The first online stock broker I came to know happens to be ETrade, and this was way back in the 1990’s. So I’m a bit more familiar with this company than I am with other brokers, only because ETrade has been around longer and is certainly considered as one of the most recognizable. However, being the most recognizable doesn’t necessarily mean that it’s the best or the most suitable broker for you, so let’s go through the pros and cons of E*Trade, their target customer base, general reviews and awards, and their platform features and pricing structure.

ETrade has established itself as one of the top discount brokerage services synonymous with online investing, being best known for their comprehensive tools, resources and customer support which cater to both long term investors and active traders alike. However, much like a lot of other brokers, E*Trade gives the best rates to customers who are active traders, as the company charges account service fees on inactive accounts.

The Pros & Cons of Using E*Trade

Here’s a quick summary of what E*Trade does well, as well as what they can improve upon.

The positives:

- Site Layout – Their platform layout provides a good visual read and is easy to use. It’s generally attractive from a look/feel perspective and is pretty easy to navigate.

- Tools – Their fully customizable platform and tools allow you to manage assets, move funds around easily, and estimate your portfolio worth.

- Security – E*Trade has developed a comprehensive security feature called SecurID that is highly effective at keeping out hackers from your accounts.

- Research – They do a good job of providing a lot of educational support to investors seeking to beef up their knowledge about the investment world.

The limitations:

- Tools – I’ve included their tools in this list because these tools are somewhat geared towards customers that want ease-of-use and flexibility, but may focus less on the needs of more advanced but passive investors (although you may find more sophisticated functionality on their software platforms that are targeted towards active traders). There’s always room for improvement.

- Fees – This is the major downside to E*Trade. The commission fees are often much higher than those of other online discount brokerage firms; however, if you make a minimum of 150 trades per quarter, the fees are greatly reduced. Also note that like most online brokers, you’ll pay more for broker-assisted transactions.

E*Trade’s Awards List

E*Trade has received top awards and is obviously highly regarded by the financial press. So right off the bat, they’ve got a good reputation if you’re going to base it on what publications are saying. These are just some of the reviews they’ve earned.

- Smart Money (WSJ Magazine) rated them as #1 Online Broker in 2007 and 2008.

- They’ve consistently scored 5 Stars for Trading Tools, Mutual Funds and Investing Products, Banking Services.

- They’ve received 4 Stars for Customer Service, Research.

- Barron’s gave them 4 out of 5 stars in 2008 and recognized them as part of the “Top 10 in the 2008 Online Brokers Survey”. In 2011, they received 4.5 stars for Research Amenities.

- Kiplinger’s granted them 5 stars for Customer Service in 2011.

- The Investor’s Journal gave E*Trade four of five stars in their 2010-2012 review period.

- As an aside, Money Magazine pegged them as one of the Best of the Breed for their online banking arm.

Let’s take a look at E*Trade’s pricing, products and features to see why they’re so well received.

Pricing, Commissions and Brokerage Fees

Check out this quick table that shows you how their pricing works:

| 150+ Trades/Quarter | Standard Rate | |

|---|---|---|

| Stock & Options Trades | $7.99 | $9.99 |

| Options Contracts | $0.75 | $0.75 |

| Futures Contracts | $2.99 | $2.99 |

| Bonds | $1.00 | $1.00 |

| Broker-Assisted Trades | +$45.00 | +$45.00 |

When you open a brokerage account with E*Trade, the most you’ll pay is for $9.99 per stock or option trade, which is the standard commission — this has gone down $3.00 in the last two years as E*Trade has responded to changes in the financial landscape (e.g. the crisis). Note that there are no fees for mutual fund trades. For better rates, you can fund your account with at least $50,000 or make frequent stock trades (at least 150 trades per quarter); by doing so you’ll lower your cost to $7.99 per trade. If you make over 1,500 trades a quarter regardless of how much you have in your account, E*Trade will customize a package based on your usage. There’s also a bonus for those opening new accounts with at least $2,000: you can qualify for free trades for 60 days!

E*Trade Online Brokerage Review: Complete Investment Account

If you sign up for a brokerage account with E*Trade, you’re effectively opening an E*Trade Complete Investment Account, which is an “integrated investment and cash management account”. Here are its basic features:

- You can trade and invest in stocks, options, mutual funds, ETFs, IPOs and bonds.

