So is the buy and hold strategy dead? I’ve been reading a lot of articles about this lately. But do you believe it?

SVB: Well, I have someone here with a guest post that I found highly interesting. David from AllAboutTrends argues that we’re in for a long, grueling bear market akin to what happened in 1929. I thought I’d share his views here, and I welcome your arguments for or against his premise. While I concur that we’re in the midst of a deep recession and a hideous stock market environment the likes we haven’t seen in a while, I don’t entirely agree with David’s stance. After all, I wrote a post stating why I thought that long term investing is better than short term trading.

Personally, I’m not keen on abandoning a long term investment strategy and find that a lot of technical analysts love to engage in a few scare tactics to justify their trading positions. So I’m all for sparking a discussion about this.

And talk about timing! Let us know what you think, now that Wall Street has just closed up with its best numbers for 2009. Or is this a “dead cat bounce”?

The following guest post is by David Grandey from AllAboutTrends.net. Thank you David, for this contribution.

What Technical Indicators and Historical Stock Trends Are Telling Us

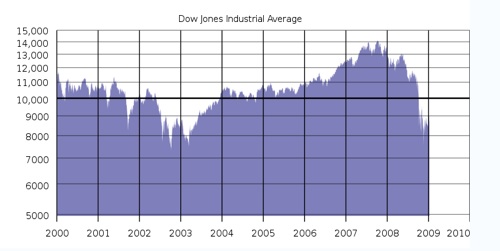

With the Dow Jones sinking well below 7,000 not too long ago, not only did it break some key support levels, but it has reached lows not seen since 1997. So how should these events affect how we make our investment decisions going forward? Should we make changes in the way we invest?

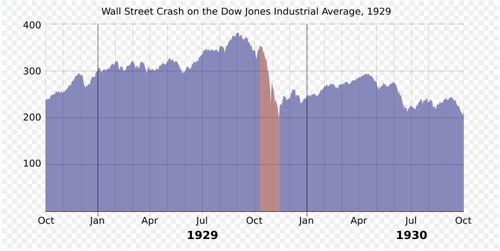

Allow me to try to analyze what’s happened to the stock market so far. As we consider these levels on the Dow in a greater sense, let’s look at the peak to trough analysis. If we chart stock market trends, the current peak to trough from Oct 2007 to date is down over 50%. Not only is this a recessionary decline of historical proportions, but if we put it in context, it has some unhappy effects in drawing conclusions on recovery.

Analysis of Stock Market Cycles: Comparing 2000 – Present Bear to 1929 – 1937

We are now in the 4th worst decline from peak to trough (and by the way there is no certainty that the latest stock market bottom is the final down leg). The worst declines in percentage terms were in 1929, 1937, 2000 and 2007. Let’s take a look at what this means for us today:

1. Our current decline has just passed the 1974 decline of 47%, pushing 1974’s recession into a dubious 5th place.

2. As in 1929 and 1937, these 2000 and 2007 declines were part of the same economic cycle resulting from a bursting asset bubble. In other words the detrimental effect of two related recessions took years to create. The eventual recovery out of the 1930’s was the chain effect of years of adjustments and policies that worked though the system to finally create a foundation for growth and confidence. Unfortunately, in 1929 it took 25 years for the market to recoup its losses which included the aftermath of World War II.

3. What emerged from the post-WWII era were measures that have impacted our economic policies and recent investment thinking. Many of today’s conventional portfolio models began their measurements once WWII ended. By design, we’ve come to expect that stock market movements, volatility and uncertainty like we’ve seen in earlier eras were now things of the past. Clearly, this is not the case! Even Alan Greenspan admitted defeat to Congress when he said that his assumptions about how the world works and operates, have been wrong.

4. Finally in conclusion, given the magnitude and relationship among the periods of 1929, 1937, 2000 and 2007, I am inclined to assume that today’s recovery will be similar to the 1930’s. Now if I’m correct, we can officially declare buy and hold as dead for any investor who is in the market at these previous price levels and waiting for a quick recovery.

