Today I’d like to take a closer look at a popular credit card rewards program. What’s in Chase’s Ultimate Rewards Program and just how attractive is it exactly? But first, let’s check out the credit cards that will allow you to participate in this program. Here are a couple of top Chase credit cards, which you can use to pile on the rewards:

|

Note that Chase also has the Chase Slate card, but it isn’t a rewards card.

Redeem Chase Rewards At The Ultimate Rewards Mall

So what can these cards do for you? Let’s start with the fact that the Ultimate Rewards Mall from Chase offers a range of travel and shopping benefits to its users.

Earn Chase Travel Rewards

Instead of making it complicated to figure out when you earn points, Chase has a simple way to earn points on this program, just like many credit card rewards programs out there today: you just have to make purchases (hopefully for stuff you were already going to buy anyway). It’s really simple: your purchases will earn you points for your purchases, with several opportunities to earn bonus points.

The most attractive feature of Ultimate Rewards is its travel benefits. You can take advantage of the program’s Online Booking Tool for travel. This means that you can find hotel rooms, book flights, and even find car rentals without having to sign up to and use a separate travel site. The Online Booking Tool is available 24 hours a day, which makes it easy to get your travel plans in order.

Let your points go further by using them for travel; most major airlines are available for booking. Note that your points will be worth 25% more if you book flights with the booking tool. You won’t have to contend with blackout dates or restrictions, either. To pay for your trip, you can use your points, use your Chase Ultimate Rewards credit card, or combine the two.

What if you already belong to a loyalty program? Actually, it’s possible to transfer your Ultimate Rewards points to certain airline and hotel loyalty programs. Also, you can redeem points for gift cards from a lot of popular travel partners, including hotels, cruise lines, airlines, and other companies that participate in these programs. Some of the partners who offer gift cards include Avis, Marriott, and SpaFinder, among others.

Enjoy Cash Back, Shopping & Sports Events through Chase

And it’s not just travel you can enjoy in this way! As an Ultimate Rewards member, you’ll be able to redeem points for tickets to sports, events, and shows. Plus, members can enjoy private chef dinners, wine tastings, and culinary festivals.

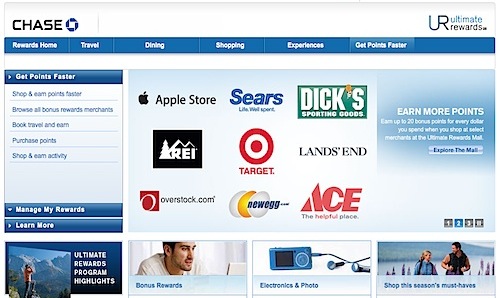

Then there’s the shopping. You can redeem points for merchandise like electronics, jewelry, kitchenware, and other popular categories. If you prefer, you can redeem points for gift cards from stores like Best Buy, Macy’s, Target, and other popular retail stops.

And let’s not forget one of my favorite rewards offered by my credit cards: cash! It’s also possible to redeem your points for cash. When redeeming, just pick out the Rewards Check option. That way, you can pick out your own reward whenever you like. Another way to earn cash back is through Pay Yourself Back. You have the ability to turn your purchases into a statement credit, making it incredibly simple to reward yourself.

You can also choose dining and entertainment rewards in the form of gift cards. Restaurants, movie theaters, and theme parks are among the choices, including Starbucks, Applebee’s, and other well-known merchants. Ultimate Rewards even has tools to help you pick the right restaurant and book reservations. How’s that for ultimate flexibility?

Get Those Bonus Points

To grow the number of points you have faster, you can employ a few tactics. As mentioned above, the Online Booking Tool is convenient for booking flights — and it will yield double points for flights.

You can also earn additional bonus points when you shop at the Ultimate Rewards Mall. It includes merchandise and services from several hundred vendors. Depending on your credit card, it may be possible to earn up to 10 bonus points per dollar spent here. You’ll find favorites like Williams Sonoma, Ann Taylor, Saks Fifth Avenue, and even iTunes at the Mall, where it’s easy to shop.

What if you don’t have enough points to apply to an item? The program allows you to purchase the extra points you need, up to 5,000 in a month. This can be a great tool when you’re just within reach of the item you want. What more, these points don’t expire.

As mentioned earlier, several credit cards are available as part of the Ultimate Rewards program. One is Chase Sapphire, which offers 10,000 bonus points when you make your first purchase (the equivalent of $100 cash), enhanced identity protection, and no annual fee. Another is Ink Plus, which offers one point for each dollar in purchases, and other amenities for business travelers.

When you don’t have a credit card rewards program or you want to upgrade to one with more benefits, Chase’s Ultimate Rewards can be a viable choice. Look over the benefits and see if they fit your expectations. And it’s easy to become part of the program — just apply for a Chase credit card and get accepted, and you’re on your way to rack up the points. For those looking to find out where the Ultimate Rewards store is, do check out the site here.