- Lots of no load and no transaction fee mutual funds are available.

- Use investing tools (streaming quotes, screeners) to help you with ETF management and asset allocation.

- Financial advisors are available, but this may require extra (paperwork, fees).

- Learn from free educational resources and materials, seminars, tutorials and webcasts.

- You can open IRAs of various stripes and colors with E*Trade. There are no fees and no minimums when you sign up.

- You get free bill pay, checking, a debit card and some free checks.

- You have ATM access.

- Fund transfers are easy.

- You’ll get access to a sophisticated “trading platform” with high end trading tools if you’re an active trader. This platform is called the Power E*Trade Pro platform, which I describe further below.

Power E*Trade Account and Power E*Trade Pro Platform Features

Here’s how E*Trade supports the more serious traders among us. If you’re an active trader, you’ll get lower transaction costs, better prices and more advanced tools for your use. Once you have an E*Trade Complete Investment Account, it will automatically be “upgraded” to a Power E*Trade Account if you make at least 10 trades a month, or a minimum of 30 stock or options trades a quarter. You will then have the features of the Power E*Trade Account (via the Power E*Trade Pro platform) available for as long as you maintain your trading frequency. These features include free access to powerful trading tools, advanced charts, technical studies, scanners and analytics tools, and something called “NASDAQ TotalView”, a tool which gives you a more comprehensive view of market liquidity. All this for $9.99 a trade or less, if you really trade a lot.

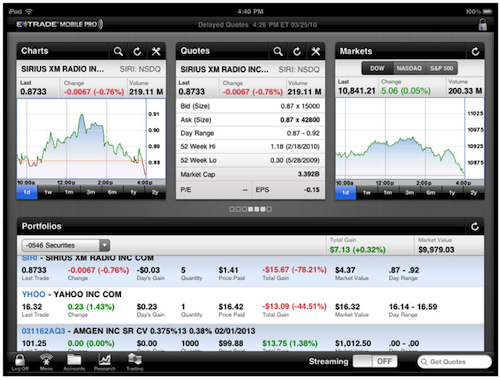

The E*Trade platform is compatible on both PCs and mobile devices, such as the iPad. The platform works identically on any device you choose to run the platform. In the screenshot below, you can see the basic E*Trade “home screen”. It shows you general information on market trends and an overview of your portfolio. In addition, you can see specific information about a particular stock — our example showcases the stock of Sirius XM Radio. The platform will also give you a quote on that particular stock with the option to invest immediately if you are interested.

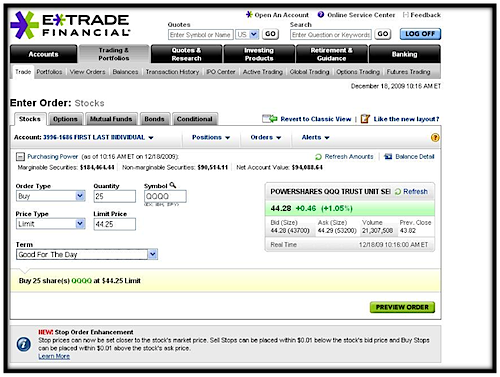

Placing an order on the platform is also relatively simple. You just need to enter the quantity, the ticker symbol, and the price you are willing to pay. You can also tell the system how long your price is good for. So if you choose the term as “good for the day”, then the system will do its best to buy that stock at the price you’ve set for the day.

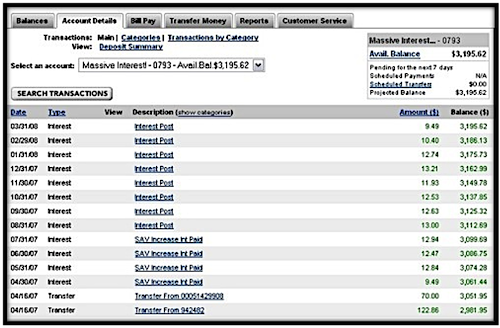

Finally, like many other online account platforms, E*Trade will show you a summary of your transactions by date and amount. This screen provides an overall summary of account activity.

