires premium should always be factored into the cost of owning that vehicle. One should not try to cut corners by being cheap because it can cost more in the long run.

It’s quite amazing how many of these little things add up to 1 million dollars that I wonder why not many people are rich!

Great list, but I’m wondering about the car wash cost. Where the heck are you washing your car? Mine costs $8 (with vacuuming the interior), and SUVs are only $1 more.

Excellent post.

I’d rather add a link to any compound interest calculator just in order to show how fast the interest could grow.

Anyway thanks for the estimations and especially for the visuals.

My wife bought a three-pound bag of limes at Costco because it was such a “good deal.” Do you know how much money we spent on Corona’s to use all those limes?

Great piece of work on this post. A couple of comments – yes, you can save a lot by cutting out small recurring payments, but I find that some of these small things are extremely enjoyable. If someone like gum, giving it up to save $1 per day might not be the best trade-off. As always, I think that moderation is good advice – living only for tomorrow, not so much.

On my blog I created an interactive latte factor calculator – you put in the amount you save, the length of time and the rate of return and the tool tells you your total saving. You can check it out here: http://moneyandsuch.blogspot.com/2008/02/latte-factor-calculator.html

you are assuming that if you cut out coffee completely you’ll save 5488. there is some cost to brewing it at home, albeit much lower than buying at starbucks.

your article is good, but you are not calculating in the cost of the downgrade. you are for gas, but there are alternative costs to everything you list unless you eliminate them entirely.

and of course if you actually win the lottery you won’t be reading articles like this anymore…

@Matty,

With regards to coffee, why not just toss it out of your system completely? I have. I don’t take any caffeine after I found it that it doesn’t agree with me… (I get too worked up). So yes, if you are radical enough, and determined enough, you may actually save $5,488.

Lots of these costs are approximated. They may come across as the best case scenarios as well. But then again, depending on the “habit” that one decides to eliminate, these estimates may not be entirely unrealistic. For instance, I only considered the case of a weekend smoker when tallying up the amounts. A pack-a-day smoker who goes cold turkey would add tens of thousands of dollars to their end result in 10 years.

Years ago, I read a book called “The Wealthy Barber.” I think it can still be found in bookstores. Anyway, one of the characters sarcastically says that as long as you are taking care of your future i.e. retirement, you can do all your grocery shopping at 7-11, buy the most expensive gas in the world and fritter the rest of your money away on anything you want. Why would you do these obviously unwise things? Because you are already taking care of the future. And besides, life is too short to cut out the modest treats i.e. a good cup of coffee, even if it costs you $5500 over 10 years!

@Val,

I like the stance of “The Wealthy Barber”. Ultimately, it’s all about balance and moderation. One needs to enjoy the fruits of one’s labor while taking care of one’s future. It’s a bonus if you are someone who honestly already “enjoys” saving money and being frugal. I have this friend who’s made it his goal in life to be financially independent as soon as possible. In my mind, I think what he’s been doing has been overkill — they guy already IS financially independent. But he won’t quit his ways because he absolutely “enjoys” his way of life.

So yes, I’m all for that balance, even if it means the daily coffee for some or the regular movie dates for others. But too often, many people wonder what’s happening to their finances and wake up many years later with meager or no savings. Here, I hoped to illustrate that there is hope — and ways to find that money to build into a decent nest egg down the road.

If you’re already doing all you can and have trimmed your budget to the bone and you’re still unable to make progress with your savings, then I will suggest a new plan of attack: make more money. With alternative income sources or a new job that pays more, you should gain some savings momentum, but only if you maintain your frugal mindset.

Before I learned to keep a checkbook balanced, I had thousands and thousands in overdraft charges alone! I wish I had that much $$ now!

Isn’t it amazing how the little things, when added together, add up to one big expense? You clearly demonstrate that we can all conserve our monies wisely, but only if we pay attention to the smallest items too.

Five bucks for a beer! Yipe!!! What a rip.