Buy and Holders Hold Out Hope For V-Shaped Recovery

If you do not agree with this, then you may believe in the V-shaped recovery. We have had those recoveries, most recently in 1987 and 1989. Those declines were quick and were immediate shocks that lacked any real threats to the foundation of our economy. However, in contrast, the single recession of 1974 which did have fundamental economic threats, took 7.5 years to recover, and that decline did not have a related 1-2 punch like we had in 2007 relative to 2000. In other words, the post-2000 policies created to offset the 2000 recession are a big part of the bubble economy we are feeling now. Our case today feels similar to what we saw in 1929 and 1937.

The current decline we are in is a result of the slow drip of asset reductions caused by an asset price bubble of cheap money and loose credit. The pain of de-leveraging and deflation hurts, and the more this process is fought unproductively and without reforming our domestic economy, the more slowly the economic recovery will take shape. This lack of reform is what hurt Japan, and has put their “lost decade” into its 25th year spanning 13 stimulus packages.

As for the U.S., from the 1929 decline, it took 25 years for us to get back to those stock market levels. Could we be in store for something similar? At least what we have going for us is that the initial decline that began in 2000 is now 9 years in the rear view mirror. My assumption here is that we are in store for a 16 to 20 year stock market recovery. So if we are already 9 years into it, we have at least 7 more years to go, with a stock market bottom hopefully in sight. So what do you think, does this mean that we should consider the “buy and hold” investment strategy dead?

For those of you who are fans of stock market charts, you can check out these links — they may just put things in perspective:

- Dow Jones from 1929 to 1937 with corresponding closings

- Dow Jones from 1974 to 2009

- Bear market comparisons

- Dow Jones: the big picture

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 16 comments… read them below or add one }

You can’t buy and hold perpetually, I mean if you don’t cash out of the market four or five times in your investing career — you will be back to square zero.

Manshu,

Good points! I guess here’s how I’d define a buy and holder — but it’s probably not the most accurate term to use, because as you said, it may be interpreted as really just sitting there and holding on to stocks indefinitely. So I’ll qualify that position here; what I understand the term “buy and hold” in the context of this article is this — it’s someone who:

– does not market time or trade as a major part of their strategy

– sticks to their asset allocation for the long term

– has a long term investment horizon.

I guess the question I have is — have you changed the way you’ve invested because of this market? If you had a long term strategy, are you now switching to something else? Do you follow technical analysis?

As for me, I follow an asset allocation strategy but also follow technical analysis for building my portfolio. I also practice some experimentation and market timing for a very small portion of my portfolio.

What good is asset allocation in a market climate were all asset classes for the most part have fallen in tandem. We’ve heard diversify diversify so we have, we bought defensive positions like food and staple and even those rolled over and died, so much for the “but people gotta eat” and its a good defense , ya right. Its called forced selling, when wall st and banks have no money and need to maintain net capital requirements it becomes a matter of survival hence they dont care about asset allocation anymore they just sell in order to survive. Look even gold fell like a rock during the Oct. and Nov. 2008 time frame.

As for long term time horizon? we what good is it when we havent gone anywhere in the indexs since 1998. So much for long term investing, years of net nowhere and gee at wall street’s buy and fold cant time the market put your money in and over time you’ll get your 7-10 %per yr. style, do the math and figure out how long its going to take you just to get back to where you were in Oct 2007 hmmmm another 7-10 yrs? which puts us at pushing 20 yrs of nowhere in buy and fold. No thanks wall st. we dont need your help anymore.

As for switching to something new? Well how long is long enough to give a style time to work? gosh I mean it’s been 13 yrs of net nowhere so far but the next 10 years will be better right? At least thats what wall st will tell us huh? We’re not getting any younger you know, and by buying into tradtional wall st. garbage thats been jammed into our subsconscious for 20 yrs has now amounted to another 7-10 yrs worth of returns just to get back to 2007 levels? Thanks anyway.

