The Frugal Duchess talks about her frugal memoir “How To Live Well and Save Money” and her favorite money saving tips.

The Frugal Duchess, Ms. Sharon Harvey Rosenberg, has launched her own book, an autobiographical piece. Sharon writes for the Miami Herald on financial topics and also runs The Frugal Duchess blog, which you no doubt have seen mentioned here on our site throughout the years. As some background, I’d like to mention that Sharon’s blog was one of the handful I found inspiration from to start my own blog. 🙂

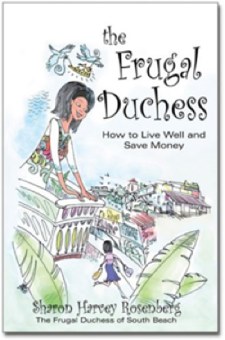

We’re truly honored to be one of the stops on her book tour! When Sharon contacted me about her book, I jumped at the chance to check it out. Her book weaves money saving advice along with stories from her life, and is called “The Frugal Duchess: How To Live Well and Save Money”, which you’ll find listed on Amazon.

So what we’ve got here today is an interview with Sharon, which I thought would be a wonderful way to learn more about her and what she’s worked on.

An Interview With The Frugal Duchess

SVB: Do you have objectives for your book? What inspired you to write one?

The Frugal Duchess: That’s a great question. I wrote a book that offers a memoir with frugal tips. The book tells the story about my parents’ Depression Era childhood. I discuss and demonstrate how the Depression shaped my parents’ lives during the 1930s-1940s and how the Depression influenced the choices my parents made when they raised me and my siblings during 1960s and 1970s.

In the Frugal Duchess, I also offer a literary tour of the homes and towns where my family has lived over the last four generations.

I wanted to deliver a frugal living book that people would want to read for pleasure. Writing a book was been a childhood dream.

SVB: Do you find that frugality is something that is “built in” rather than taught? Do you find that frugality is a trait that doesn’t come naturally to everyone? (Sometime ago, I wrote about the science behind money behaviors and the influence of genes on how we spend (or save), and I thought to explore this topic a bit here.)

The Frugal Duchess: Very interesting question: Nurture versus nature? Some folks — of course — are hard-wired for thrifty living. From the cradle, some people are natural savers. I see that trait in my children. One child may be thrifty and hold onto every penny of a birthday check or allowance.

Other kids, however, are big spenders even in preschool. They’ll run after the ice cream truck and spend their last dollar on a Popsicle.

Fortunately, frugality is also an acquired habit. Kids and adults can be taught to live frugally. I’m not naturally frugal. But I’ve taught myself — and my kids — to spend mindfully and to save willingly.

SVB: As income goes up, do you find that most people tend to save less? That is, the more money we make, the less money we save. Do you have thoughts on this phenomenon?

The Frugal Duchess: Raises and so-called “found money” can be dangerous if we have the wrong attitude and poor savings habits. For example, after receiving a raise or bonus, it’s tempting to spend more on restaurant meals, new clothes or perks. We feel wealthier and therefore, we feel entitled to spend more.

One solution: Spend a little and save a lot. A friend of mine earned a large bonus ($5,000) for coming up with a money-saving idea for her employer. She used a fraction of the money for luxuries ( a couple hundred dollars) and saved the rest.

Additionally, a higher salary may be bundled with longer working hours, with less time for thrifty do-it-yourself choices. When we’re pinched for time, we’re more likely to spend on expensive lunches, take-out dinners and other step-saving conveniences.

A solution: Organization and careful planning make it easier to save money. A dose of creativity also helps. For instance, I started a new job about six months ago. Packing lunch is a challenge as I try to leave my house on time.

But there are supermarkets near my office and once a week, I shop for lunch fixings during my lunch break. I stock the company fridge with a big brown bag of groceries. This routine liberates me from the daily drill of packing a lunch or the expense of buying expensive meals. I eat well and save.

SVB: You are one of the best when it comes to finding bargains! So how did you develop your shopping skills and frugal habits?

The Frugal Duchess: I’ve always been a bargain hunter. I love sales. But after I had my first child, I realized that bargain hunting could be just another excuse for wasteful splurges. Motherhood prompted me to evaluate how and why I spent money. I needed to find money in the budget for diapers, childcare, baby clothing and other expenses. I began to track money drains and became more mindful about budgets and saving goals.