E*Trade also has many more products in its roster, including support for retirement accounts, investment clubs, global trading, educational accounts, small business plans and of course, their banking division.

How Does E*Trade Compare To Other Brokers?

There are of course, many contenders in the brokerage industry. Let’s see how ETrade stacks up to two of its major competitors: TD Ameritrade and Merrill Edge.

| E*Trade | Merrill Edge | TD Ameritrade |

|---|---|---|

| $9.99 per standard trade | 30 free online trades per month as long as your balance is over $25k, otherwise $6.95 per trade | $9.99 per standard trade |

| Add $45 for broker-assisted trades | $44.95 for assisted trades or trades made by phone | $44.99 for trades involving customer service and broker assistance |

| Typically $2,000 to open the account, may incur maintenance fees if you don’t use the account often | $0 to open the account, no maintenance fees, get free trades with a $25k+ balance | $0 to open most accounts, low maintenance fees depending on your level of use |

Hopefully, this information has helped you make a decision about E*Trade.

Created April 19, 2009. Updated March 29, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 23 comments… read them below or add one }

This is your opinion. I don’t know what class you base your review on. If you decide to base you review on someone making $20,000 a year and the person make only 10 trades, then the commission fee is a lot. In scottrade, you can buy stock for $7 compared with etrade that costs $13 for buying a stock . It is only day traders that make 1500 trades a year.

ETrade is not the cheapest broker around (TradeKing, Zecco and OptionsHouse are), but they’re well regarded. I’ve been reviewing the well-known online brokers for a while now, and it was ETrade’s turn.

Also, it’s possible that not everyone opens an account with a broker purely because of price. To me, it’s all about value — if I find that a broker offers me good value, service and works well for my purposes, I keep an account with them. ETrade has the advantage of a product that is both an investment account and a cash management account in one (they called it an integrated account, and yes, ING has the same set up). I also know many people who trade at full service brokerages and who refuse to go with discount brokers (even though they are heavy traders) for various reasons. So it all depends on what you’re looking for in a broker. I won’t disagree with you that most people will look at commission costs to determine their choice of brokerage.

I use both E*Trade and TradeKing but I prefer TradeKing mostly because of price, $4.95 trumps $12.99 a trade (or even the $9.99 I’m paying).

I have my money spread around a few brokerages for diversification purposes. And ETrade has served me well.

Yes, ETrade is best. Not because of price but of the value and the services. So many good services for little money. If you look at all the infrastucture provided, it’s actualy cheaper. “QUALITY IS ALWAYS CHEAPER IN THE LONG RUN”.

I had my money in a brokerage firm that ETrade bought. Hadn’t heard much of them till that point but now I’m pretty happy with my account with them. I have ETrade’s index fund and so far I’ve done well with it over the long term. I like their customer service too. I’d recommend them to anyone.

etrade is HORRIBLE where it counts. Their commissions are really high and they have a TON of hidden fees. They charge you $25 just to transfer money electronically to your bank account. I decided to leave etrade after they charged me a $20 reorganization fee and billed an account I set up for my son $80 for inactivity (the account only had $200 in it for my son to practice with). Now its costing me another $120 just to get my money away from these crooks. I called them and just got the “tough s**t” response. They have $225 of my money that they shouldn’t have. Take your business somewhere else, these people are thieves. There are other brokers out there that don’t charge ANY of these fees.

Hi,

Very well documented article.

Thanks for this info (that I’ve discovered) and good coverage.

-A French reader.

I’ve been using etrade for a couple years now, and it had been going great for me, until I started (and rapidly) losing money in my portfolio. I knew these companies were going to raise back up, which they did. So I held onto my stocks and made no trades for a few months, then I got hit with a $40 service fee. Yes, if you don’t make the set amount of trades per quarter, you’ll get hit with a $40 penalty!! So if you wanted to make a long-term portfolio and hold onto it, you’ll be paying $160 a year in service charges! that’s something you need to keep in mind if you decide to use them.