This is why I never drink alcohol in restaurants and bars — partly so I’m not driving home with a snootful and partly so I can enjoy really fancy beers for a fraction of that price.

Here’s a toast to your health: with a nice, cold club soda! 😀

Wow, great illustration! Big Eye Opening!!!

That chart is remarkable. What an eye-opener. Although we do not do many of those things listed, I can’t wait to print this off to share with my family.

The information you provide is incredible. Thanks so much.

Great post. Love the table and graph. It really gets one thinking about the small stuff. I linked to this from my blog. Good info.

THESE numbers are off the chart!

WHO in the world spends $400 for fake nails!!!

If you are a business lady and get a normal set of nails that is $30 per trip and every two weeks that is $780 per year = $7,800 for ten years! AND if you are even remotely rich and you go to a spa to get your nails done you still will only pay $50 per visit!

Heck, as a treat years ago, I had a lady come to my house for a birthday present to myself; the at home facial and nails only cost $75!!!

I must agree my weaknessess are GADGETS! OH my gosh! GADGETS are my kryptonite! BUT, at 41 I have decided to adopt a minimulistic life. I am not getting rid of everything, but anything I buy must have a purpose right away. NOTHING for future use! AND I side step every sales lane!

Other wasted money from me – FAST FOOD and Walmart! Terrible wasted money over the years on those two things. NO more though. I am not getting perfect right away, but I have decided to work from home, see my family more, and cut back on “stuff” !!

Where are you getting your numbers for fake nails?! Fake nails almost anywhere you go never cost more than $40 to put on and $15-20 to maintenance every 2 weeks. And, yes, they have to be maintenanced at least every 2-3 weeks – can’t be done quarterly.

You might have forgotten about another wasteful expense, collections that are not investments ie: beanie babies, cup&plates, car models, knives, salt &pepper shakers, teddy bears, cd’s, dvd’s, and other items that become obsolete and the list goes on. How much money is spent on dust collectors that end up being sold for 1/4 the original price,or give away because no one is interested in your taste of choices.

well, you can save a lot of money by just killing yourself.

then your expenses will be zero.

whats the point of living and having money if you don’t spend it? thats a lot of stuff to enjoy over 10 years.

Now if you lost $175 000 in one night gambling in vegas…. thats different.

@This is dumb,

If you have the money, why not spend it? Yes, you have the prerogative. This was just an exercise to show how much the little things add up to big numbers over time. It’s up to you to decide whether you want to spend and enjoy those little things now, while forfeiting the future value of any savings on those items down the road.

It’s all about balance really — some stuff you’ll never want to give up, while there are other things you can probably do without and not notice if you do away with them. Up to you to make those decisions and figure out what works.

Great post! I never realized just how much I was wasting. after going through your list I actually thought of a few more things I waste money on. Time for me to make my own list of stuff to cut out 😉

Another awesome post about the amount of money I can save by doing a few small changes. It’s incredible how much the small things add up this way!

Wow – based on this list I should be rich. It’s a good list to look at. Makes you realize how all the little things add up to a lot!

I’m not a woman, so maybe I don’t understand….but how do you get manicures on fake nails? It seems like if you’re getting manicures, you don’t need fake nails. And $500 to $600 for fake nails? What are they made of? 24k gold and faberge egg? Also, $58 for a car wash is ridiculous. There’s two $3 places near me and most places are around $7.

I’m scared with the huge interest of credit cards. Just paying the minimum will take 21 years which is very true. I don’t know how to deal with it. But if we have nothing to pay in full, the 21 years will most likely take effect. “sigh”

I’ve been reading a few books similar to this. Eliminate waste, and propser!

Yeas, expensive, but without some of those things you pointed out, life wouldn’t be so comfortable

I like how this fellow estimates that he will save over $3,000 a year by quitting a cigarette habit. That’s a big chunk of change! Here’s the illustration he created to explain his savings.