What do you think of the Citi ThankYou Points network and rewards program? If you’ve got a Citi Forward credit card, you’ll earn and redeem your rewards through this program.

Shopping For A New Bank

Things have been in flux lately due to the current state of the financial industry. For instance, with banks failing and merging in the past year, it’s been a challenge for customers to keep up with the changes. In my case, my personal and business accounts with Washington Mutual are now with Chase. Our mortgage with Countrywide is now with Bank of America.

Because of the transitions going on, my spouse and I have decided to make a fresh start with a new bank: might as well, since loyal customers are getting the shaft in more ways than one anyway. The banking industry should look upon this as a ripe opportunity to grab disillusioned customers (like me) who are seeking some stability.

So we decided to check into Citibank and met with a Citibank advisor to take a look at what they’ve got. I discovered that Citibank’s accounts and products are extremely competitive compared to the “free checking” and other perks offered at my current banks. Furthermore, I came across their “ThankYou Points Network”, a rewards program that helps you earn points every time you use your credit or debit card.

For my next steps, I wanted to do a bit more research on the Citi ThankYou rewards program before making our final decisions about signing up with Citibank. Here’s what I found:

Citi ThankYou Points Network: Rewards For The Shopper

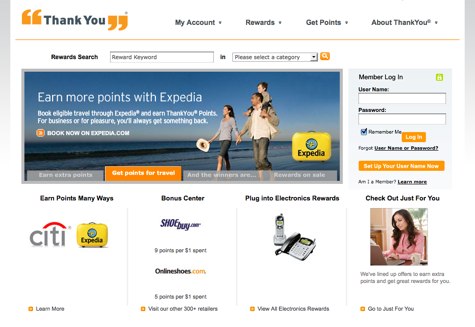

With the ThankYou network, I discovered that you not only get points for using your Citibank checking account, credit card or debit card, you also get points for every $1 spent on purchases made with a Citi Credit Card.

Here’s a sampling from that list:

|

This is an advantage I don’t have with other banks. As a dedicated online shopper, I take advantage of multiple rewards programs ranging from Upromise to MyPoints and Memolink. The idea of earning points for gift certificates and merchandise for simply doing what I usually do is very appealing.

Other ways to earn points include:

- Booking eligible travel through Expedia.com, regardless of how you choose to pay,

- Shopping at your favorite retailers (including Macy’s, Target and Best Buy) through thankyou.com or in-store using a Citi Credit Card,

- Using your Citi Card at certain specialty stores such as FAO Schwartz, Eddie Bauer and Timberland,

- Making purchases from participating catalogs and buying gift certificates.

When you accumulate points, you get to cash them in for rewards. Cash outs start at 1,000 points. You can redeem your points online or on the phone. If you have 10,000 points or more, you can create your own reward through the “Your Wish Fulfilled” option (just contact a “wish specialist”). As for standard rewards, here’s a sampling:

- Gift certificates including the Gap, Bath and Body Works, Macy’s, Hard Rock Cafe and many more,

- Merchandise including books, DVDs, sporting goods, home and garden, kids and baby, electronic and office and more,

- Cash, savings or charity,

- Travel and experience.

With countless rewards to choose from, I was sold on this program. My other banks do not have an extensive rewards program like this plus they’ve also been hitting me with sneaky bank fees that I’m not thrilled about. As an alternative, Citibank has comparable financial products and accounts as other banks do, and I like how the Citibank representative offered to help me with several strategies for avoiding charges and for keeping my banking free. Adding the ThankYou Points network was enough to sweeten the deal. On top of capitalizing on the ThankYou rewards program, I’m also planning to use my Citibank debit card to accumulate other rewards such as those from MyPoints, thereby maximizing the rewards I earn.

Although switching my business and personal bank accounts with direct deposits to another financial institution can be a hassle, it’s worth it when you have such an alluring incentive. We’re going to be bracing to make the switch in the next few weeks after taking care of all the necessary arrangements.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 4 comments… read them below or add one }

There are several problems with the Citi Thank You program. Although the number of rewards points is excellent, the rewards are very expensive compared to other programs. While spending $1 on a card should result in rewards of about 1%-2% the Citi Rewards are less than 1% in almost all cases.

Many of the items result in a return of only 0.5%. Another major problem with the card effective November 2008 is that they charge an additional 2% on any charge processed through a foreign bank in addition to any exchange rate charges. For example, I recently purchased tickets on a MAJOR international airline form the US and received a charge on my bill of several hundred dollars. I was able to get it reversed but only one time. They slipped this change in the fine print of a statement. When buying from online sites how am I supposed to know what bank they use?

I have the Citi Forward card and it’s been a great rewards card for me. I’ve picked up a few items from the Citi ThankYou program and have been satisfied with it so far. It’s worked well for me.

I would just like to share my poor experience with Citibank. Basically if you close your Citibank account, you will lose all your thank you points within 30 days. They do not tell you this and will refuse to reinstate the points even if you rejoin. Because of this I will never do business with Citibank ever again. I spent over 50k on the card and even with the loyalty, they refused to honor my Thank you points. On top of that the Thank you program reduced the value of the points where 1 point = $1. I would rather get a cashback card of 1% where you are guaranteed 1% back.

@David,

Sorry to hear about your negative experience. However, whenever you close your account, you need to use those rewards immediately. There is no guarantee you will keep those rewards once you DO close your account. In general, rewards are a privilege given to you by a credit card issuer and I am certain that their terms and conditions will tell you that they will wipe out your rewards if you don’t use them right away.

The lesson learned here is this: DON’T hoard your rewards. Use them right away. Those programs can disappear or change on the fly. Credit card companies don’t owe you anything. If you care a lot about your rewards, then please use them as soon as you earn them. And most importantly, use them BEFORE you close your account, or you will risk loss.

Best of luck to all!