On the other hand though, and this was the reason I started using Etrade and never switched, for the $13 trade commission rate, you get an outstanding effective service that is incredibly fast! What I mean is that I’ve never had a problem getting rid of nor buying a limit stock! I ask to sell at this much, and they have my shares sold almost immediately, and they’ve never failed. So the $13 price is great in that sense, the $40 is Not!

ETRADE sucks. Period. I hope you didn’t have anything invested in ETSPX when ETRADE unilaterally liquidated the fund and didn’t tell their investors last March, when the Index hit its absolute rock bottom.

Not only that, once you have money in ETRADE, it’s impossible to transfer it out. Try on a $60 transfer fee per account to transfer CASH!

And, their customer service is the worst. Go ahead and try to find a contact phone number or even an e-mail address to get answers to your questions. They also like to notify you through hidden “alerts” that are so hard to find, but are critical to managing your accounts.

Avoid ETRADE at all costs!!!! Check out other websites and the number of complaints against ETRADE is staggering.

I too had been using ETRADE since 1995. I used to LOVE them. But after this little scam I hate them to the core and plan to destroy them.

Etrade is a total nightmare. Rina said on 8/11/2009 that her Etrade index funds have done well. In fact, Etrade liquidated its index funds in March 2009 (at a market bottom) without telling it clients. I’ve been trying to get my IRA money out of Etrade for 5 months and they simply won’t do it.

I’ve used ETrade for many years and have always been very satisfied. Excellent year end documents for tax time. Easy to buy and sell. I even bought a very small amount of their stock in my “mad money” account.

There’s an excellent Power E-Trade Pro Review at the following trading forum site. The review covers a lot of the software functionality but doesn’t really touch on pricing. The “Pro” platform from E-Trade seems to be intended for day traders and other more active investors.

ETrade Pro Platform is great. I have used it at my last job.

I like Charles Schwab :))) I also like Elvis Presley 🙂

You’re on crack to join Etrade. The worst company service. There are way too many bad reviews and complaints about this company. I would not waste my time. It’s easier to use share builder.

Can you use margin?

@Poe,

All brokers allow you to create margin accounts, subject to some requirements they have. You’ll have to check their terms & conditions for details.

Don’t know what the beef is with ETrade. I personally like them — I have a diversified portfolio and am mostly a passive investor and from my experience, it’s worked out well. It has a varied set of products and tools to offer the small investor. Many times, people blame the broker when they should blame themselves — a lot of people trade based on how they feel, their gut instinct, intuition or emotion. Then when things fall apart, they want someone to point the finger on. I hear this a lot amongst my investor friends — they complain that the broker did this or that. Most people who comment just want to vent, imo.

One question. And this applies to many reviews of brokers. Does E*Trade calculate performance for customers and compare it to a benchmark? I wonder: do investors even care about performance? I ask people and they look stunned. They don’t know their performance. Many brokers offer great technology and research that enables trading because that’s what generates commissions. Most fall short on client friendly performance measurement technology. Maybe that’s because they don’t want clients to see a bottom line number of their performance results.

Schwab, for one, offers performance versus a benchmark that is up-to-date — forget having to wait for end-of-quarter reports. To me this counts for a lot.

I am not affiliated with Schwab.

@DIY,

Regarding performance measurement tools — I haven’t seen the kind of direction you describe as commonly available among brokers. Certain ones (like Schwab), yes. I’ve seen it with some mutual fund companies too (some have brokerage arms), but such functionality doesn’t seem to be widespread. For analytics, I often find myself using resources like Morningstar more often. You raise some interesting points!

Etrade sucks. I just transfered my 401k over there. They said they would give me real timie quotes and one day it all of a sudden changed to 20 minute delay. I’m an option trader so really doesnt work for me. Plus there website sucks. It is very difficult to use. Not to mention the online trader sucks. I am sending all money to tdameritrade. I have used them for 10 years and never had a problem. Only reason I went with etrade is the mutual funds I wanted were going to financially benefit me there, Well, my mistake. In summary, DO NOT USE ETRADE!!!

You must perform comprehensive research on brokers before opening accounts. Make sure you email or call them to ask for all the things you’re concerned about before sending any funds to them. Also check the web for anything negative about the broker. A good place is Forex Peace Army web forum: they will have a lot of info on all brokers and service providers worldwide.