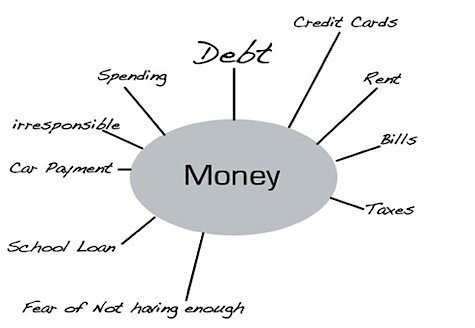

How are your personal financial habits? Wouldn’t it be great if you never spent a dime out of place? Most people think of this as a distant dream. But it can be closer to reality.

Terrible spending habits permeate every part of our lives. Some of us have spending vices that have quite a grip on us and continually test our will power. Bad financial habits are dreadful things to have but you can certainly get rid of them –- if you know how to spot them.

I’d like to share these ten warning signs to watch out for, which point towards too much personal spending. Please feel free to add on to this list in our comments!

Spending Too Much Money? 10 Warning Signs To Watch Out For

- Buying things you don’t need. How many things do you have in your home that you don’t actually need? Why not sell them, and get some money back and invest it? Don’t keep buying stuff you have no need or use for. I usually sell my stuff through Craigslist or a home consignment store. Or you can turn to these garage sale tips to determine how you can pick up extra cash by getting rid of stuff you no longer need.

- Spending more than you need to on a daily basis. Keep track of your spending. Don’t buy things for the sake of it (refer to point one). Think about how much you could save by simply spending less than we actually do, each day!

- Impulsive spending. Another ugly monster that can grab you at any time. Whenever you get struck by it, count to ten, walk out of the shop and give yourself time to cool down. Most of the time, you will find that the impulse goes away and you no longer have the urge to buy whatever it is that caught your attention initially. But even if you find yourself succumbing to shopping temptations, you can still recover from a huge impulse buy!

-

Not having a budget. Budget? What’s a budget? If you’ve never had one before, start using one now. It’s the only way you can truly be in control of your finances.

Try a great budgeting tool like YNAB software. You can read more about it in our YNAB (You Need A Budget) review. Or check out our long list of budgeting tools here.

- Forgetting to pay bills on time. This is a dreadful way of losing money for no reason. Set up bills on direct debit. Put reminders or alarms in your cell phone to pay them a few days before they are due. Do whatever you have to do so that you don’t pay unnecessary charges.

- Emotional spending. Hungry? Don’t go food shopping just yet. Eat something first and spend less. Bored? Don’t go shopping unless it’s without your wallet!

- Loving your credit cards too much. If you know you can’t be trusted with them, don’t go out with them. Use cash more. Or use prepaid debit cards. These days, there are such things as debit rewards cards which allow you to earn rewards on a debit card (one that won’t cause you to build up debt). It’s a lot harder to spend money when you know you have to part with it straight away.

- Succumbing to sales. Sales are there to tempt you. They are there to try and get you to break rules 1, 2, 3, 5, 6 and 7 above. Resist temptation and carry on walking.

- Succumbing to “pay no money now” deals. You may not pay now, but you certainly will later. And it will probably cost you more as well. Would you buy that same item if you had to pay for it right away?

- Not paying yourself first. What does this mean? If you have a job, you’ll get paid, yes? Certainly you will, but before you start making use of your income and paying others your hard-earned money, think about “paying yourself first” as well. If you don’t, you may find that you have no savings to fall back on. Here are some great techniques on paying yourself first.

Image from HarmonizingStatements.com

Image from HarmonizingStatements.com

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 27 comments… read them below or add one }

Regarding debit rewards…don’t get too comfortable establishing this habit. They may soon be a thing of the past. Effective Feb 8th, Chase will no longer accept new debit card rewards enrollees. US Bank hinted on a recent earnings call that they might even start charging for debit cards. If the interchange fee legislation passes, we’ll see big changes to debit cards this summer across the board.

May I suggest one more? Learn to Handle Cash. Every dollar is important and should be treated as such. I see folks take $100 out in cash from and ATM, spend it recklessly, repeat 3 or 4 times a month, and then wonder why their budget is busted.

Excellent points! Too bad the people who need this most will not pay attention!

There are multiple factors involved to this article. At the very first, it have a solid look from each and every angle of the spending habit, budget, debt. I strongly believe three actions from any individual can certainly tackle such situations successfully to a great extend.

