I know that a lot of you are sick of hearing about the Madoff scandal. I certainly am. I just wish they’d resolve his case already and make him pay his countless dues and debts to his riches-to-rags, hapless victims. But I can’t help but revisit the whole story after I stumbled upon concrete details of how Madoff lived.

Madoff’s Outrageous AmEx Credit Card Bill

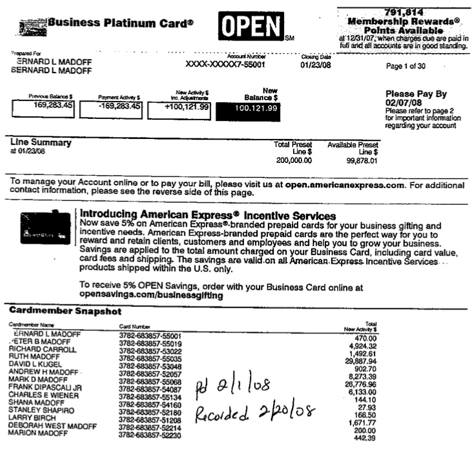

While many of us are struggling to pay off credit card debt, others are enjoying unlimited use of their credit cards. ABC News reports just how hard Bernard Madoff, his family and cronies decided to live things up with funds from their investors. The evidence is preserved in a credit card bill from a company business platinum card which Ruth Madoff, Bernie’s wife, decided to use at her discretion.

How This Amex Credit Card Bill Came To Be

How about I try to explain where this credit card bill came from.

I think this whole story emphasizes a few interesting things about people and their behavior towards money. When you feel like you’re using someone else’s money, or imagine money growing on trees, you begin to experience an overconfidence and in some cases, even a delusional sense of invincibility that makes you feel that

(a) you may be above the law

(b) you should be entitled to anything and everything

(c) your appetite for consumption deserves to grow in line with your bank accounts.

Check out her January 2008 bill from American Express:

I experienced this strange effect of financial overconfidence first hand, albeit in a transitory and much smaller scale during the dot com boom. That was when we experienced a glut in IPOs and witnessed the emergence of well funded companies like the Silicon Valley startups I had once been part of. Deserving or not, many people were beneficiaries of this wild economic boom; its effects extended beyond the material as this dot com bubble had a hand in strongly altering the attitude and behavior of those who lived in the thick of it.

For many (except perhaps for the most serious tightwads among us), our relationship with money and our financial psychology shifts once we feel that there is easy and fast money to be had and used. For those swimming in dough, it becomes extremely likely that you’ll readjust your living conditions accordingly, if not now, then eventually. So a credit card bill of 6 figures in a month? That won’t be so shocking in such circumstances, when people become accustomed to the good life.

This of course doesn’t change the fact that this matter is ridiculous on so many levels. Granted, this credit card bill came to light before the massive financial crisis and recession hit; but it still remains as one that was going to be paid using other people’s money (through illegal means).

So here’s a question: do you think that if you ever found yourself living high on the hog, that you’d ever change your lifestyle so much so that you’d find yourself on the other end of a credit card bill like we just showcased here? While it’s something we may not feel compelled to justify or even admit to a public audience, it’s something we may want to be honest with ourselves about.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

All the more reason why the WHOLE family’s assets should be taken to pay back the poor souls who’ve lost their entire savings since everyone related have obviously benefited. (just look at the names under the same bill).

Ironically, when I saw the Amex statement while I was listening to Kanye’s “The Good Life”. Must be nice to that kind of cash flow.

I experienced the “wealth effect” back in the day when I saw my JDS Uniphase and CMGI stocks double every month and split twice a year, but no where close to this magnitude.

Just curious, but I’m wondering how his wife racked up 30k for one month using their business card. Gives a whole new meaning to working lunches.

Some months it feels like my credit card bill is this big. But seriously – people are loosing their homes!

If you actually look at the itemized statement, you can see that most of her purchases were donations to charitable organizations ($14,000+). Not much of a consolation, but at least she wasn’t buying $10,000 diamond necklaces.

Actually I am not so shocked as I thought I will be. I checked every line in their bill and I did not found anything very shocking, of course totals are very big. My opinion – most of rich peoples bills are like this.

Main spendings there are:

– flights (nothing shocking)

– car rents, hotels etc (of course they are using god cars and good hotels (rich is rich) so actually nothing very shocking

– restaurants (little shocking about prices, but still not very big shock)

– sports and sports equipment ( OK, there some prices are little shocking)

– book store (still nothing shocking)

– computers, mostly apple (not shocking but little strange why they need new computers so often)

– closes, italian, armani 🙂 and this was only once in that bill, so still not shocking. Lets be onest, we all sometimes buy closes, of course we dont buy Armani. But if we check armani prices then I think – they have bought only few peaces so again nothing shocking.

SO: Mostly their spendings was reasonable, of course they buy high rank products not as we.

only thing that shocks me is total 🙂 but I couldnt find any shocking items in bill.

Thanks for posting that but I am fascinated by a couple of things:

1. Ruth Madoff made over $10K in charges for charitable orgs, meanwhile stealing money from them…Ironic!

2. Mark Madoff is a CRAPPY tipper. He left a $60 tip for a $1K meal at Per Se. I hope to god everyone else left tip money in cash for the server.

3. The quotidien stuff is v. interesting. Who buys their groceries where, who saves money by being a Barnes and Noble Member, etc. Someone, and I’m not saying who, has a Mac or two he can sell now that he’s unemployed…

4. Shana Madoff is also a crappy tipper and she really likes her fancy cupcakes and baked goods. I think her <$5 purchases at Barnes and Noble are actually in-store cafe fancy coffees.

I know I wouldn’t change my lifestyle too much. Part of it is sheer laziness. My sister has a mcmansion and I can’t imagine having to clean that monstrosity. Would I get a nicer car? Sure. Would I worry less about how much I am saving on my next tv? Sure. But would you see me chartering an airplane? Hell no! The money is about the freedom, not the toys!

I would be surprised if I found myself with a lot of easy money and that didn’t change my lifestyle and perception of money.

$100K!!!!! That’s absurd! I’d love to see the itemized list of charges.

Wow, that’s just F’d up!

I wonder if some of the charges were faked and they were just siphioning off money into other places his family could access under the assumption Bernie was going to get nailed.

Well, I’d love to be on the other side of that credit card bill…but only if I earned it ethically(and if I literally had money to burn!).

Holly cow! Thats huge. I wouldn’t want that bill.

What a bill! That is why I always prefer cash. I know credit cards offer numerous advantages over cash – only if I know how to control my purchase and used it appropriately.

Wow, quite the bill. It’s amazing how wasteful people can be when they feel as if they own the world.