I like Harman’s point about how history has become inaccurate predictors of future trends. This downturn has all but proven many truisms irrelevant.

1) Diversification does not protect you when there’s a systemic liquidation, especially one is too heavily invested in the equity market. I think diversification used to describe the mix of bonds, preferred and common equity, not only diversification within various equity classes (large vs small cap, regional, commodities vs tech, etc).

2) On Manshu’s point, timing does matter. A lot of people got into trouble because they failed to line up their assets and liabilities with respect to their investment horizon and financial obligations. So if you don’t want to substitute impending retirement for a lifetime of involuntary employment, or have to tell your kids to hold off college for a couple of decades while the market recovers, then performing some kind of “liquidity matching” is important.

3) Most people are used to the overall bull market in the last few decades and have not truly grasped the concept of risk when it comes to stock market investing. Brokers came along carrying charts and graphs touting 10% annual returns and almost guaranteed safety with phrases like diversification. Issues like survivorship bias hardly ever come up, nor does anyone question the soundness of basing future expectations on a very limited examination of the past. For example, should data prior to WWII be included, certain assertions and quantitative models of housing prices would not have held up.

This post is very informative and certainly I am not that knowledagle about investing but i think the best principle to follow is when everyone is selling, then buy, and when everyone is about to go buy, start selling.

As Warren Buffet says, when you see people are fearful, get greedy, when they are greedy, be fearful.

And one other thing, when you hear about these hot tips on television such as CNBC, I think that is an indication to sell that specific stock, if you have it.

Because let’s think about it for a second, millions of clueless people watch dumb television and will believe what they are told, and this is probably another strategy that is used to make money. It isn’t necessarily about the market but how people behave.

Hope I made sense.

I think this analysis makes perfect sense, its just that for my dollar amount, the only choices are to use mutual funds, or buy stocks on my own. I do not have the time or knowledge to do it myself. I wish there were more options. Like Dana said, diversification does not help with all these liquidations, there must be a better approach.

@Harman and Dana,

Thanks for your great insights.

Diversification involves participating in cash, bonds, currencies, precious metals and other such asset classes. Yes, if everything really is falling (if the sky is indeed falling), and all these asset classes go to the dump, then we’re hosed. There are things that are under our control and there are things that aren’t. Those things under our control are simply the principles and “truisms” we are offered as tools to help us manage our risk. We have forgotten that we face risk no matter what we do.

I still believe that proper asset allocation and understanding of your risk profile would have made things easier for someone in this downtrend. If someone at the age of 50 hadn’t been beguiled into being 100% fully vested in equities, they would be in better shape right now. I’ve taken a big lesson from this — that I should be much more particular about what should go in my asset allocation, and I should take stock of what “long term” really means. At my age, I’m going to have to be less aggressive and only “invest” in things where I fully understand the risk.

Now if everything goes to pot, then at least I’ve tried all I could to “do the right thing” by my investments. I’d then focus on stuff that will help sustain me going forward, or move to a cheaper, low cost living environment (I hear that a rustic cabin in a tropical beach doesn’t take much upkeep).

Well, I essentially learned how NOT to hedge against a down turn. I used to buy a lot of put options to hedge myself against the stock meltdown. But, what happened was that since PUT options are priced based on time and the price of underlying assets, even if the price target was met — the time left sort of meant that I didn’t make money out of the options. So next time I plan to buy — Out of the Money puts with the expiry date of at least one year or longer.

Other than that this downturn has not impacted my investing style much. I ignore all forms of technical analysis that I am familiar with, especially the – Elliot Wave.

The only thing that I religiously follow is that I stop buying stocks when my aunts start buying them. And I don’t buy stocks from sectors that every one is talking about. I had no technology stocks during the dot com bubble and no real estate stocks during the last bust. I don’t plan to buy any gold assets or bonds right now.

It’s an unusal market. It’s one you’ll be sharing with the grandkids… but it’s okay and it’s one that you can withstand. Good value persists.