1. Have a well planned WRITTEN monthly budget – This would tackle point: 2, 3, 4, 5, 7

2. Learn and practice debt management: This will tackle point 6, 9, 10

3. Know and practice the difference between “need” and ‘want” along with money saving tips on shopping: This would tackle point: 1 and 8

Appreciate further comments on this view…

I think this post hits the topic squarely on the head, covering key warning signs on spending. Really, in many ways it’s more important to avoid making mistakes than going for the gusto with personal finance. Follow principles such as these, consistently over one’s working years, and a comfortable retirement would seem much more likely. The key is avoiding mistakes.

As for the commenter above, I can’t disagree with a monthly budget, debt management, and differentiating wants and needs. I most specifically agree with the latter two, as I don’t like debt at all and think that the ability to discern wants/needs is quite underrated. Really, that point also touches on #5 in the post, Emotional Spending.

Absolutely! In my case, I always emphasize value. If it’s good value, I normally don’t really worry about the price. I’m one of those “black” or “white” shoppers. I have interesting shopping habits — for the discretionary stuff, I usually go on long periods without buying a thing (e.g. I buy clothes once a year), then I buy a lot. It helps that I don’t like shopping really and look upon it as a chore. But when I do, I usually come pretty prepared with coupons and lists. 🙂

I will explain an extra reason why sales are bad. If you’re really in the market for the item on sale, AND you have the money, then bonus to you. But most folks don’t. We live in a society where our earning and our spending are disassociated from one another. We used to be farmers, hunters, etc, where what you grew or caught was what you lived off of…there was a direct relationship. But now we go to 9-5 jobs, do some work, get paid for it with $ … then go use that $ to buy the things we need. The $ acts as a disassociation from the job you perform to what you receive by doing it. When some folks get frustrated at their job, they feel they’ve “earned” the right to go blow some money and make themselves feel better.

People have an ingrained need to feel like their job is rewarding and satisfying, so when it’s not they still want to fill that need. So they spend money to artificially fill the gap. I’ll use the stereotypical shoe-shopper woman (no offense). She sees $100 shoes on sale for 1/2 price. What a deal! She doesn’t have the money to actually buy them, so she buys them on credit. $50 on the credit card. She never pays off her credit card, or only makes minimum payments. Before too long, that $50 has ballooned to $200 due to interest. So, that 1/2 off sale actually ended up costing her more money than if she had paid full price for the shoes. Folks that abuse their credit cards don’t think about that, though. They see “sale” and instantly translate that into money saved, but in buying things on credit they don’t take the interest into account and keep wondering why they’re going further in debt if theoretically they’re getting a “bargain” on everything they buy.

A credit card also disassociates your spending from your earning one step further. When you use a debit card, you can see the money in your checking account go down. But when you use a credit card you just see a balance racking up. You have $10k limit…you’ve only spent $1000…wow, you’re not so bad off! But your checking account only has $50. And your next paycheck will only be $800. And half of that goes to rent…gas…food… Folks get it into their head that their credit card limit is money “in the bank” that they can spend, because they’re not looking at their checking account draining. So they spend spend spend. Then the bill shows up, and they’re finally forced to have Mr. Checking Account meet Mr. Credit Card, and it’s an ugly revelation…they’re not earning enough to live the way they have been on Mr. Credit Card. But most keep on doing it.

The hugest disservice we’ve ever done to ourselves was get it in our heads that it’s ok to be a borrower…live on credit. Back in the Popeye days, they used to make fun of Wimpy for wanting to “gladly pay you Tuesday for a hamburger today.” Borrowers were bums. But these days, the world revolves around your credit score. Borrowing is fashionable. Credit companies have gotten it into our heads that it’s a mandatory thing to do in life, and your financial future lives and dies based on your credit scores. This is so back-asswards, it’s amazing. People used to have to go to loan sharks and risk getting their knee-caps broken for borrowing money. Now folks regularly lend money to others that can’t afford to pay it back, because a huge business model has been built around that. It’s ok if folks were responsible, but many people have shown irresponsibility.

Having spending vices can be a real problem, especially if it’s a particular hobby you may enjoy doing and can easily get carried away with. Case in point: my brother-in-law collects expensive action figures and LEGO. He’ll often buy LEGO by the pound or in bulk (which in his defense, is quite the savings vs. buying them brand new), but I often wonder if he may accidentally cross the line of sensible hobby spending.

