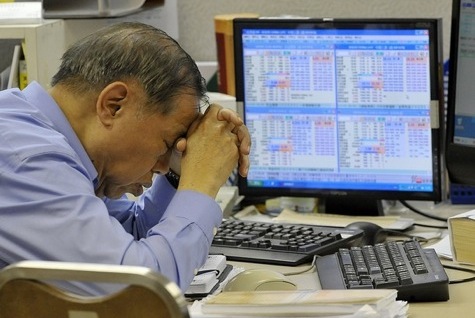

Ever think about the reasons why stock traders lose money, their collective shirts and everything else? Here’s why and how trading stocks and market timing have cost many a poor soul their nest egg.

Our guest post today is courtesy of Manshu Verma from OneMint, a website with the vision of “creating wealth for everyone”. If you liked this article and wish to read more about the economy, stocks, investing, credit cards or other topics on personal finance, please consider subscribing to this feed.

Over the years, I have seen several people (including myself) lose fortunes while trading stocks, and I’ve found that invariably, it would be for the same reasons. Such reasons appear mostly psychological and occur often in the trading scene. This is not to say that every trader loses money; I’ve simply observed that more often than not, traders DO lose money. So I thought to discuss what I believe are the top reasons for this.

6 Reasons Why Stock Traders Lose Money

So how can trading stocks make you poor? For those engaged in the practices of short term trading or market timing, here are some scenarios that may be preventing you from making headway with your investments.

1. Being unable to cut your losses.

The practice of day trading involves the capture of profits as quickly as possible. So it’s no surprise when traders jump at a 2 or 3 point gain, eager to pull the trigger and book small profits quickly. However, let’s see what happens when any one of their stock holdings drops 5 points: the same traders find themselves unable to cut losses quickly, so they wait for a rebound. In fact, even when their stocks drop by larger points, many short term investors become hesitant to book losses.

Every investor has experienced this — the paralysis that comes when we’re forced to sell at a loss. I think that taking a loss is more than just losing money; it’s also about admitting defeat. It’s difficult to do because it would mean that we actually made a mistake. And mistakes with our money is not something many of us are willing to easily accept.

Think it’s worth it? A 20% loss on a single position wipes out the profits that a trader makes on 10 winning transactions, each returning 2% gains.

2. Taking on the risk of leverage.

Most traders use borrowed money to trade. They typically borrow money to transact at higher trade volumes because they’re dealing with such small margins. To trade at higher volumes, traders get involved with margin trading, where they pay a certain interest rate for the privilege to use other people’s (the bank’s) money for their purposes. This activity can get pretty unnerving. When you’re leveraged this way, and your position turns against you, it can mean big losses. Again, it only takes one big loss to wipe out all the small gains you’ve made over the course of a given week.

3. Preventing your investments from experiencing long term growth.

My finance professor used to joke that any stock that goes down in value becomes a long-term investment. There’s a lot of truth in that. It’s possible that if you have the ability to hold on to a stock long enough, it may just bounce back. But when you’re trading, the goal is to make money on large volume, thin margins and quick turnarounds, and well… you’re not really out to make money by holding on to your stocks. There’s opportunity cost here: if you’re trading, you can’t really take advantage of the power of compounding, which is what helps build a hefty nest egg over the long term.

4. Learning how to “trade” during a bull run.

Traders are born during bull runs: this is because they assume that their success with stock trading during a bull market is a result of their market timing skills, rather than due to the perpetual upward movement of stock prices in general.

Most ordinary people who decide to become traders are bitten by the stock market bug during bull markets. Naturally, they start trading stocks that are in the midst of all the action, and which reach new peaks every day. They end up purchasing inflated stocks at peak prices, chasing stocks at higher and higher prices while riding the upward momentum of the bull. They buy stocks indiscriminately, without regard to stock fundamentals, quality or price. Everything is fine till the bust comes, and then it gets rough. I know many friends and relatives who started trading during the boom. They continue to hang on to formerly high-flying Indian real estate stocks, which are now hovering at 10% of their peak values today.

The sad truth is that some of these stocks will never rebound, at least during our lifetimes.

5. Getting whipsawed by volatility.

Have you ever noticed how challenging it is to play the swings in the market? Why is it so tough to time the market? The reason of course, is that we are subject to the whims of volatility, and only extremely experienced traders are likely to be successful with using volatility to their advantage. I have lost count of the number of times the following scenario has occurred:

- Buy a stock, only to have it drop 5 points in ten minutes.