“The current decline we are in is a result of the slow drip of asset reductions caused by an asset price bubble of cheap money and loose credit. The pain of de-leveraging and deflation hurts, and the more this process is fought unproductively and without reforming our domestic economy, the more slowly the economic recovery will take shape. This lack of reform is what hurt Japan, and has put their “lost decade” into its 25th year spanning 13 stimulus packages.”

Yes I agree. I’m fed up of keep reading that by the end of the year it will all be over and we’ll be well on the road to recovery. The banks will be freely lending and everyone will be happy. To me this seems utter madness.

Hi SVB,

The way I see it you need to be totally knowledgeable about the stock market or just enough to make conservative investment choices.

As we have seen, even the stock market “gurus” are suffering. Everyone is right in hindsight, which also means not everyone can be right all the time.

I strongly believe in asset allocation. By that I mean you also have to look at bonds and equities, both foreign and domestic. Real estate, commodities, cash, gold, absolute returns, etc… Only a fool or a high risk taker would invest 100% in equities even if they were diversified. And even Harvard invests in less than 50% equities, and these are split up between foreign and domestic, large and small cap.

Like I said, you either need to be very knowledgeable or invest conservatively. By conservatively I mean stay out of equities and stick more with bonds. I’m mostly out of the stock market now. I get lower returns, but they are still great because inflation is so low.

As for what will happen in the future. Well I think the DOW will stay where it is at for a long time. But plenty of stocks will grow way faster. The DOW isn’t the end all, be all of the stock market. Give me a break! Just look at the chart and read it correctly!

First off you have to notice that the bottom portion below 10,000 is exaggerated. This makes the dips below there look bigger than they really are. It also makes the upswings look less than they really are. Make the top portions bigger and the swings in both directions look huge!

Second, the time horizon is too short. It starts with the height of the DOW in 2000. Just from this chart we see that the DOW doubles from 7000 to almost 14000 in 5 years from 2002 to 2007! Reality tells us that this mix of companies isn’t earning twice as much in 5 years. Guess what? The DOW TRIPLED from 1995 to 2000! Going from 4000 to almost 12000! Can anyone honestly say they produced three times as much earnings as they did 5 years previously? No! The P/E Ratios are all out of whack!

Thirdly, data can be used to prove any point! I can probably prove that the moon is made of cheese with just a few data points if you are dumb enough to believe me!

Obviously I get fired up about these topics because I hate when people deceive themselves…

News flash: The DOW is right in line with where it needs to be. The bubble has burst and we are back down to reality.

Besides, how many of you know how much of your money is in the DOW anyhow? If you invest in mutual funds or index funds instead of individual stocks than you almost certainly have no clue. I’m sure your fund could answer the question for you, but even they may need to do some research and get back to you.

Just like real estate there are some stocks making money! 7 out of 50 states posted home price appreciation as high as 4% last year. Texas was one of them.

Not everything is losing money across the board no matter what the news or anyone else leads you to believe.

Be smart. Do the research. Know what you are doing or get out of the game. Stop giving your hard earned money to stupid people who only know how to waste it.

Hope this helps. 😉

Cheers,

Jeremy

I’m admittedly not an investment expert, but I would think a “buy & hold” strategy would differ based on your age and expected retirement date.

I just turned 30 and am only on the beginning-side of my retirement accumulation. I’ve got 35 years to invest, and I’m getting in pretty much at what is probably the bottom. If possible, it’s probably beneficial for me to invest even more in the market now, since it is “on sale”. Especially since very few of my retirement dollars will have been lost as a result of this downturn.

Look – the post is a good one as far as it goes, but I fail to see a logical connection between showing stock charts of previous recessions and the conclusion that we are in for a 16 or 25 year recovery cycle. In short – the conclusion is not supported by facts or even by arguments.

Economists have been drawing parallels between our current predicament and the 30’s – but everything I have read suggests that circumstances were extremely different back then (e.g. anemic government response, no unemployment benefits, no insurance of bank deposits etc.) Global government response to this crisis has been vigorous and timely. In short, this looks nothing like the great depression.