For a look at another top rewards program, check out our coverage of the Citi ThankYou Points Network from Citibank.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

In the last several years I have come to prefer rewards cards over airline frequent flyer cards. With the reward cards you can actually get a ticket based on its price, up to a certain level. You do not have to worry about finding a frequent flyer seat at a certain mileage level (the 25000 miles tickets almost are impossible to find and book). Airlines seem to have cut back on those.

I just got switched to the 5% in certain categories each quarter. Sounds like they do not give you the remaining 4% extra until the 4-8 weeks after the end of the quarter. Is this the same thing everyone else is seeing with a Chase Freedom Card?

how do i find out how many points have accrued on my chase visa debit ultimate rewards card? Ann

Some questions here. I would assume that earnings on rewards are prorated over time. I don’t have the exact answers for the reward schedules, but perhaps you can ask Chase customer service about ow your awards are accrued.

For specific questions on your rewards, I would give Chase customer service a call. I will see if I can find the answers online as well.

i’ve been trying since July to find out how to check the supposed “special” discounts and just how and what I can buy things at this mall. NOBODY has been able to help me figure it out. Haven’t used a computer in 35yrs. but I’m not totally stupid ! Everybody at Chase from the Branch Manager up tells me to “go online”. when I ask the people at the Branch, they tell me to call the “Call center” and when I call the “Call center” they insist that I have to go to the Branch ! I feel like a ping pong ball !

I need a comforter for the bed, I need a space heater , I need a warmer coat, I need a couple of Valium from trying to get this stuff as cheap as I can through Chase. I don’t know how much I might be able to save, but Chase keeps telling me about “terrific” deals at the “mall” and special discounts from their “marketing” partners , HUH ? They tell me that Sears is a “marketing” partner, I tried to buy an A/C that they had on “SALE” for $ 100.99. By the time I found out how to get this fabulous (?) “extra special” discount, the A/C went off sale and the price jumped to $299+ ! Some “discount” huh ? Anybody care to tell me how to find this ##^%?~@& ** %%$^?~+# “Mall” ? Winter’s a comin, I don’t have a lot of money, I gotta get stuff as cheap as I can. I just don’t want to spend money at a retailer and find out later that they are “Marketing'” partners with Chase and I mised out on some “GREAT” deals !!!

Not sure why you are having trouble but I have Chase cards and they’ve always been pretty straightforward to use. Plus they have a great debt management tool called Chase Blueprint that helps you control your debt balance.

I want money!

sill tying to “look” into shopping at the “ultimate rewards mall” I give up ! I’m going to Sears, and Bank of America ! If this is a “real” store, where I can see “real” merchandise to purchase, I can’t find it ! Like I said before, by the time I even got close to trying an A/C , the #*%#$$% summer had passed ! I can’t let that happen again . At this rate I’ll get the “space heater” in time for the summer ! Oy ve

How can I, or can I put my Amex travel points together with my Chase points?

BIll Husetr – don’t go to Bank of America!! They are really bad – I was with them for 10 years and quite frankly, chase is far better as far as their incentives, cash back etc. I got 100 dollars cash in wach of my checking accounts when I opened new accounts – NO bank can compete with that.

OK, as far as ultimate rewards, lets see if we can figure it all out. I use it all the time to get extra points. So, you sign in to your account. Under your account there should should be a blue link that says “show rewards”. When you click there, click on the UR account that you want to view. This takes you to the UR mall. On the left hand side there are several drop downs – if you want to shop online to get more points click on earn points, and then shop the UR mall. Once there you can browse by merchant, products, top deals, etc. To redeem reward, just click on use points. I do a lot of online ordering, so I can earn points really fast by shopping online. I got 40 points per dollar for buying magazines. Just MAKE SURE to go to the website through the mall, otherwise you will NOT get bonus points.

I am surprised they weren’t helpful. I think you need to go in with specific questions. If you sit with someone and say, show me how to navigate the UR mall, they will surely be able to help you. Just sign your name in when you walk in and speak with one of the guys that has a desk. This should not be a problem.

I was unable to redeem my rewards!!

do u hv a list of all the stores in your ultimate rewards mall? i cannot find it!!!

and, do u have catalogue companies within this list?

I ordered a laptop through using my ultimate rewards points. I was told a week later that the item I ordered was on backorder. This was ordered in November as a Christmas present that I still have not received. I have made 3 phone calls to customer service and each time I am told that someone will get back to me, and no one has. Oddly, when I currently go to the rewards mall the same laptop show that it is available with one day shipping. Can someone please check on my order!

For any issues with Chase and their Rewards mall, please give Chase a call. Here is their contact info.

I agree… I too am finding it difficult to access the online treads catalog… oh well, guess that’s why they have branch locations… Hi Silicon Valley Blogger..