Some time ago, the Dow Jones closed at 6,700. Look at it now!

So far, my earlier prognostications and expectations about the stock market possibly revisiting its lows somewhere at the 6,000 level for the DJIA, have been proven “wrong” (I owe some of these prognostications to the influence of my other half who still can’t feel the love for our economy). Instead of the market sliding down into the abyss and hitting the previous low of 6,700 (thereabouts), it has instead done an about face to flirt with 10 month highs, ameliorating worries among investors, the world over.

Are Stocks Really “Back”?

While I’m not sure I’m convinced about how solid this turnaround is — with unemployment rates still expected to stay up, along with jobless claims — I’m a little less anxious than I was earlier this year when the market was hopping around like a toad on a roller coaster (it was that bad, remember?). At least now, we’ve got some choices ahead of us. You see, what the last year has done was to show many investors that they may have gotten in way over their heads — some of us have become more and more aggressive about taking risks the longer the bull market lasted, and we’ve become spoiled by great stock market returns. Now that the market has shown us just how hard it can pull back, this mini-recovery may be a good time for us to evaluate just how “right” our investments are for us at this time.

Some questions to ask yourself about your stock investments today:

1. Are you overextended? Shelter some of your funds by placing them in safer accounts (go for those high yield savings account interest rates).

2. Are you diversified enough? Reallocate your funds across different asset classes to better manage your risk.

3. Are you prepared to see the stock market dip yet another time? If you feel a knot in your belly just thinking about this, you may want to scale back on your investments.

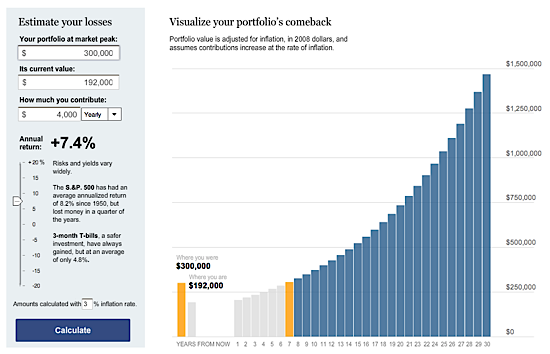

All this aside, I thought to show you this neat interactive graphic (from the NY Times) that may give you some idea about how well your portfolio can recover over time. Here’s how I’ve used it (as an example only… this is not my real portfolio 😉 ).

When Will Your Investment Portfolio Return To New Highs?

For the specific example I provided here, I entered a portfolio value of $300,000 at the market peak with its current value today at $192,000. If I contribute $4,000 per year and estimate an annual return of 7.4% going forward, this portfolio will reach its former high of $300,000 in 7 years. Still seems like a long time, but you can speed up the process of getting your portfolio back to where it used to be if you raise your contribution amounts (or find a way to get better returns).

By aggressively adding new contributions to your investments — which is something you can control more easily than the annual rate of return of your investments — you’ll cut that “waiting period” by a lot. For example, if you decide to invest $20,000 a year in a portfolio returning 7.4% per annum (instead of a puny $4,000 a year), then you may be able to shave off a few years from your wait. In fact, it’ll only take you 4 years to restore your portfolio to its former glory.

So how long do you expect to wait for your portfolio to come back? I’m not having any illusions here, so I’m prepared to wait a long time. Actually, right now, I’m not worrying too much about my investments. Instead, I’m trying to focus on improving cash flow while I keep an eye out for more convincing signals that the market is finally back on track.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

It is a raging bull market again, but I’d be careful here. I’ve sold more than half of all my equities in the run up, and will gladly stay under invested in September and October.

The one great thing is that the job market is back, and packages are being given out in the once downtrodden financial services industry which are surpassing 2007 highs.

When government owned Citigroup is paying $100 million bonuses to Andrew Hall, doesn’t that say something?

Good times are back, just keep one eye open!

Financial Samurai,

Are you planning to get back into the market after October? I’m guessing you’re under-invested right now because of the traditional weak months in the fall for the stock market… But I’m speculating of course. Would be interesting to know what you plan to do next, given what’s going on.

Have been tempted to time the market, but it goes against my strong feelings of maintaining my asset allocation as is. I feel we’re already under-invested to begin with and trimming further would skew our allocations quite a bit.

By the way — where are financial services companies getting their revenue all of a sudden? Not much has fundamentally changed it seems… or has it? California is still in crappy shape so the view isn’t that great from where I am.

I agree with the samurai, I am watching October. However, market timing is a waste of time, I steadily invested thru all this mess, and my portfolio is still down – because my portfolio spans years not months.

I just do not think we will see the stock market from 1980-2000 returning anymore. Too much has changed – everything from day traders to information thru RSS feeds. I think we will see a choppy market frequently show up at times so enjoy the ride. And when you get closer to retirement, START moving some of your money!