So how do you know if you have a spending vice and if you need to start fighting the urge to splurge? Here are some hints and clues. Watch out when:

Interesting points Cap. Maybe we should all share what our secret vices are!

My big vice this year is going to be MLB Extra Innings. My favorite team is out of market, and I have never been able to watch more than a few games per year. Hopefully I’ll be able to watch bits of at last 60-70 games, though.

My dreadful spending vice is Starbucks Venti Hot Chocolate – most every day, year around. I cannot face my job without it, and believe me, I have tried….

My vice is coffee. I love the stuff and there is a coffee shop across the street from where I work. I try to limit it to a couple of times a week, but would love to go every day. I probably spend $50-$100 bucks a month on coffee when there is free pot of Folgers at work.

I try to be frugal with most everything else, but that is one vice I have allowed myself.

Neatly explained. Makes me think twice on how I go about spending money… just like you, I don’t follow a monthly budget. However, I do make sure I have enough money to cover myself for 6 months at least. As of now I have a whole bunch of vices (let’s say wish list) and owning them might require efforts on my part.

Oh, well…. you’ve motivated me 😀

I have a vacation vice. I am so good with my money day in and day out. However, once I get into “vacation mode” my frugal habits get thrown out the window.

@Kevin,

Traveling is my vice as well… my guy and I have already spent 5 days in Honduras (which I learned to Scuba Dive for) and are busy planning our summer 3 weeks to Thailand… we go kinda stir crazy if we don’t make it out of the country at least once a year!

I really love movies, so I spend most of my money on new dvds or special movie collections, or going to the cinema. Except for this, I am very frugal and thrifty.

Thanks for all your confessions 🙂 . When giving in to a spending vice, you’ll need to figure out if it’s simply something you tend to splurge a little bit on — or if it’s something that’s drastically affecting your financial health. In my personal opinion, splurging on experiences (and yes, material things that make you happy) is completely worthwhile and acceptable. After all, what’s the point of making money if you can’t enjoy life? But the minute you’re piling on debt or credit card bills just to enjoy your habits or hobbies, you’re surely heading down a slippery slope of trouble.

I don’t think we’re immune to having a spending vice or two. We all tend to have something that we splurge on. But what’s important is that we are able to keep the spending on our favorite activities, hobbies, or collections in check, and that the spending we do does not spiral out of control.

Books.

It’s a good thing they’re cheap (compared to lots of other spending vices).

There are too many good books in this mixed-up world of ours.

Rob

Baseball is my spending vice.

I split Angel’s season tickets with my brothers and it’s not cheap, especially during playoffs. I also took a small vacation to Phoenix for Spring Training this year. It’s something we like to do together as a family. But, it certainly adds up as a budget killer.

Good advice. My spending vice is handbags, which I keep in check by telling myself “I really don’t need that new bag”. I don’t have a strict budget, I just test my will power.

I think I spend way too much on taxes and get little in return. The harder I work to offset them, the bigger bite they take.

Well since we’re on the subject of spending vices, let me jump in here. For me, it’s anything for the home. I love to decorate and feel comfortable in my space. So I’m a sucker for Bed, Bath and Beyond!

My vice is traveling AND I’m worse with cash on hand than a credit card. =)

Though I’m super super cheap the rest of the time (e.g. brown bag my lunch every day) to compensate for my frivolous trips around the world.

My dreadful spending vice is shopping, most are for clothes, music and movies. I am good with managing other people’s budgets but still not good enough to manage my own budget. lol.

Good advice. My spending vice is handbags, which I keep in check by telling myself “I really don’t need that new bag”. I don’t have a strict budget, I just test my will power.

Certain things seem to bring out the splurge in an otherwise frugal guy. Those certain things are travel, electronics and my clothes/shoes. For the most part we go for quality versus quantity. I may overspend for shoes, but I keep them for 20-30 years. BTW, the only debt I have is a small mortgage, so I am in control of my spending.

Critique your spending habits; come up using a program for organizing your coupons to ensure that you understand what you’ve got; discover your preferred store’s policies relating to coupons together with their sale cycles, and find coupons anyplace you feasible can! It can be time consuming to create probably the most out of implementing coupons, but the savings is usually effectively worth the effort.