- Get anxious, but wait patiently for a rebound.

- See the stock drop ten more points, then sell it to cut losses.

- See the stock recover and climb above the price you sold it for, before the market closes.

- Get extremely frustrated, but get ready do it all over again the next day.

So be honest — how often has this happened to you?

6. Mistaking luck for skill.

Are you lucky? Napoleon was once asked whether he preferred courageous generals or brilliant generals. Supposedly, his response was “neither”, for he preferred lucky generals.

You may or may not agree, but there are some things we can’t explain (just yet), and luck is one of them. Some people have the instinct — or luck — to get out of bad trades at the right time. Others simply just don’t have it. Although some people may actually have the instinct or ability to make the right market moves; most of us probably just rely on luck to get on the winning side of a trade. So, the question here is: how lucky are you?

I’ve been subject to the vagaries of the market and Lady Luck far too often to continue trading, so I gave it up a long time back in favor of long term investing, which has been much easier on my wallet and my nerves. I have not regretted this decision since.

Trading Stocks: Next Steps

So what can we learn from this semi-confession? If you’ve been trading stocks and find yourself agreeing with me on the points I’ve made, or see yourself experiencing the same troubles with trading, then you should consider doing any one of two things. Either give up trading altogether or consider taking a hiatus from the big bad world of market timing until you’ve learned enough about it to get a handle on this activity. You can learn more about trading practices and technical analysis by using stock charting tools which are freely available from brokerage companies or certain discount brokers if you sign up as an account holder. Sites like TradeKing, ETrade and Zecco offer awesome tools, a cheap trading environment and a financial community from which you can learn from.

Trading is both an art (do you have the instinct for it?) and a science (do you have the right tools to do the job?), and until you’re well equipped to participate in this avocation, I’d strongly recommend that you limit the use of your money for this purpose, and stick to fantasy stock picking.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 11 comments… read them below or add one }

The biggest reason for them to lose money is greed, to make more profit even when they have earned quite a handful amount of money.

Thanks a lot! It’s great to see OneMint featuring on your wonderful site.

It’s fun to do but you’re right, not for the weak-hearted.

I would have to agree with selena but it’s also about poor choices. Making the wrong decision about what stocks to buy and sell and at what time can result in bad outcomes.

Yup! I would have to say that it is their greed. Sure, if you are just making your way in the share market, you are bound to come across a few situations which you cannot get out of. Soon, you end up losing it all. That happens to every trader right in the very beginnnig. But once you become a seasoned trader, you should be able to meander your way through all the pitfalls of the market with ease. On account of greed and the desire to make more often leads you astray, so you end up losing it all despite being a seasoned trader and all that!

I agree that day trading can be nerve wrecking but exhilarating at the same time. It’s all a big gamble really and the only half sure way of profiting from the stock markets is by investing long term.

Probably the best approach to trading is an unemotional one, when you just think of it as a job. A lot easier said than done I’m afraid.

You called it. I took my turn at daytrading and it was exactly like what you wrote. I got away from it because I thought I was taking too much risk for the little profits.

Don’t forget the costs associated with day trading even if you are successful. Day traders tend to have super high portfolio turnover rates, which leads to trading costs and short-term taxes cutting into your profits. Both of these costs are minimized when you buy and hold for the long-term. In order to be a day trader, not only do you have to have a strong stomach, but you have to outperform the market by more than the extra costs required to be a day trader.

Trading Stocks, Forex, etc. is very hard, you always have to be ready to lose money. One way to trade better is being able to money manage your investment. Remember, it’s all about Risk/Reward. How much are you willing to risk to make a certain amount of reward. Practice, practice, practice ……….

An alternative view point might be: How trading stocks can make you money: Here is how to make winning trades.

No question stock trading is hard, especially day trading. What are easy (legal) ways to make money?

As for trading costs. $7 per trade. $14 to open and close a position. 1000 shares traded yields $36 to $86 net gain on $0.05 to $0.10 stock price change. Repeat that as many times throughout the trading day as you can. Adds up to decent money. Does require capital to trade. Why should I care about paying so much commission as along as I get my gains.

Great post! I think the biggest reason traders lose money is because they don’t have a strategy. Trading is one of the only occupations in the world where there are literally no barriers to entry. You can literally open a brokerage account in one day and start the next.

No one in there right mind, if they understood the risks, would just jump into it without a strategy or plan. Starting any business without a business plan is a recipe for disaster. Make no mistake about it trading is a business and if you’ve failed to plan, you’ve planned to fail!