I like the diversification idea to the point you are totally out of stocks with some of your money. Investing your money in small cap, large cap, growth and international funds is NOT diversification. Those all were way down in the last 18 months. I presently own a farm which I get some income from. Also, I am considering rental property and other forms of alternative investment for diversification.

I’m very diversified. My investments are in the utility companies, grocery stores, housing market and car companies. Don’t get much return though!

Even though I have an eternity of 30+ years until I retire, it’s nice to see that my retirement stocks are almost breaking even again.

I am optimistic of the future, but will still be cautious.

-Dan Malone-

I have a lifestyle fund set up so it is diversified even if my knowledge lacks. Being younger I am not too worried as my investments are more on a 10 year plan so anything low now I can invest in will hopefully boost over the next decade.

I am kind of iffy on this. I think I’ll wait a few months before jumping in again with stocks. This was a very helpful article on it though.

The stock market is a great way to spend time in a bull market. In a bear market it is a great way to get hammered.

So are we in a bull or a bear? Well for the past few months we have been on a tear. Returns have been great IF you managed to invest at the lows of the market. If you had a portfolio invested over the past decade you probably are break even at best.

We all have opinions on where the market is going and where we need to be invested. I wrote about mine earlier and published an update recently. It covers basically the next 18 months so only time will tell if I am right or not. Let me know what you think. I love a good debate.

http://www.askthewealthsquad.com/blog/why-you-should-get-out-of-the-stock-market-now/

Now that the stock market has recovered a little bit it is time for most of us to diversify. A lot of people made mistakes and did not diversify before the crash of last year. This is everyone’s second chance, to get it right this time.

Insiders are dumping stocks like crazy, so I will be very wary of this rally in the markets. It is a typical pump and dump scenario that is playing itself out, and personally I will not go near it!

Indeed, I read about how insiders are now dumping stocks (whereas they were buying them at the market lows). Sure feels like they know something we don’t! But I wonder…. if there are those of you who “won’t go near” this market, then when will you be convinced that this market is healthy enough to jump back into (in case you’re “timing” the market)?

In my case, I haven’t made any significant timing moves and have, for the most part, just held tight during the roller coaster we’ve had, so to me, there’s no real concern about jumping back in.

I’m very curious to know what market timers who are out of the market are thinking right now. What will entice you back in? What signals are you looking for? Aren’t you concerned that by waiting in the wings, you may “miss the train” on genuine bull runs? It’s happened before and it’s going to happen again (people missing the run ups because they’re skeptical about the market and economy).

I have a couple of items that I look at. My timing is far from perfect. I caught part of the move off the lows but had to move some money around about half way through the move. I didn’t think it would have the legs it has had.

1) The calendar 🙂 Until September and October are over, I will happily miss a few percent gains if they happen.

2) P/E ratios of stocks – From a long term standpoint (10 years) the P/E ratio when you buy stocks has historically been the largest determination of what kind of return you will have. I am waiting on companies to show increased earnings from increasing sales rather than cutting costs. You can only cut so deeply. Right now P/E ratios are still on the high side (in the low return side)

3) Short term I look at % of stocks that are bullish in the S&P http://stockcharts.com/charts/gallery.html?%24bpspx When it drops below 25% it is usually a good time to buy for a short term bounce.

4) Market sentiment dropping. Until the majority of the market is scared it is probably too early to get back in.

5) A sense of a coming turn around. I think things have stabilized from being in free fall but don’t think we are going to stop dropping. Just a slow fall down. I have several economic indicators I watch (and dig into the reports – if you have insomnia read the actual jobs report or housing report in depth).

I think the market is tired going up. Until employment improves, I see more downside possibility then upside. I would really hedge my bets in this market and use tight stop losses.

Can one predict where the market will be next week or next month or at the end of the year? The price volatility of a stock can be huge in the short term. However, this price volatility is a minor factor over the long term,. The risk is no longer in the short term price volatility of the stock, but in your assessment of the long term business potential of the company you invest into.

Generally, the prices of the stocks should follow the earnings of the company. The price volatility in the market should be taken advantage of by the long term investors to buy stocks at the price when the risk/reward ratio provides their desired potential returns.

Generally, anytime is a good time to invest into stocks. Here are some simple guides:

Avoid buying when the market is obviously high.

Always buy good quality stocks at fair or bargain price.

Never buy a lousy stock at any price.

The market has risen very steeply from the low of March 2009. Are the prices reflecting the fundamentals? Is the market too high at present?

The market has recently fallen ‘off the cliff’, and has recently recouped from an over-sold position. There will be short term volatilities but for those with a long term investing horizon, this is still a very good time to invest into selected stocks.

Diversification or spreading your risk is always key when investing. Whether it be the stock market, property or any other form of investment. We have done pretty well ourselves out of the stock market in recent months, but we do not over expose ourselves. We have missed out on some big gains yes, but also avoided some big losses.