If you are in it for the long-haul, now is probably a phenomenal time to get into the market. In a smart, calculated way, that is.

I must say that I am concerned with the comments on this post that bemoan the end of asset allocation. There are also a number of inaccurate beliefs held by commentors that I’d like to clear up:

1. Asset allocation was given creedance after the Brinson, Beebower, and Hood study of 1986 that was retested in 1991. It held that rates of return were predictable over long periods of time based on allocations in cash, stocks, and bonds. It was NOT put together by anyone on Wall Street but was from the academic community.

2. “if you don’t cash out of the market four or five times in your investing career — you will be back to square zero” – this couldn’t be further from the truth. An investor that started saving in 1929 would have been very, very wealthy by the time 1954 came around. By investing continuously over that period of time and with increased dollars invested annually thanks to his/her earnings growth, the investor would have broken even in just a couple of years and been well ahead in only a decade. Believing that cashing out is necessary simply isn’t true over a career span. However, a declining exposure to equities over time is necessary and prudent for most.

3. Harman – I get that you’re frustrated, but this is part of the natural cycle of the market. I posted on this very topic on Feb 19 at http://www.wealthuncomplicated.com and see very clearly that long-term is not 7 years, it’s not 10 years, it’s 25 years or more. This is the litmus test for long-term, as the worst market we’ve seen was a 25 year top to full recovery during the Great Depression. Keep in mind that investors during that market that continued to add to portfolios and dollar cost average recovered in far less than 25 years.

Folks, asset allocation isn’t dead, nor is it on hiatus, it’s simply not the perfect cure all that so many people want it to be. I’ll have to put together a more detailed defense of asset allocation, but I’ll leave you with this. Do you remember the late 1990s? I read article after article proclaiming the death of price-to-earnings ratios. They were to be replaced by price-to-sales and top line revenue growth. Do you remember what happened next? How about the early part of this decade? Do you remember that real estate ‘never’ loses? What happened next? It’s sounding all too familiar.

For those of you who are just ‘done’ with the market, I can tell you from experience that the folks I’ve worked with from the Great Depression Era were considerably poorer than they could have been if they’d stayed invested. Remember always that all of our fortunes are linked to Wall Street…not in the form of stocks, but in the companies they represent.

Lots of good points here.

There are some differences with the Great Depression. Michael pointed them out, but one thing I’d like to add is that the make up of indexes was different and included very few companies. For example, IBM that actually did very well during that time, was removed from Dow in 1939 and not added until many years later. Had it been part of the index, the picture would’ve been better.

I do agree – and I hope I learned my lesson – that one cannot hold indefinitely. I thought I learned in in 2000s, but I guess I thought that since we didn’t have P/Es in 100s we were OK. I knew real estate was overvalued and expected it to crash, but not knowing about CDOs and such, I didn’t draw the lines to overall economy. I think that as the markets are risky, we should pay attention to the economy.

I particularly like this strategy from Manshu: “The only thing that I religiously follow is that I stop buying stocks when my aunts start buying them. And I don’t buy stocks from sectors that every one is talking about. I had no technology stocks during the dot com bubble and no real estate stocks during the last bust. I don’t plan to buy any gold assets or bonds right now.”

A very famous story from the Great Depression was about how a rich guy decided to exit the stock market when he hear shoeshine boy giving him stock tips.

One thing regarding bonds – I wouldn’t buy government bonds now, but I’ll consider I bonds if the fixed portion looks attractive after the next rate reset; maybe TIPs too — people aren’t buying them now because they fear deflation. Although this might have changed since yesterday, need to take a look.

At the same time, there are still good deals in municipal and especially corporate bonds. You just need to pay attention to interest rates except in cases of individual bonds you plan to hold to maturity.

Just thinking aloud, when was this buy and hold theory formulated? Could it have been after the 1929 era or well before that?

I think that a number of investment theories will be reengineered and jigged to take into account the recent financial carnages. I’ll just wait for those.

Cheers