Clearly, my frugal self was born with my first child.

SVB: The interview wouldn’t be complete without a sampling of your best tips. What are your favorite saving strategies and ideas?

The Frugal Duchess: I try to build meals around weekly food specials and stock up on discounted items. End-of-season sales are great for home merchandise, clothing and accessories. Red-tag clearance items fill my cart.

However, it’s a waste of money to buy items that are not really needed. A sale is not a bargain if I purchase unnecessary, ill-fitting or unpractical merchandise.

I like to shop with a list and a purpose. I’ve saved a lot by eliminating recreational shopping. In fact, my best strategy is to avoid malls or stores unless I really need something.

Other areas to save:

Home energy: Get an energy audit. Ask your public utility to perform an onsite test of your home energy usage. We had a few energy hogs in our home and the energy audit has saved us a lot of money because we identified and replaced some of the energy vampires in our home.

DIY personal care: In my home, haircuts, manicures, pedicures, facials and other personal grooming perks are often done in our DIY “salon.”

Take public transportation!

SVB: Tell us more about the projects you’re involved in. It would be great to hear how you manage to juggle them all! 🙂

The Frugal Duchess: I have a weekly newspaper column that runs in the Miami Herald and on the McClatchy-Tribune News Service. In addition to three children, I also have a blog to feed.

After years as a write-from-home mom, I now have a full-time job in a corporate office. I also work on assorted writing projects in my free time.

Sometimes, I feel as if I have mastered the art of juggling by using to-do lists, schedules, calendars, laptops, etc. But other times, I feel like a tangle of nervous energy and deadlines.

That reality has prompted me to cutback on freelance writing assignments and to drop out of graduate school. I hope to resume my studies in a few years.

Meanwhile, exercise, prayer, yoga and meditation also preserve my sanity. Additionally, I love to play catch with my dog and dance around the house with my kids!

Well that was a fun Q & A and a truly awesome interview! I’d like to thank Sharon for taking the time to share her thoughts, ideas and frugal philosophy with us. Please join me in wishing her luck on her upcoming book tour 🙂 .

To close, I’d like to invite you to visit some of Frugal Duchess’ favorite posts:

- “What I Learned About Money From Writing A Book”

- Can We Split This Expense? Timeshare Ideas for Everyday Life

- Ripped Off at Group Dinner: Splitting the Bill?

- OK, OK: A Whine-Free, Turning-50 Birthday List: Frugal and Grateful

For more budgeting tips and frugal tricks from The Frugal Duchess, please visit her blog.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 9 comments… read them below or add one }

I really like the idea about spending a little on luxury saving the rest.

That is practical advice that I can use, as I face that situation quite often.

With what’s going on in the economy now we can all use advice on being frugal! Congratulations to The Frugal Duchess.

So true that a sale is not a bargain if you don’t really need the item! I’m working on cutting down on “deals” and using up what we already have. I’m looking forward to checking out your book, Frugal Duchess!

I’ve noticed that the most frugal people have the fewest degrees of separation between themselves and someone who suffered from really terrible poverty. The Duchess mentions the Depression, but growing up in a poor country does it, too.

I totally agree with the sales comments as well. You can spend tons of unessessary money on sales items that you don’t need. Using a list prepared ahead of time keeps you on track.

Also, frugality to me is a learned trait. You tend to carry the habits of your parents even if they unintentionally taught you. And our society has pressured us with a “you got to have the best and have it now attitude”.

All true and great words of advice, I would like to comment on making more spending more unfortunatly I fit into that group for years and now I beat myself up when I need the money for more important things, I think back to if only I wouldn’t have done this or done that

great but i find this “One solution: Spend a little and save a lot” one the hardest to do 🙂 this is what the whole thing is all bout. no?

thanks for an interesting interview. I think that saving money has never been so important but as you point out it is also good to indulge yourself from time to time.

On the section about energy audits. We had the same thing done to our home. Your idea about contacting your local power company is a good one. We had an independent company come in and do ours. Even then it was only a few hundred dollars. Most of the fixes were pretty easy, and our lower bills have since paid for the audit.